Business

Stagflation in Sri Lanka? Risks and policy responses

By Binura Seneviratne

The world economy is showing signs of a serious slowdown due to overlapping crises including the Russia-Ukraine War, the COVID-19 pandemic, China’s real estate crisis and the global tightening of monetary policy.

In June, the World Bank revised the 2022 growth prediction downward to 2.9% from its January forecast of 4.1%. The slowdown has come along with a decade-high bout of inflation worldwide with the global median Consumer Price Inflation (CPI) inflation rising to around 7.8% on a year-on-year (YoY) basis, the highest since 2008, according to April 2022 data (Figure 1). The emergence of a low-growth international environment together with a significant rise in inflation has raised concerns of stagflation; a period of low growth combined with high inflation.Monthly CPI Inflation, Year-On-Year The Effects of Stagflation

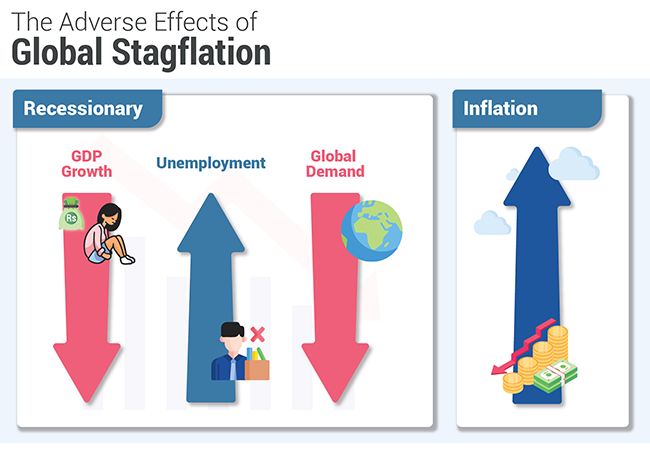

A global stagflationary environment could further weaken global economic growth while increasing inflation. To combat inflation, many central banks including the US Federal Reserve, the Bank of England and the European Central Bank have resorted to monetary tightening measures. The rise in global interest rates as a direct attempt to anchor inflation expectations will further subdue economic growth thereby increasing borrowing costs globally. This results in a downward economic cycle as rising borrowing costs will reflect in lower investments. The effects for developing countries could be more pronounced as inflation will hit the poorest and the marginalised the most. Weak global growth will decrease export income in these markets while higher global commodity prices will increase import expenditure leading to macroeconomic imbalances.

Risks for Sri Lanka

A global stagflationary environment can worsen Sri Lanka’s current economic crisis restricting growth and increasing inflation. Higher global borrowing costs will be detrimental to Sri Lanka’s future growth when the country resumes international borrowing once an IMF agreement is in place. The rise in commodity prices could further increase the country’s worsening food insecurity, with the World Food Programme reporting that 25% of the population is food insecure. Higher commodity costs will also increase import expenditure while lower global demand could reduce export revenue thus expanding the current account deficit. However, if global inflation is transient, the effects on the current account would be ambiguous. The global economic downturn will spark lower demand for commodities such as oil which could lower import expenditure but also reduce the demand for Sri Lankan exports.

Due to rising inflation and lower growth, the Sri Lankan economy is approaching stagflation. Growth expectations for the country have nosedived after the sovereign default with the economy projected to decline by -7.8% in 2022 and -3.7% in 2023 according to the World Bank. The combination of a myopic “organic” agricultural policy, the inflation pass through from the depreciation of the Sri Lankan Rupee by 80%, an expansionary monetary policy and global market conditions have resulted in inflation surging to 59% in June (YOY) (Figure 2).

Consumer Price Inflation (Jan 20 – May 22)

The tightening global economic conditions along with domestic supply-side factors such as shortages in food and fuel will continue to drive inflation in the country. Increased policy rates to combat inflation will result in lower investments. These factors, combined with political instability, lower than expected remittances, and lower productivity due to acute shortages of essential items will further constrict the Sri Lankan economy, pushing it into stagflation.Change in Policy Interest Rates of the Central Bank of Sri Lanka Policy Options

Sri Lankan policymakers are constrained within this economic environment. The country will need to impose austerity measures to receive an extended fund facility from the IMF. These measures will include tax reforms to increase government revenue, curtailing non-essential government spending and reducing subsidies. While a fiscal stimulus package is out of the equation, the country needs to target the most vulnerable groups in providing emergency subsidies, as rising inflation and job losses have led to lower standards of living, especially among the vulnerable segments of the population. Due to financing constraints, Sri Lanka will have to look for further bilateral and multilateral aid in securing funding for short term, targeted “in-kind” transfers such as food stamps. It is also imperative to have a bridge financing arrangement, to import essential commodities like fuel, so that supply shortages reduce. This should help in keeping productivity intact and inflationary pressure in check.

Monetary tightening should also continue. The CBSL hiked interest rates by 700 basis points in April this year. Interest rates were increased by another 100 basis points in July to control the rising inflation (Figure 3). Monetary policy decisions need to be communicated very clearly so that there is a stronger anchoring of inflation expectations. Anchored inflation expectations would limit a wage-price spiral to control inflationary pressure so that production costs do not rise further. Due to a global economic downturn, rising commodity prices and high rates of borrowing, Sri Lanka can expect a challenging external sector environment next year. Policymakers will need to understand these global challenges and make pragmatic economic decisions to minimise further damage to the economy.

Link to the blog https://www.ips.lk/talkingeconomics/2022/08/10/stagflation-in-sri-lanka-risks-and-policy-responses/

Author

Binura Seneviratne is a Research Officer working on macroeconomic policy, poverty and social welfare research at IPS. He holds a Master of Economic Policy from the Australian National University and a BSc in Economics and Finance from the University of York. (Talk with Binura: binura@ips.lk)

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”