Business

Sri Lanka’s graphite: A potential player in the global electric vehicle revolution

Malisha Weerasinghe worked as a Project Intern in the Macro, Trade & Competitiveness Policy Unit at IPS. Her research interests include macroeconomic policy, international trade, and development finance. She is currently pursuing a Bachelor’s in Economics and Finance at the University of Hong Kong.

Malisha Weerasinghe worked as a Project Intern in the Macro, Trade & Competitiveness Policy Unit at IPS. Her research interests include macroeconomic policy, international trade, and development finance. She is currently pursuing a Bachelor’s in Economics and Finance at the University of Hong Kong.

Asanka Wijesinghe is a Research Fellow at IPS with research interests in macroeconomic policy, international trade, labour and health economics. He holds a BSc in Agricultural Technology and Management from the University of Peradeniya, an MS in Agribusiness and Applied Economics from North Dakota State University, and an MS and PhD in Agricultural, Environmental and Development Economics from The Ohio State University. (Talk with Asanka – asanka@ips.lk)

Asanka Wijesinghe is a Research Fellow at IPS with research interests in macroeconomic policy, international trade, labour and health economics. He holds a BSc in Agricultural Technology and Management from the University of Peradeniya, an MS in Agribusiness and Applied Economics from North Dakota State University, and an MS and PhD in Agricultural, Environmental and Development Economics from The Ohio State University. (Talk with Asanka – asanka@ips.lk)

By Malisha Weerasinghe and Dr Asanka Wijesinghe

Sri Lanka has a rich history of mining and exporting graphite, which thrived during the World Wars, hitting 35,000 metric tons in annual exports. The vein graphite produced by Sri Lanka stands out for its remarkable purity, flawless crystal structure, and strong electrical conductivity, making it suitable for various commercial uses. However, in 2023, only 2,792 metric tons were exported, yielding approximately USD 6 million in revenue. The emerging trend towards electromobility on a global scale presents fresh opportunities to revive Sri Lanka’s graphite industry. The newly established Chamber for Mineral Exporters has also emphasised the importance of well-defined policies to harness the untapped potential of the mineral sector.

Graphite in EV Batteries: Opportunities for Sri Lanka

Graphite forms the core anode material in lithium-ion EV batteries, with quantities varying from 10 kg in hybrids to 70 kg in all-electric vehicles. Consequently, the US Department of Energy classifies graphite as a critical mineral. Projections indicate global demand for electric vehicles (EVs) will surge to 40 million units by 2030. Consequently, the demand for lithium-ion batteries for EVs has increased and securing sustainable and reliable critical raw materials (CRMs) has become a policy priority. Purity, extraction sustainability, cost, and geopolitical tensions are vital factors impacting the graphite supply chain. The US industrial and national security policies aim to diversify the sources of CRM for EV batteries- cobalt, nickel, lithium, and graphite- away from China, designated as a “foreign entity of concern” (FEOC).

