News

Restructuring Guru Buchheit Warns Sri Lanka on Holdout Creditors

A clause on some of Sri Lanka’s older dollar bonds gives creditors a potential opening to hold the sovereign hostage and stall restructuring negotiations, Lee Buchheit, a veteran of over two dozen debt restructurings who has also been consulted by the Sri Lankan government, told Bloomberg on Thursday.

He says some of the nation’s debt contracts contain the so-called single series collective action clause, which could allow a minority of bondholders to veto or demand terms in the negotiations.

“One must always anticipate the possibility of holdout creditors in an operation of this kind,” Buchheit said in email replies. “No one seriously doubts that Sri Lanka needs debt relief. The debate may focus on how much debt relief and from whom will it be sought.”

While Sri Lanka is seeking a bailout from the International Monetary Fund, the multilateral lender insists that existing debt must be brought to sustainable levels before any aid is doled out. That could include protracted discussions with not just global asset managers but also large bilateral creditors such as Japan, India and China, each of whom would also impose their conditions.

For instance, India has stated that it wants China to be treated on par with other creditors in the debt restructuring process. However, China has historically preferred to hand out fresh loans as refinance rather than rework existing debt and doesn’t often share details of the credit. Sri Lanka hasn’t been able to tap a $1.5 billion swap line from China over concern that the IMF may consider it as a loan and force delays in repayment.

‘Main Challenge’

“The main challenge I see is one of coordination among the three main creditor groups — bondholders, Paris Club bilaterals and non-Paris Club bilaterals like China and India,” said Buchheit. “A commitment by Sri Lanka to even-handed treatment of these three groups should go a long way toward smoothing the path of the negotiations.”

China has indicated that it will not insist on preferential repayment of loans and is willing to be treated at par with other creditors, Sri Lanka’s President Gotabaya Rajapaksa said in an interview on Monday.When asked if Beijing would be willing to be treated on par with other creditors, Foreign Ministry spokesman Zhao Lijian said on Tuesday that China supports “the proper settlement through consultation with relevant parties and institutions” and hopes other countries will also play a constructive role.

“We hope that Sri Lanka will protect the legitimate rights of foreign investors and safeguard and uphold the credibility and good investment environment at home,” he added.

Sri Lanka is grappling with a worsening humanitarian crisis after it ran out of dollars to import food and fuel, stoking inflation to 40% and forcing a historic debt default. Sri Lanka needs $5 billion to ensure “daily lives are not disrupted,” and a further $1 billion to strengthen the rupee, Prime Minister Ranil Wickremesinghe told Parliament Tuesday.The first step would be a Debt Sustainability Analysis from the IMF, which will provide an outline of how much of a haircut creditors could see. Unlike corporate bankruptcies, debt restructuring has no clear, defined rules.

That’s where Buchheit fits in. The retired lawyer has worked on almost every major sovereign restructuring case in a career that spanned over four decades, including leading the legal team for the $206 billion Greek negotiations in 2012. That restructuring — the world’s biggest — retroactively imposed an “aggregated collective action clause” across domestic notes, which has since become an important tool to ensure that a majority of creditors can force any minority holdouts to accept a restructuring deal.Bonds issued before 2015 are likely to be subject to the problematic single-series CACs as innovations after that year have eliminated more protracted negotiations by requiring only investors who hold three quarters of overall debt to agree, according to Matthew Vogel, London-based portfolio manager and head of sovereign research at FIM Partners.

News

US sports envoys to Lanka to champion youth development

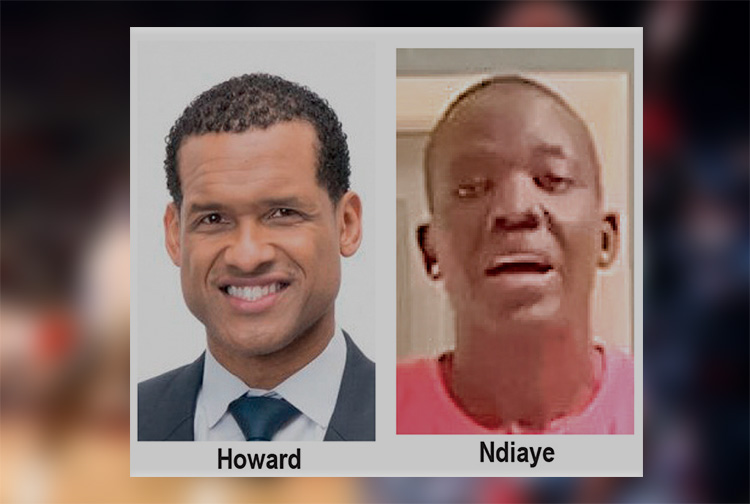

The U.S. Embassy in Colombo welcomed the U.S. Sports Envoys to Sri Lanka, former National Basketball Association (NBA) and Women’s National Basketball Association (WNBA) players Stephen Howard and Astou Ndiaye, from June 8 through 14.

