Business

Russia-Ukraine conflict: Economic implications for Sri Lanka

By Asanka Wijesinghe

The Russian invasion of Ukraine deepens the existing global economic woes – persistent supply chain bottlenecks and associated rising inflation – clouding the prospects of a smooth global economic recovery from the pandemic. The West, led by the US and the EU, swiftly imposed strict economic sanctions, targetting Russian banks, oligarchs, political leaders, and state-owned and private entities, generating additional uncertainty over the global economic outlook. The initial disunity in the West on cutting off Russia from SWIFT-a global financial telecommunication system that allows the smooth and rapid cross-border transaction of money- was resolved over the weekend. Such a move will inevitably make payments for Russian exports and imports hard. The ongoing military conflict in Europe could not have come at a worse time for Sri Lanka given its own prevailing high inflation, rising energy costs, and scarcity of foreign exchange. Against this backdrop, this article discusses the economic impact of the European conflict on Sri Lanka, the sectors that will be hit hard, and ways to mitigate the negative impact.

The Russian invasion of Ukraine deepens the existing global economic woes – persistent supply chain bottlenecks and associated rising inflation – clouding the prospects of a smooth global economic recovery from the pandemic. The West, led by the US and the EU, swiftly imposed strict economic sanctions, targetting Russian banks, oligarchs, political leaders, and state-owned and private entities, generating additional uncertainty over the global economic outlook. The initial disunity in the West on cutting off Russia from SWIFT-a global financial telecommunication system that allows the smooth and rapid cross-border transaction of money- was resolved over the weekend. Such a move will inevitably make payments for Russian exports and imports hard. The ongoing military conflict in Europe could not have come at a worse time for Sri Lanka given its own prevailing high inflation, rising energy costs, and scarcity of foreign exchange. Against this backdrop, this article discusses the economic impact of the European conflict on Sri Lanka, the sectors that will be hit hard, and ways to mitigate the negative impact.

Global Economic Impact

Immediately after the Russian invasion on 24 February, commodity markets rallied up. The Brent spot price of a crude oil barrel reached USD 105 for the first time after 2014. Similarly, the cost of wheat futures for March 2022 in the Chicago Board of Trade (CBOT) exchange peaked, at its highest since mid-2008 (Figure 1). The Russian Federation and Ukraine-known as Europe’s breadbasket- are major cereal, fertiliser, critical minerals, and iron and steel exporters. Meanwhile, the Western powers were busy over the weekend in negotiations to tighten sanctions on Russia.

Immediately after the Russian invasion on 24 February, commodity markets rallied up. The Brent spot price of a crude oil barrel reached USD 105 for the first time after 2014. Similarly, the cost of wheat futures for March 2022 in the Chicago Board of Trade (CBOT) exchange peaked, at its highest since mid-2008 (Figure 1). The Russian Federation and Ukraine-known as Europe’s breadbasket- are major cereal, fertiliser, critical minerals, and iron and steel exporters. Meanwhile, the Western powers were busy over the weekend in negotiations to tighten sanctions on Russia.

While the fate of Ukraine hangs in the balance, the consensus among analysts is that the Ukrainians were mounting a fierce and unexpected resistance, effectively increasing the costs for Russia. The US, EU and their allies are contributing to the military conflict by providing financial and military assistance to Ukraine while imposing sanctions on Russia to make dollar transactions difficult. Thus, the severity of the global economic impact will be determined by the scope and duration of the conflict and the effectiveness of Western sanctions.

Western countries will be keen to minimise the spillover effects of sanctions on their economies. Like Germany, the major European economies heavily depend on Russian energy, making it necessary to exempt the energy sector from sanctions. Indeed, the sanctions package unveiled by the Biden administration did not target the energy sector. As long as payments for energy-related transactions go through non-sanctioned and non-US financial institutions, an unconstrained flow of money is guaranteed. Thus, oil prices dropped with futures closing below USD 93 a barrel in New York. However, that optimism was largely fading in early trade on 28 February. The Brent price rallied over 100 dollars again while wheat, soybean, and corn futures were up. Cutting off Russia from SWIFT and imposing sanctions on the Russian Central Bank can deal a severe blow to the Russian economy in the long run. The collapsing ruble can be a harbinger of Russia’s economic collapse. A possible economic fallout will reduce Russian demand for foreign products, and if Russia cuts off natural gas to the European market, a likely outcome will be a recession.

