Business

Sri Lanka’s Debt Restructuring Roadmap: Following the evidence

By Dr Dushni Weerakoon

Debt restructuring is fundamentally about allocating the associated economic costs to someone. The onus is typically on the debtor country to secure participation from its creditors, applying comparable treatment to all. As with all negotiations, the level and modalities of relief will always be subject to some degree of controversy. Sri Lanka’s recently gazetted domestic debt restructuring (DDR) exercise too has drawn expressions of both support and criticism. Overall though, negotiations have to be framed within certain desired outcomes to minimise costs to the economy. To this end, Sri Lanka’s negotiating stance dovetails neatly with crucial research evidence.

A restructuring process, whether pre-emptive or post-default, imposes significant output costs. For a debtor country to minimise these, some notable findings are:

A restructuring process, whether pre-emptive or post-default, imposes significant output costs. For a debtor country to minimise these, some notable findings are:

Output losses are higher in post-default restructuring.

When defaults are accompanied by a banking crisis, the fall in output is particularly large.

Even in a post-default setting, output costs can be reduced the quicker the debtor country is able to reach an agreement with its creditors.

The size of creditor losses (haircuts) is among the best predictors of participation rates on bond restructuring.

To begin with, there was no real appetite to include a DDR in Sri Lanka’s case, especially in view of the substantial real erosion in value to debt holders as inflation spiralled. But, as opening gambits commenced with external creditors, the bondholder group’s request that ‘domestic debt is reorganised in a manner that both ensures debt sustainability and safeguards financial stability’ could not be ignored if only to avoid an impasse. Sri Lanka has limited room to circumvent a DDR altogether. As a middle-income country, the inclusion of domestic debt optimisation is implicitly encouraged in the IMF’s debt sustainability framework (DSF) for market-access countries. It focuses on the total stock of public debt but is avoided by low-income countries where the applicable DSF focuses only on external public debt.

Having opened the door to a DDR, there would have been very real concerns that the combination of skyrocketing inflation and financial fragility would test the banking sector’s resilience to deal with a DDR. Figures on capital adequacy and asset quality (with the non-performing loan ratio on stage 3 loans rising from 5.2% in 2020 to 11.3% in 2022) and exposure to restructuring the country’s international sovereign bonds (ISBs) meant the stakes were high. When times are uncertain, a herd mentality will rule, and this is to be avoided at all costs.

Another element in a DDR is that there are negative externalities that need to be internalised – i.e. there may be direct costs to a country’s financial sector from a DDR, such as recapitalisation and these have to be taken on board. This is particularly so where there is a strong link between the sovereign and its financial system. In setting aside resources to ensure financial system stability, the anticipated fiscal benefits of a DDR can potentially reduce. Thus, on both counts, ringfencing the banking sector to avert a far more damaging economic crisis and deeper output losses has been the first step in Sri Lanka’s approach.

Having left out the banking sector, the economic cost appears to have been disproportionately directed at the savings of workers contributing to pension funds. Private bondholders have been exempted denying ‘comparable treatment’ while the captive nature of the Employers Provident Fund (EPF), managed by the Central Bank of Sri Lanka (CBSL), means there has been no attempt to ‘secure participation’.