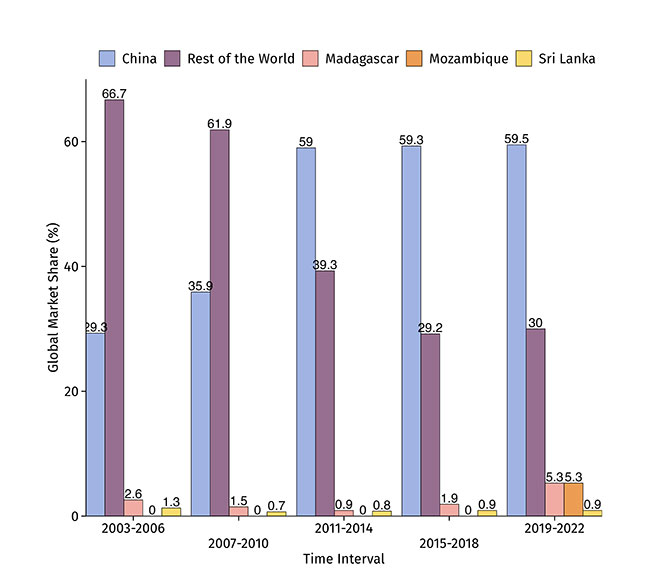

As the primary graphite producer (Figure 1), China possesses 80% of battery-grade graphite resources and controls more than 50% of the processing capacity. More than 65% of the anode material supplied globally was sourced from six companies in China. Crucially, China holds a notable edge in productivity and cost (Table 1), when exporting natural graphite to major economies. Yet, China’s prominent role as the primary graphite exporter has raised concerns about “supply chain resilience” among key Western importers, especially given their geopolitical aspirations.

The Biden Administration’s ambitious Inflation Reduction Act (IRA) has excluded EV batteries that contain graphite of Chinese origin from lucrative federal subsidies. While this may lead to a relative price increase for EV batteries using Chinese graphite, it also drives up demand for alternatives. Sri Lanka, known for exceptionally high-quality graphite production, could benefit from this shift. With the IRA-induced increase in demand and trade restrictions on China, Sri Lanka’s graphite exports to the US could potentially surge by 65.7% .

Positioning Sri Lanka’s Graphite in Global EV Battery Manufacturing

Sri Lanka’s current graphite production stands at 5,000 metric tons. Yet, according to the Board of Investment, the potential production capacity reaches 450,000 metric tons per year. Given that Sri Lanka is a rare producer of the finest form of natural graphite in an environmentally less harmful manner, the country has an opportunity to tap into the growing global demand for “non-China origin” graphite.

There are several stages of EV battery manufacturing that Sri Lanka may consider joining: exporting natural graphite, exporting processed graphite in the form of electrodes or anodes, exporting lithium-ion cells, and exporting the entire battery pack. For a few reasons, the last two might not be within Sri Lanka’s feasible options.

First, the general organisation of EV manufacturing is that vehicle production plants and battery pack production are located in geographical proximity due to logistic reasons. Second, the US’ renewed tendency to re-shore manufacturing through active industrial policy limits attracting investors to Sri Lanka for producing an entire battery pack or battery cells. Thus, Sri Lanka’s most viable options might be exporting natural graphite or processed electrodes and graphene to the US, Japan, South Korea, and the EU-centred EV manufacturing production network.

Policy Recommendations

Sri Lanka should take proactive measures to leverage global policy shifts and identify potential roles within the EV battery value chain. Thoughtfully crafted industrial and trade strategies will play a significant part in maximising the benefits from Sri Lanka’s graphite resources in the emerging landscape. Sri Lanka’s industrial policy should strive to identify graphite-based products with an existing comparative advantage, link the producers with the end-users, facilitate the acquisition of required technology for value addition, and remove the hurdles for possible mining expansion.

Engaging private sector stakeholders in thorough consultations can help Sri Lanka strategically position itself in the competitive EV manufacturing ecosystem. Concurrently, industrial policy must prioritise environmentally sustainable graphite extraction and processing, leveraging Sri Lanka’s potential as a “non-China origin sustainable graphite” source.

A pivotal trade strategy involves forging critical minerals agreements with the US and EU. A pact with the US enables Sri Lanka to process and export value-added graphite, aligned with IRA subsidy rules. Moreover, a formal accord with major graphite-consuming EV battery manufacturers fosters mining and processing sector investment by eliminating uncertainty.

A burgeoning hub for EV battery production is forming in Thailand and Indonesia, with China, Japan, and South Korea investing in regional EV manufacturing. Agreements among countries possessing critical mineral deposits are increasingly common, motivating Sri Lanka to broaden its proposed trade deals with Thailand, Indonesia, and other East Asian nations into the EV battery value chain. Trade agreements should facilitate investments in graphite mining and the subsequent processing into electrodes and graphene.

Link to original blog: https://www.ips.lk/talkingeconomics/2023/08/22/sri-lankas-graphite-a-potential-player-in-the-global-electric-vehicle-revolution/

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”