Business

Revamping welfare: Is Aswesuma the salvation Sri Lanka’s poor hoped for?

Lakshila Wanigasinghe is a Research Officer at the IPS with research interests in poverty, social welfare, development, education, and health. She holds an MSc in Economics with a concentration in Development Economics and a BA in Economics with concentrations in International, Financial and Law and Economics from Southern Illinois University Carbondale (SIUC), US. (lakshila@ips.lk)

By Lakshila Wanigasinghe

With the introduction of Aswesuma as a brand-new initiative targeting the poor and vulnerable, social protection in Sri Lanka has been a much-debated subject lately.

Aswesuma primarily intends to overcome some key weaknesses of existing social protection programmes – at least on paper – but several challenges prevail. However, opinions regarding its capabilities to accomplish this remain ambiguous. The public has been protesting the scheme, and opposition party critics have called it an unfair political gimmick. Initially scheduled for disbursement in July 2023, the benefits for July finally commenced distribution last Monday (28th August) for 800,000 beneficiaries.

This blog delves into the key areas that warrant clarification, with the hope that authorities will address these concerns transparently.

Eligibility and Beneficiary Selection

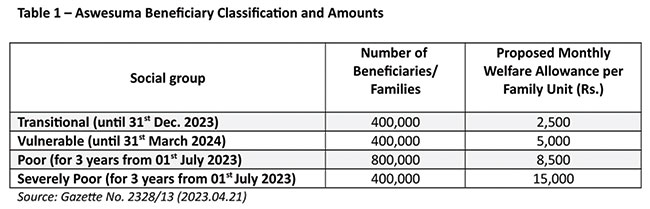

Aswesuma introduces a multi-dimensional approach to poverty assessment, a notable improvement from the family size-based method employed by its predecessor, Samurdhi. Aswesuma employs six criteria measured by 22 indicators to determine if a household is non-poor or poor and deserving of assistance. Accordingly, eligible families receive assistance under four social groups (Table 1).

Publication of Aswesuma’s initial eligibility lists sparked concerns as many households called it unfair and demanded re-evaluations. As a result, 982,770 appeals and 62,368 objections arose from the process that followed. The sizeable appeals and objections raise questions about the accuracy of the selection process. Nearly 650,000 appeals were from already approved beneficiaries requesting an upgrade to a higher allowance category. However, without information on the cut-off points for the total number of families per beneficiary category and criteria determining allowance amounts, it is difficult to draw any conclusions regarding the methodologies’ ability to identify the most deserving families. The appropriateness of certain indicators, such as those assessing the “economic level”, comes under scrutiny due to their sensitivity to fluctuations like electricity consumption patterns and inconsistent monthly incomes.

Fate of Samurdhi Recipients

In 2022, Samurdhi cash transfers supported approximately 1.76 million beneficiaries. In contrast, Aswesuma aims to support 2 million beneficiaries annually. So far, Aswesuma has over 1.7 million eligible beneficiaries, of which nearly 950,000 are families that did not previously receive government welfare assistance. Over 1.28 million Samurdhi recipient households applied for Aswesuma, of which only 887,653 are eligible.

In 2022, Samurdhi cash transfers supported approximately 1.76 million beneficiaries. In contrast, Aswesuma aims to support 2 million beneficiaries annually. So far, Aswesuma has over 1.7 million eligible beneficiaries, of which nearly 950,000 are families that did not previously receive government welfare assistance. Over 1.28 million Samurdhi recipient households applied for Aswesuma, of which only 887,653 are eligible.

Cabinet approval was recently granted to extend Samurdhi cash transfers to 393,094 existing Samurdhi recipients unqualified for Aswesuma until the appeals and objections process concludes. Perhaps some of them will be included in Aswesuma’s final beneficiary list; however, it is unlikely that all will. Since Aswesuma attempts to correct Samurdhi’s targeting errors, understandably, some existing Samurdhi recipients are left out. However, it is important to ensure that those truly in need are included. Failure to do so will remove the support these families receive through Samurdhi and leave them without Aswesuma. Additionally, uncertainties linger for recipients who did not apply for Aswesuma (households that were unaware of the application process, missed the deadline, etc.), leaving them without any support.

