Business

Sri Lanka’s Runaway Inflation and the Limits of Monetary Policy

by Dr Dushni Weerakoon

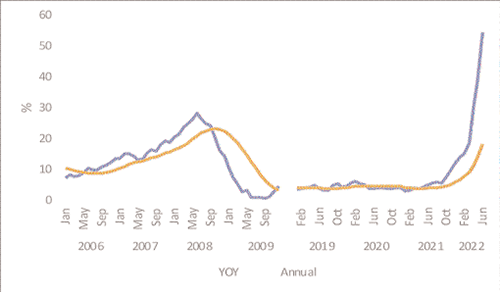

The bad news on inflation keeps coming. As of June 2022, year-on-year (YOY) inflation nationally is estimated at an all-time high of 59%. Annual inflation is lagging significantly behind at around 21%, indicative of the speed at which price inflation has been spiralling in recent months. This is in sharp contrast to Sri Lanka’s previous bout of high inflation in 2008 where the YOY increase was far more gradual (Figure 1). Then too, a similar combination of factors was at play. On the external front, a global financial crisis, a spike in international oil prices and sky-rocketing food prices prevailed. On the domestic front, a depressingly familiar combination of unsustainable fiscal, monetary and exchange rate policies were in place.

This time around too, the inflation bout was triggered by a series of macroeconomic policy blunders in managing the fallout of the COVID-19 pandemic; an untenable red hole in public finances, a massive injection of liquidity within a short time span, and an improbable exchange rate policy combined to bring about Sri Lanka’s harshest economic collapse. The inflation ‘pass through’ from the more than 80% currency depreciation that followed amplified the global price increases in food and fuel. The ban on chemical fertiliser use, import controls on food and high costs of transport added to the shortages, driving up prices further.

While Sri Lanka is still well below the commonly used threshold for hyperinflation (monthly inflation exceeding 50%) the rampant inflation this time around is consistent with a serious crisis of confidence across the economy. Monetary policy – i.e. raising interest rates – is the most appropriate tool at hand to fight inflation, but there are limits to its efficacy.

Today, inflationary pressures have intensified the world over with countries like the US and the UK seeing inflation rates hit 40-year highs. Unlike Sri Lanka, the inflation trigger in many of these economies was set off by buoyant demand and tight labour markets as countries emerged from the COVID-19 pandemic. The Russian invasion of Ukraine that followed went on to fuel energy and food price increases and add to supply bottlenecks – already battling a combination of challenges including a resurgence of COVID-19 in China. Almost everywhere, central banks embarked on a monetary policy tightening cycle, with New Zealand and South Korea starting early and aggressively. The intention is to anchor inflation expectations and cut off more persistent strength in nominal wage growth. Thus, the upswing in inflation and interest rate cycles point to a downswing in growth globally in 2022.

Having kept monetary policy too loose for too long, Sri Lanka started its tightening cycle in August 2021, albeit with timid steps – raising policy interest rates by a total of 200 basis points up to March 2022 even as inflation breached double-digit figures in November 2021. This was followed by an aggressive 700 basis point hike in April 2022. It signalled firm intentions to regain the Central Bank of Sri Lanka’s (CBSL) focus on price stability by engineering a reduction in demand through high interest rates and withdrawing liquidity from the economy. Effectively, in the current dire growth outlook for Sri Lanka, the policy intention means forcing a recession to tame inflation.

In choosing between the options of an aggressive hike that will lead to a recession or tolerating a prolonged inflationary spiral bordering on hyperinflation, the former is preferable. Once inflation takes hold, the damage can be corrosive, especially its deeply regressive impacts on lower income households. But a contractionary strategy to suppress demand will not achieve the desired outcomes if (a) inflation expectations are not well anchored and people expect rapid price increases to continue, and (b) supply side factors remain unaddressed.

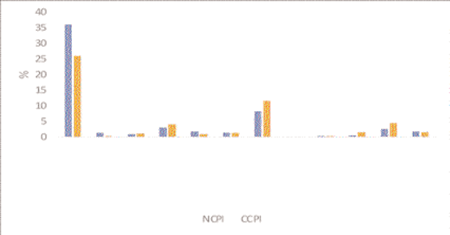

A sector-wise breakdown of the National Consumer Price Index (NCPI) and the Colombo Consumer Price Index (CCPI) of YOY inflation in June 2022 shows that demand-driven domestic inflationary pressures appear to be responsible for much less of the rise in headline inflation. Food price increases are contributing the largest share of 36% towards the YOY national increase in inflation in the NCPI (carrying a weight of 44%) while it contributes a similarly large share of 26% in the CCPI (with a weight of 28%). Transport is the second largest contributor (8-11%) in both indices. Overall, the strength of inflation appears to mainly reflect the large increases in energy and food prices; in fact, when inflation is driven largely by excess liquidity and demand, price increases across goods and services tend to be more uniform.

With runaway inflation, tightening monetary policy hard and fast was almost inevitable to anchor inflation expectations. The policy will work though only if fiscal adjustments evolve in line with monetary policy. Sharp interest rate increases make government debt even more expensive to service, and when interest rates exceed economic growth, a country’s indebtedness keeps rising. Higher interest rates in the current context of a crisis of confidence overall in the economy, and especially on exchange rate risks, means that it will not be reflected in stronger capital inflows to stabilise the rupee either.

Upward pressure on inflation in Sri Lanka will not dissipate immediately. Continued direct financing of Treasury spending by the CBSL, high global energy and food prices, and continuing domestic supply-side factors – food and fuel shortages, import policies, and related market distortions – will add to price increases. Thus, the current upswing in real interest rates will likely go further if it appears that the policy mix is unable to reverse the inflation trend.

At this crucial juncture, prompt action on all macroeconomic policy fronts simultaneously is essential to help the CBSL put price stability at the core of Sri Lanka’s monetary policy framework and better anchor inflation expectations. If workers and businesses are unconvinced that runaway inflation is firmly in check, higher price expectations will feed back into the process, making the fight against inflation even harder. It will also delay the recovery from recessionary conditions – through cuts in investments and shortening of investment horizons that ultimately hurt employment and jobs – as the country looks to ease back from the current economic crisis.

Link to the blog – https://www.ips.lk/talkingeconomics/2022/07/27/sri-lankas-runaway-inflation-and-the-limits-of-monetary-policy/

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”