Business

Special goods and services tax: Issues and concerns

By Dr Roshan Perera & Naqiya Shiraz

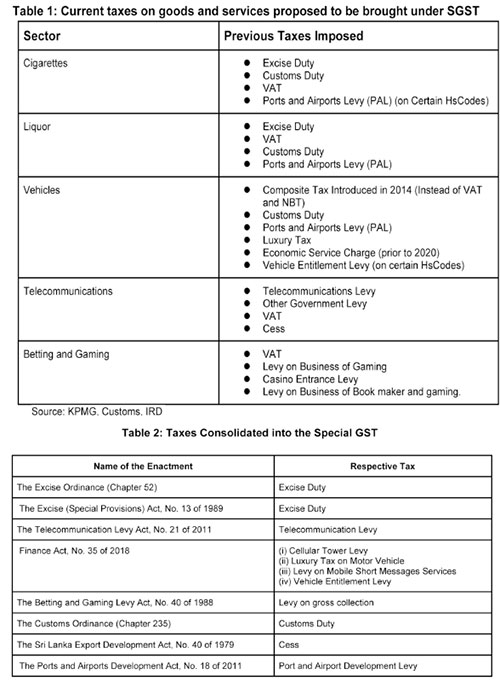

The new bill titled ‘Special Goods and Services Tax’ was published by gazette dated 07 January 2022.1 The Special Goods and Services Tax (SGST) was originally proposed in Budget speech 2021 but was not implemented. It has once again been presented in Budget 2022. The SGST aims to consolidate taxes on manufacturing and importing cigarettes, liquor, vehicles and assembly parts, while also consolidating taxes on telecommunication and betting and gaming (see table 1 for existing taxes on these products and table 2 for taxes consolidated into the SGST as per the schedule in the gazette). The rationale for this new tax as per the bill is “…to promote self-compliance in the payment of taxes in order to ensure greater efficiency in relation to the collection and administration on such taxes by avoiding the complexities associated with the application and administration of a multiple tax regime on specified goods and services.”

Given the multiplicity of taxes and the complexity of the current tax system as a whole, rationalising taxes is necessary to improve collection. However, whether the proposed SGST simplifies the tax system, while ensuring revenue neutrality or even improving revenue collection, needs to be carefully examined.

The SGST Bill is silent on the treatment of the existing VAT on these goods and services. However, according to the Value Added Tax (Amendment) Bill also gazetted on 07 January 2022,1 liquor, cigarettes and motor vehicles will be exempted from VAT while telecommunications and betting and gaming services will still be subject to VAT.

While the gazetted Bill sets out some of the features of the proposed SGST there are many important areas not covered in the Bill. These are expected to be gazetted as and when required by the Minister in charge.

Issues & Concerns

The motivation behind SGST is the simplification of the tax system. Although the objective of introducing the SGST is to improve efficiency by reducing the complexity of the tax system there are many issues and concerns with this proposed tax.

Revenue

Tax revenue which was 13% of GDP in 2010, declined to 8% in 2020. Ad hoc policy changes and weak administration contributed to the decline in tax revenue collection. This continuous decline in tax revenue has led to widening fiscal deficits and increasing debt. One of the main reasons for the current macroeconomic crisis is low tax revenue collection. Hence, any change to the existing tax system should be with the primary objective of raising more revenue.

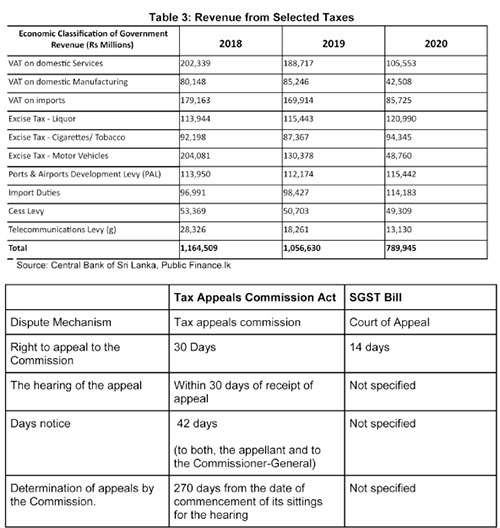

According to the budget speech the SGST is estimated to bring in an additional Rs. 50 billion in revenue in 2022.1 Revenue from taxes proposed to be consolidated under the SGST has significantly declined over the past 3 years. Given the already difficult macroeconomic environment, along with ad hoc tax policy changes raising the additional revenue estimated at Rs. 50 billion seems a difficult task.

