Business

Participation of the Employees’ Provident Fund in the Domestic Debt Optimisation Programme

The Employees’ Provident Fund (EPF/the Fund) wishes to inform its members that as an eligible participant and with the approval of the Monetary Board of the Central Bank of Sri Lanka, it has submitted an offer to exchange the portfolio of Treasury Bonds of the EPF under the Domestic Debt Optimization (DDO) programme in terms of the invitation made by the Ministry of Finance, Economic Stabilisation and National Policies (MOF) following a Resolution adopted by Parliament.

Accordingly, the following are brought to the notice of the members:

a. On 04 July 2023, MOF announced the Government’s policy on domestic public debt optimization strategy, which was approved by the Parliament by a Resolution on 01 July 2023.

b. As per the announcement, MOF has identified, inter-alia, the conversion/exchange of existing Treasury bonds of superannuation funds into new Treasury bonds to constitute the DDO, to avoid superannuation funds incurring a substantially higher tax of 30% on taxable income from Treasury bond investments. This tax will be applied from 01 October 2023, as per the Inland Revenue (Amendment) Act, No. 14 of 2023. At present, the tax rate applicable to the income of the EPF including the income from Treasury bonds is 14% and the continuation of a concessionary tax rate of 14% beyond 30 September 2023 is contingent upon the effective participation of the EPF in the DDO as defined in the Act.

c. The Exchange Memorandum dated 04 July 2023 and subsequent amendments issued by MOF contained comprehensive details of the debt conversion/exchange. Further, the MOF held an investor presentation on 07 July 2023, outlining the proposed terms of the debt exchange and its implications, and subsequently issued clarifications to questions raised following this presentation. As per the Exchange Memorandum, eligible holders were required to analyse the implications of making or not making an offer by reference to the legal, tax, financial, regulatory, accounting and related aspects of the DDO. All communications in this regard can be accessed through https://treasury.gov.lk/web/ddo.

d. In this regard, a presentation was made to the Cabinet of Ministers on 28 June 2023, titled “Debt Restructuring in Sri Lanka” prepared by the MOF in consultation with CBSL. On 29 and 30 June 2023, the Committee on Public Finance (COPF) has been informed regarding the expected impact of DDO on EPF through a presentation, followed by extensive discussions. Further, the COPF at its meeting held on 07 September 2023 discussed the impact of the proposed amendments to the Inland Revenue Act on the superannuation funds.

e. As per the Exchange Memorandum, the following two options were available for EPF under DDO programme.

i. Exchange Option: EPF can exchange a minimum required amount of existing Treasury bonds with 12 new Treasury bond series that mature from 2027 to 2038. These new bonds are offered with a coupon rate of 12% per annum until 2026 and 9% per annum thereafter.

The EPF would continue to pay income tax at 14% per annum on its taxable income attributable from its Treasury bond portfolio.

ii. Non-Exchange Option: If EPF decides not to exchange the existing Treasury bonds a 30% tax rate would apply to the taxable income of Treasury bond portfolio of the EPF.

f. The Monetary Board has carefully examined how the DDO could affect the Fund under the above two scenarios. Accordingly, to assist the Monetary Board to ascertain the possible impact of the DDO on the Fund, the internal staff of CBSL has conducted relevant analyses.

Such assessments have been carried out on the basis of several prudent and realistic assumptions and further taking into consideration the legal, tax, financial, regulatory, accounting and related aspects of the DDO.

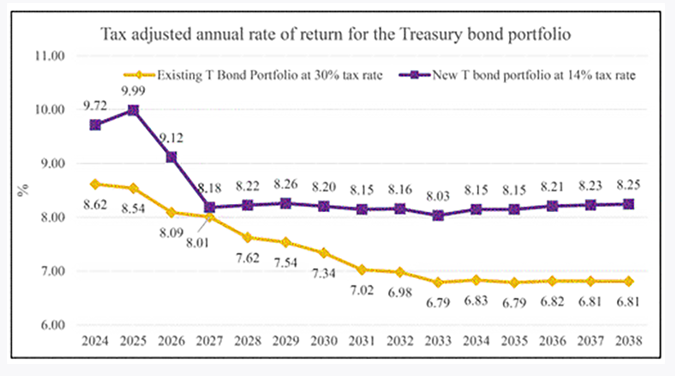

The summary of the expected returns of the EPF

Treasury bond portfolio under the two scenarios is given in the Chart below. At present Treasury bond portfolio consists of 88% of the total Fund and a larger portion of the remainder is in Treasury bills. Treasury bills portfolio and new funds can be invested at prevailing market rates so that total return of the Fund portfolio would be higher than the likely returns of the Treasury bond portfolio under both scenarios shown in the Chart below.

g. The main factors and assumptions taken into due consideration in arriving at the above annual rate of return of the Treasury bond portfolio are given below.

i. The face value of the Treasury bond portfolio of EPF is Rs. 3,220 bn. In order to fulfill the minimum participation requirement, 78% of the face value of the Treasury bond portfolio on face value basis had to be exchanged.

ii. The government will service all obligations relating to Treasury bonds including the new Treasury bonds issued under the Debt Exchange as they fall due in a timely manner.

iii. Cash receipts due from above mentioned maturities and coupons will be reinvested in sixyear Treasury Bonds at rates of 13.50% for 2023, 12.00% for 2024, 10.50% for 2025 and 10% for 2026 and onwards. (Expected returns were also been computed under different reinvestment rate scenarios of which the pattern of the returns remains the same).

iv. If EPF participated in the Exchange Option, the current tax rate of 14% will be applied.

However, if EPF did not participate in the Debt Exchange, the tax rate applicable on the taxable income of Treasury bonds will be increased to 30% which is more than double the applicable post exchange tax rate. It was further assumed that these tax rates will remain unchanged until 2038. (CBSL)

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”