Business

World Bank gets straight to the point on charting a new FDI path for Sri Lanka

By Sanath Nanayakkare

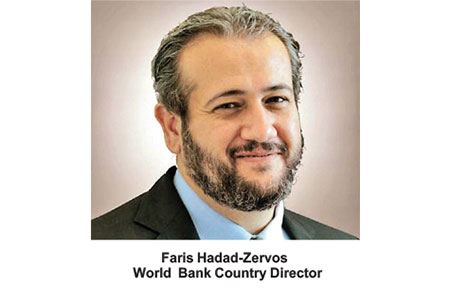

Faris Hadad-Zervos, World Bank Country Director for Sri Lanka, Maldives and Nepal skipped the usual preliminaries at the recent Sri Lanka Invest Forum (SLIF) and came straight to the point and told the participating global investors that Sri Lanka’s potential for attracting investment and creating an equally attractive business environment for new entrants was very clear, and if and when the right combination of things were in place this would become an ideal time to come and invest in Sri Lanka.

Speaking at the plenary session of SLIF on June 7, 2021 he said: “Let’s remember friends, not to focus today much on what Sri Lanka was, is and what it will be. We care about that but the reality is, the investors don’t. They don’t focus on what Sri Lanka is, what it was and what it will be, but what Sri Lanka is versus other countries from an investment point of view. And that’s the name of the game,”

Further speaking the World Bank Country Director said,”

Covid has likely triggered the biggest economic fallout since the Second World War.. I commend Sri Lanka on the many achievements in containing the pandemic in the past two weeks. The government’s management of the health crisis has been recognised worldwide and the measures it has taken to contain the ongoing wave.”

“The Sri Lankan government is focused on addressing its macro fiscal challenge and creating an enabling environment for investment in the short to medium term. We all agree on that and that’s why we are here. FDI has a huge role to play in helping to leverage the potential and diversity of growth in Sri Lanka.”

“In our analytical work, we have identified that some sectors such as textile/clothing, ICT services, Sri Lankan firms are expanding its global footprint, becoming globally competitive moving up the value curve, to diversify its growth and to offer more sophisticated products in different markets. You are showing the potential in these sectors. They have scaled up with the latest outside technology and experience to drive Sri Lanka for transformation. Where can the policymakers tap into the ecosystem to drive innovation in the large existing manufacture sectors such as apparel, ICT and high-tech products to fully harness Sri Lanka’s competitive advantage and integrate into the global value chain further? “

“Then the Tourism sector is the second largest export earner accounting for close to 55% of GDP before the pandemic. Tourism investments were around 10% of total FDI before the crisis. Now we are looking at the light at the end of the Covid tunnel, let’s build back better and greener. It’s time to address logistics, connectivity and shortage of skills to build a service oriented workforce so critical if Sri Lanka is to attract more high value Tourism services. But Sri Lanka’s distance to the frontier markets [in this regard] remains vast. And this is not me speaking about a shortcoming but rather a massive upward potential for a country with very positive horizons.”

“Sri Lanka’s FDI performance in 2019 was less than we wanted it to be.- at 1% of FDIs while Vietnam, Malaysia were able to attract 6% and 2.5% respectively. Sri Lanka aims to attract $ 5 billion FDI by 2025. We believe that this is entirely doable and is realistic given its rich natural resources, strategic location , highly literate workforce and available opportunities for investment.”

“If and when the right combination of things are in place , this becomes an ideal time to come and invest. This alternatively rests on a collective set of policies and practices that make up an investment ecosystem ranging from the improvement of the investment climate and elimination of unnecessary regulatory burdens and to enhancing responsiveness of bureaucracy in order to deliver effective FDI services. What we have seen in other countries is that investment promotion is the beginning of the story and not the end. The name of the game is attracting and retaining investment.”

“Also for the immediate term, the government will face a challenging balancing act between fiscal sustainability and jump starting the economic recovery. All countries are grappling with this. This is not unique to Sri Lanka. So what is the recommendation here? Use this pandemic to turn challenges into opportunities, to tackle the fundamental core issues that existed before the pandemic to build back better, greener and to be more agile. We are believers in the vast potential of Sri Lanka and that’s why we are here today.”

“We need to recognise that the government is focusing on and is trying to balance between fiscal sustainability supporting economic recovery, saving lives and catering to emerging post- pandemic spending needs. We have to recognise that this is a very difficult balancing act.”

“We have to agree that economy depends on production, labour and capital and optimal productivity. These were all affected by Covid leading to prolonged school closures, unemployment, digital barriers in education, reduction in overall investment etc. These will affect growth everywhere. Public investments are likely to be held back by revenue constraints. Sri Lanka is not unique in the world to this unfortunate thing.”

“On the macro fiscal perspective, Covid has aggravated Sri Lanka’s long standing debt vulnerability which pre-existed.. So it is not that Covid created all these problems. Covid exacerbated them and brought to the surface some structural issues that existed, and we have seen sharp contractions in export activities, the largest in recent times.”

“So it is not an easy task contraction in output, lower revenue collection have led to rapid deterioration of fiscal deficits and GDP ratios across the world. No country is immune, so what are the priorities?.First, from a World Bank’s perspective, a policy dialogue is important. When we talk to the policymakers here, it’s agreed that let’s get the debt thing tackled to give more space in the future.”

“Sri Lanka has high debt services obligations that obviously constraints fiscal growth moving forward. We have to focus on this. The government is tackling it. Opportunities for debt financing is limited. Domestic revenue mobilisation is very important which must be central to addressing pressure on public expenditure in the future. I would say, let us keep the momentum on global integration. The government is focused on it and that is commendable. Let us put the export earnings as a key measure over GDP, to follow. Export earnings over GDP – let us follow that over time and see what happens. It would require constant touch-ups to policies. When it comes to import trade regime, I know the government’s policy. I respect it. Let’s address tariffs, para tariffs and barriers to ensure predictability in this regime. While there is no right or wrong policy, look at the role of imports; when does it help exports and domestic industry. Let’s get them in”,: he said.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”