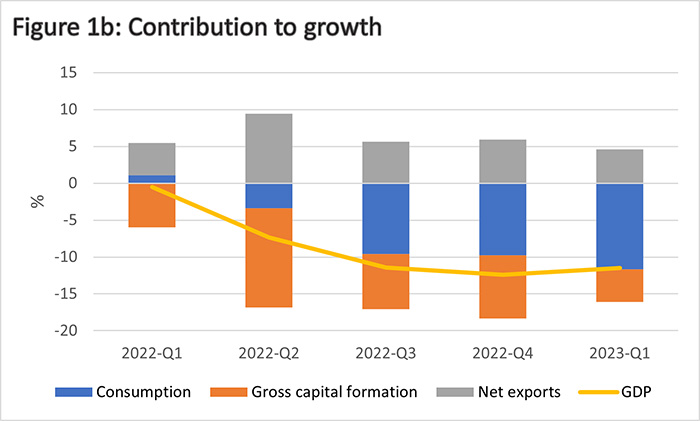

Sri Lanka’s DDR treatment in effect is an example of the considerable degree of influence that a sovereign can exert over domestic legal and regulatory frameworks, unlike that of an external debt restructuring (EDR). Under the terms, pension funds are required to opt for a 30% haircut or be liable for higher taxation at 30% instead of the prevailing 14%. For EPF savers, there is the only assurance of receiving a 9% return in the long-term for a fund that has often performed below par even against the simplest alternative instrument that an average saver may look at, such as one-year fixed deposits (Figure 1a). Where there has been a substantial erosion of real savings from a crisis-induced economic environment, this is scant consolation for workers. The premise of a return to single-digit inflation merely means that price increases have slowed from the previous exorbitant high levels, but the erosion of the value of savings remains very real.

The second step of the negotiating process is to bring as many of Sri Lanka’s external creditors on board as quickly as possible. Having complied with the bondholder group’s request on including a DDR, comparable treatment is being offered by way of a 30% haircut on EDR too. As a bilateral creditor, China’s preference globally is for deferral rather than reduction. But merely pushing repayments down the line with maturity extensions (and some coupon adjustments) still leaves Sri Lanka at the risk of being permanently illiquid and, therefore, vulnerable to repeat short-term crises. Clearly, the deeper the haircut, the more sustainable the debt becomes, but negotiations will likely drag on. A complex creditor group and geo-political wrangling add to these risks. Ecuador, a middle-income country, came to an agreement with its bondholders to a haircut of 9% on USD 17.4 billion in 2020, with a high 98% of bondholders agreeing to the deal. China persisted with maturity extensions and coupon adjustments.

Corralling in the bilateral creditors will require more diplomatic persuasion than economic analysis. China’s recently concluded deal with Zambia to restructure USD 4.2 billion of loans under an initiative driven by the G20 Framework for low-income countries pushed back repayments and accommodated interest rate cuts. This follows on from its deal with Ecuador a year earlier that included maturity extensions and interest rate adjustments on debts worth USD 4.4 billion. There are two key arguments put forward by China for not taking losses in debt restructurings: first, that its loans are development-oriented, tied to projects that generate revenues for the recipients, and second, that multilateral banks should also participate, instead of the current preferred status of having their loans repaid in full. In many ways, Sri Lanka will be a test case on these issues.

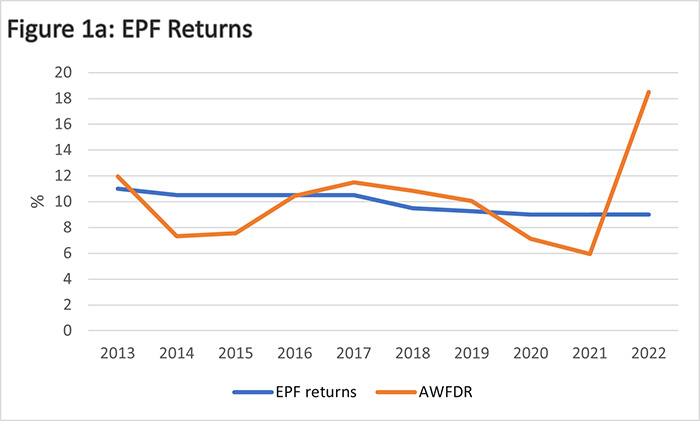

The expected deceleration in the contraction of Sri Lanka’s economic output in the coming months is only the start to claw back lost output. This too is under threat. As domestic consumption faltered, net exports were the only positive driver of growth in recent quarters, but there are concerning signs of a slowdown (Figure 1b). In the event, it is even more probable that the allocation of costs associated with debt negotiations will be weighed and measured against the need to get an overall deal done as quickly as possible to support Sri Lanka’s slow-burn economic recovery.

Link to blog: https://www.ips.lk/talkingeconomics/2023/07/18/sri-lankas-debt-restructuring-roadmap-following-the-evidence/

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”