Tax Base and Rate

For the SGST to raise taxes in excess of what is already being collected through the existing taxes, the rate and the base for the SGST needs to be carefully and methodically calculated. Further, the existing taxes have different bases of taxation. For instance the basis of taxation of motor vehicles is both on an ad valorem1 basis and a quantity basis while the basis of taxation of cigarettes and liquor is quantity.2 In light of this, the basis of taxation on which SGST isapplied becomes an issue. Having different bases and different rates for various goods and services would complicate the implementation of the tax These issues need to be carefully considered to ensure the new tax is revenue neutral or be able to enhance revenue collection.

Efficiency

One possible revenue benefit of this proposal is the inability to claim input tax credits on the sectors exempted from VAT. However, the issue is the cascading effect that would result where there would be a tax on tax with the end consumer paying taxes on already paid taxes. If the idea was to raise additional revenue by limiting tax credits, it would have been simpler to raise the tax rates on the existing taxes rather than introduce a new tax.

4. Administration

According to the bill, SGST will now be collected through a new unit set up under the General Treasury where a Designated Officer (DO) will be in charge of the administration, collection and accountability of the tax. The existing revenue collection agencies, such as the Inland Revenue Department (IRD) or the Excise Department will not be primarily responsible for the collection of this tax. By removing the IRD and Excise Department, a parallel bureaucracy will be created, at a time when public spending needs to be carefully managed. The General Treasury also has no previous experience and expertise in direct revenue collection. Weak administration is one of the key reasons for the low tax collection and success of this tax would depend on the strength of its administration.

In addition to the above mentioned concerns, as per the Bill the minister in charge of the SGST has been vested with the power to set the rates, the base and grant exemptions. Accordingly, Parliamentary oversight over fiscal matters is weakened under this proposed Bill.

It could also lead to a time lag between the gazetting and implementing of changes to the SGST (such as the rate, base etc) and obtaining Parliamentary approval for those changes.

Dispute resolution

The SGST Bill also focuses on the dispute resolution mechanism. Under the present tax system, with the enactment of the Tax Appeals Commission Act, No. 23 in 2011 the Tax Appeals Commission has the “responsibility of hearing all appeals in respect of matters relating to imposition of any tax, levy or duty”.1 The most recent amendment to the Tax Appeal

Commissions act (2013)1 seeks to address the large number (495) of cases pending before the Tax Appeals Commision2 by increasing the number of panels to hear the appeals.

Under the proposed SGST disputes will be handled through the court of appeal. However, the time period by which specific actions need to be taken is not provided in the bill. In addition, disputes have to be taken to the court of appeal. Hence, the entire process will be more time consuming. This could result in revenue lags and difficulties in revenue estimation until disputes are resolved.

Additionally, in the case that no valid appeal has been lodged within 14 days, any remaining payments would be considered to be in default. Thereafter, the responsibility is shifted to the Commissioner General of the IRD to recover the dues. Given the IRD is completely removed from the normal collection process, the rationale for bringing defaults under the IRD is not clear.

III. Policy Recommendations

As discussed, the SGST Bill has several limitations and much of this is due to the ambiguities in the Bill.

If the tax is implemented, the rate and basis of taxation needs to be revenue neutral to ensure tax collection is maximised and administrative costs minimised.

The rates, basis of taxation, exemptions etc should be specified in the Bill, as done in most other Acts. This would avoid the power for discretionary changes to the tax being placed in the hands of the minister in charge.

Given the already weak tax administration, it would be more sensible to strengthen the existing revenue collecting agencies and address the weaknesses in the existing system without creating a parallel bureaucracy.

In the case where VAT is consolidated into the proposed GST, the issue of cascading effect of input tax credits needs to be addressed. This is relevant particularly in the case of capital expenditure.

Given the critical state of revenue collection in the country the question to ask is whether this is the best time to introduce a new tax. Focus should be on fixing issues in the existing tax system to ensure revenue is maximised. The VAT is the least distortionary tax and it is the easiest to administer. Given these features it can be a very efficient revenue generator for a country. Therefore instead of introducing a new tax, capitalising on systems that are already in place and amending the VAT rate, threshold and exemptions may be a more practical solution to the revenue problem that the country is currently facing.

Dr. Roshan Perera is a Senior Research Fellow at the Advocata Institute and the former Director of the Central Bank of Sri Lanka.

Naqiya Shiraz is a Research Analyst at the Advocata Institute.

The opinions expressed are the author’s own views. They may not necessarily reflect the views of the Advocata Institute, or anyone affiliated with the institute.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”