Monitoring and Evaluation

Aswesuma will conduct annual beneficiary evaluations to ensure support to the most deserving. While eliminating non-deserving beneficiaries (one of Samurdhi’s key weaknesses) is much needed, concerns exist as it is unclear how reassessments will occur. Conducting household surveys annually is tedious, especially considering that beneficiaries are expected to be selected for Aswesuma’s second year even before the official commencement of the first.

The transitional and vulnerable beneficiary categories only receive assistance for a short period. Given this, will new beneficiaries be added to these categories after the end of the allowance period or following yearly revaluations?

Samurdhi Bank Regulation

Aswesuma benefits will be dispensed as direct deposits to beneficiary bank accounts. This is only to involve banks regulated under the Central Bank of Sri Lanka (CBSL). This approach aims to prevent third-party involvement in the process, as seen with Samurdhi, where cash transfers were done via the Samurdhi Department.

Interest has been shown to regulate Samurdhi banks and bring them under the purview of the CBSL. In this regard, discussions are underway on developing a credible system to regulate the Samurdhi banking system. Samurdhi banks established under the Samurdhi Authority Act operate as independent bodies. Hence, regulating them would likely require amendments to the Act, which is a complex and time-consuming task.

After regulation, using Samurdhi banks for the Aswesuma benefit disbursement seems like the obvious choice. Samurdhi is a familiar entity among villagers, and its widespread banking network makes it easily accessible rurally. However, the regulation has not yet been confirmed, and if it were to occur, it cannot be done within a short span of time, and hence, its ability to support Aswesuma in its initial three years is unlikely.

Continuity of Aswesuma

Attempting to correct the weaknesses of existing poverty alleviation programmes is a good starting point. However, this must be done in a logical manner. On paper, Aswesuma seems somewhat convincing, yet its practical application is to be seen.

With a three-year timeline, Aswesuma’s true impact on poverty alleviation remains uncertain. Whether the programme will be extended or if Aswesuma will conclude as a short-term relief initiative and be replaced with a new long-term poverty-targeted programme remains undisclosed.

Nonetheless, the success or failure of Aswesuma depends not on its ability to provide temporary relief but on whether it helps families graduate from poverty. Ultimately, the focus of any poverty-targeted programme should be to strive towards poverty alleviation. Although this is a long-term goal, benefits received through Aswesuma should at least push recipients toward improving their lives and livelihoods. Aswesuma should have a mechanism to support families in discontinuing their reliance on government assistance. Irrespective of whether this is done through Aswesuma or Samurdhi, it is important to communicate these plans with all relevant parties clearly.

Aswesuma’s continuity involves better information dissemination to avoid confusion among recipients, policymakers, and implementors. Flexibility will be key as this is undoubtedly a learning experience with corrective measures to be taken along the way. As the scheme encountered several practical challenges during implementation, addressing them and providing the first instalment to the most deserving families is of utmost importance now.

Link to original blog: https://www.ips.lk/talkingeconomics/2023/09/05/revamping-welfare-is-aswesuma-the-salvation-sri-lankas-poor-hoped-for/

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”

Lakshila Wanigasinghe is a Research Officer at the IPS with research interests in poverty, social welfare, development, education, and health. She holds an MSc in Economics with a concentration in Development Economics and a BA in Economics with concentrations in International, Financial and Law and Economics from Southern Illinois University Carbondale (SIUC), US. (lakshila@ips.lk)

Lakshila Wanigasinghe is a Research Officer at the IPS with research interests in poverty, social welfare, development, education, and health. She holds an MSc in Economics with a concentration in Development Economics and a BA in Economics with concentrations in International, Financial and Law and Economics from Southern Illinois University Carbondale (SIUC), US. (lakshila@ips.lk)