Implications for Sri Lanka

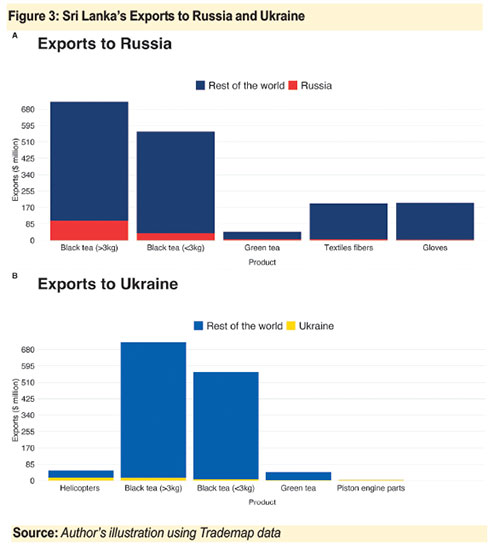

Overall, Russia and Ukraine account for 2% of Sri Lanka’s imports and 2.2% of exports in 2020. However, both countries are vital import sources for wheat and export destinations for Sri Lanka’s black tea (Figure 2 and 3). Russia and Ukraine purchase about 18% of fermented black tea (>3kg) exported by Sri Lanka. Similarly, 45% of Sri Lanka’s wheat imports are sourced from Russia and Ukraine. In addition, more than half of Sri Lanka’s imported soybeans, sunflower oil and seeds, and peas are from Ukraine. Moreover, Russia and Ukraine are significant import sources for asbestos, semi-finished products of iron and steel, copper (cathodes), and potassium chloride for fertiliser.

Unless the Ukraine crisis is not solved immediately, the fuel and commodity prices can rally further. The inflationary pressure in the Western markets, especially in Europe due to high energy prices and supply chain bottlenecks, may reduce consumers purchasing power, lowering the demand for goods exported by Sri Lanka. Europe is a significant export destination for readymade garments, tea and spices, and seafood.

There is also a growing tendency for increased military expenditure in the long run, which might reduce the “peace dividends” for European households. For example, the German Chancellor committed 2% of GDP for defence expenditure, addressing an extraordinary session of Bundestag. Replacing consumerism with militarism will adversely affect countries like Sri Lanka that depend on the European export market. In addition, a prolonged crisis may impede Sri Lanka’s ability to purchase necessary raw materials like fertiliser. Importantly, Sri Lanka’s exposure to the situation is mainly through linkages to the commodity and European export markets rather than direct exposure to the two countries involved in the conflict.

Mitigation

Sri Lanka should focus on safeguarding access to vital raw materials and food commodities. Globally, responding to the crisis, countries are stockpiling grain and exploring alternative ways to do business with Russia in purchasing raw materials. Sri Lanka has limited options to mitigate the impact on already deteriorating food security conditions and access to raw materials. As wheat and rice are substitutes, high wheat prices may increase the demand for rice.

Sri Lanka should focus on safeguarding access to vital raw materials and food commodities. Globally, responding to the crisis, countries are stockpiling grain and exploring alternative ways to do business with Russia in purchasing raw materials. Sri Lanka has limited options to mitigate the impact on already deteriorating food security conditions and access to raw materials. As wheat and rice are substitutes, high wheat prices may increase the demand for rice.

Thus, it is necessary to remove input shortages like fertiliser to ensure domestic production is adequate. Due to the current foreign exchange crisis, Sri Lanka’s ability to effectively face such shocks is constrained. Thus, the urgent priority is to resolve the current foreign exchange crisis to regain the ability to trade swiftly. Achieving debt sustainability and securing dollar inflows from multilateral institutes might be the options at Sri Lanka’s disposal. Then, entering forward contracts for raw materials and fuel and negotiations with friendly countries for food on predetermined prices are possibilities.

Link to Talking Economics blog:

Russia-Ukraine Conflict: Economic Implications for Sri Lanka

Asanka Wijesinghe is a Research Fellow at IPS with research interests in macroeconomic policy, international trade, labour and health economics. He holds a BSc in Agricultural Technology and Management from the University of Peradeniya, an MS in Agribusiness and Applied Economics from North Dakota State University, and an MS and PhD in Agricultural, Environmental and Development Economics from The Ohio State University. (Talk with Asanka – asanka@ips.lk)

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”