The Public Diplomacy section of the U.S. Embassy said that it would launch a weeklong basketball program intended to harness the unifying power of sports, made possible through collaboration with Foundation of Goodness and IImpact Hoop Lab.

While in Sri Lanka, Howard and Ndiaye, both retired professional basketball players, will conduct a weeklong program, Hoops for Hope: Bridging Borders through Basketball. The Sports Envoys will lead basketball clinics and exhibition matches and engage in leadership sessions in Colombo and Southern Province for youth aged 14-18 from Northern, Uva, Eastern and Western Provinces, offering skills and leadership training both on and off the court. The U.S. Envoys will also share their expertise with the Sri Lanka Basketball Federation, national coaches, and players, furthering the development of basketball in the country. Beyond the clinics, they will collaborate with Sri Lankan schoolchildren to take part in a community service project in the Colombo area.

“We are so proud to welcome Stephen and Astou as our Sports Envoys to Sri Lanka, to build on the strong people-to-people connections between the United States and Sri Lanka,” said U.S. Ambassador Julie Chung. “The lessons that will be shared by our Sports Envoys – communication, teamwork, resilience, inclusion, and conflict resolution – are essential for leadership development, community building, equality, and peace. The U.S. Sports Envoy program is a testament to our belief that sports can be a powerful tool in promoting peace and unity.”

News

Rahuman questions sudden cancellation of leave of CEB employees

SJB Colombo District MP Mujibur Rahuman in parliament demanded to know from the government the reasons for CEB suspending the leave of all its employees until further notice from Thursday.

MP Rahuman said that the CEB has got an acting General Manager anew and the latter yesterday morning issued a circular suspending leave of all CEB employees with immediate effect until further notice.

“We demand that Minister Kanchana Wijesekera should explain this to the House. This circular was issued while this debate on the new Electricity Amendment Bill was pending. There are many who oppose this Bill. The Minister must tell parliament the reason for the urge to cancel the leave of CEB employees,” the MP said.However, Speaker Mahinda Yapa Abeywardena prevented Minister Wijesekera responding to the query and said that the matter raised by MP Rahuman was not relevant.

News

CIPM successfully concludes 8th Annual Symposium

The Chartered Institute of Personnel Management (CIPM) successfully concluded the 8th Annual CIPM Symposium, which took place on 31st May 2024. Themed “Nurturing the Human Element—Redefining HRM in a Rapidly Changing World,” the symposium underscored the pivotal role of human resource management (HRM) in today’s dynamic global landscape. Since its inception in 1959, CIPM has been dedicated to advancing the HR profession through education, professional development, and advocacy, solidifying its position as Sri Lanka’s leading professional body for HRM.

Ken Vijayakumar, the President of the CIPM, graced the occasion as the chief guest. The symposium commenced with the welcome address by the Chairperson, Prof. Arosha Adikaram, followed by the Web Launch of the Symposium Proceedings and Abstract Book by the CIPM President. The event featured distinguished addresses, including a speech by Chief Guest Ken Vijayakumar, President of CIPM, and an address by Guest of Honor Shakthi Ranatunga, Chief Operating Officer of MAS Holdings Pvt. Ltd., Sri Lanka.

The symposium also featured an inspiring keynote address by Prof. Mario Fernando, Professor of Management and Director of the Centre for Cross Cultural Management (CCCM) at the University of Wollongong, Australia.

Vote of Thanks of the inauguration session was delivered by Dr. Dillanjani Weeratunga, Symposium Co-chair.

The symposium served as a comprehensive platform for researchers to present their findings across a wide range of critical topics in HRM. These included Cultural Diversity and Inclusion, Talent Development and Retention, Ethical Leadership and Corporate Social Responsibility, Adapting to Technological Advancements, Mental Health and Well-being at Work, Global Workforce Challenges, Employee Empowerment, and Reskilling and Upskilling.

The plenary session was led by Prof. Wasantha Rajapakse. Certificates were awarded to the best paper presenters during the valedictory session, followed by a vote of thanks delivered by Kamani Perera, Manager of Research and Development.

The annual symposium of CIPM was a truly inclusive event, attracting a diverse audience that spanned undergraduates, graduates, working professionals, research scholars and lecturers. This widespread interest highlights the symposium’s significance in the field of HRM, offering a unique opportunity for everyone to network and learn from scholarly brains.The CIPM International Research Symposium was sponsored by Hambantota International Port, Sri Lanka Institute of Information Technology (SLIIT), E B Creasy & Co. PLC, and Print Xcel Company.