Features

Options for Foreign Debt Management in Sri Lanka: Can we escape from IMF/ISB Debt Trap?

by Luxman Siriwardena,

Managing Director,

Veemansa Innitiative,

Think Tank and Advocacy Group

The setback due to the pandemic has aggravated some of the perennial macro-economic and sectoral problems in Sri Lanka. For example, borrowing and accumulating external debts has been a practice of successive governments since 1978, which was the year of partial liberalization of the economy. During the early periods, when Sri Lanka was considered a low-income country, we were entitled to substantial grant aid as well as concessionary finances.

This relatively low interest facilities and lenient conditionalities provided incentives for the governments to keep borrowing for many development projects, from bi-lateral and multi-lateral lending agencies, irrespective of inflated costs of many of these projects. In most of these cases, financial benefits also have spilled over to Sri Lankan politicians, bureaucrats, and technocrats. Notwithstanding such leakages, these foreign funded projects increased the availability of more sophisticated infrastructure and utilities in sectors such as, electricity, highways, drinking and irrigation water, as well as the Colombo port and airports. In addition, education, agriculture and health were the prime targets of both Sri Lankan policy makers and donors/lenders.

There was a period when Sri Lanka was termed as “a Donor Darling” (see figure).

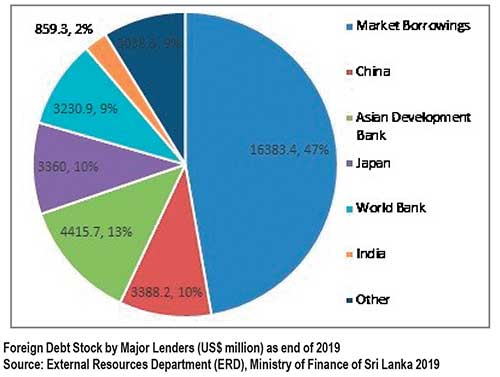

Sri Lanka became a darling of the Western donors primarily due its subservience to the West under Jayawardena-Premadasa regime). However, since we attained lower-middle income country status, concessionary funding has not been available and therefore, most borrowings have been at commercial or near commercial lending rates. In this context, the country has accumulated over US$ 34.7bn debt1 up to 2019. These borrowings have been for development projects, import of consumption items and direct budgetary support to meet current expenditure, including debt servicing. The current debt situation.

At the moment, one of the most critical challenges for the Rajapaksa administration is managing or preferably reducing Sri Lanka’s debt while meeting the current level of foreign exchange requirements and hopefully implementing necessary development projects.

While the selected development projects are generally presented to the multilateral donors; World Bank and ADB as well as bilateral lending institutions such as JICA, US-AID and similar institutions in China and European countries, seeking loan financing, the rates of lending are equal or closer to the market rates. Since 2007, borrowing through International Sovereign Bonds (ISBs), which became a common practice, has now emerged as the most serious challenge for the current government to ensure sustainability or reduction foreign debt.

The focus of this article is to discuss alternative methods of managing the debt in spite of the COVID-19 pandemic that has pushed almost the entire world (other than China) into a recession.

In this context, conventional economic policy pandits, academics and consultants recommend that the emerging economies such as Sri Lanka should seek the refuge in International Monetary Fund (IMF) Programmes. Based on the IMF guarantees the countries in foreign debt crisis will be eligible for further assistance from other multilateral and bilateral lenders, while qualifying for accessing the International Sovereign Bond Market. According to this prescription, without the support and blessing of the IMF, we have no way of securing sufficient funding for re-payment of maturing debt, balance of payment requirements or development programmes.

Since the election of the new government all our well-known economists, and many so-called experts have been promoting the above policy prescription as Sri Lanka is, according their assessment, at the verge of a default and economic collapse. Most if not, all these pandits were expecting the government will continue to proceed with the borrowing from the international markets subscribing to Samurai or Panda bonds. Surprisingly our conventional economic advisors are increasingly becoming impatient and critical of the Government for not negotiating with the IMF to enter into a programme which will be entitled and receive loan facility and more importantly in turn qualify for raising finance through ISBs. Does this process lead to a reduction of debt or payback of loans? Of course not, nor reduction of debt burden or the severity of the debt problem.

As an IMF programme is likely to impose conditionalities to meet the Fund’s debt sustainability parameters, the readers may perhaps understand that, this approach is not even to reduce the severity of the debt problem but for reducing the burden over the next few years by extending maturities probably through some form of ‘Grace Period’. The bottom line will be that Sri Lanka will continue to have challenging debt dynamics which I would like to call it as ‘IMF/ISB DEBT TRAP’ as long as we fail to achieve substantial increase of exports and FDI. In other words, we will merely be postponing and aggravating the debt problem unless we can accelerate growth by increasing production of tradable goods and services which will earn or save foreign exchange.

Cost of raising funds through International Sovereign Bonds

A sovereign bond is defined as a debt instrument issued by a national government to raise generally foreign currency requirements in case of countries such as Sri Lanka. Sovereign bonds are denominated in foreign currencies such as USD, the Euro, Japanese Yen and Chinese Yuan. The successful issue of ISBs require several steps engaging highly professional individuals and institutions including global banking giants. Under each of these steps many upfront costs are to be incurred by the government. A typical bond issue involves, fees (commissions) and other expenses. Three large components of the fees, according to a World Bank document are for the lead-managers, rating costs and legal expenses. Interestingly those transaction costs are paid at time of issuance (upfront). In spite of the competition among the banks there is little transparency specially with regard to bond issues of countries like Sri Lanka. Another major expense is often for obtaining a rating for each bond which is generally similar to the fee for the lead-managers. There are also expenses for legal counsel, marketing especially road shows, fiscal and paying agents and advisors. Cost will also depend on which markets are targeted for the road shows undertaken in major cities in developed market economies.

Throughout the Sri Lankan history of issuing ISBs people have only learned about the total value of the bond issues and subscribed but not the direct and indirect costs that have been incurred in the process, for example, officials of the Central Bank, Ministry of Finance, etc. will be travelling to several capitals in the world for negotiations, road shows and other associated events etc. incurring scarce foreign exchange of Sri Lanka. Of course it should have provided very tempting incentive for this approach

Some economists who are faithful followers of IMF policy prescriptions prefers to identify the IMF/ISB Debt Trap as the symptom not the cause of the problem. According to them the debt trap was caused by poor fiscal outcomes over many years and IMF/ISB debt was incurred to meet deficit financing.

In this article, the most pertinent and decisive issue to raise is, what should be the alternative policy recommendations of our learned economists. As we all are well aware if Sri Lanka qualifies to receive assistance from the IMF, such funding will be for as balance of payment support subject to certain conditionality which are likely to include; removal or reduction of subsidies, removal of import controls, non-strategic assets privatization, etc. and many such measures of government interventions.

Many, if not all these adjustments will be painful to the ordinary citizens and therefore, make it difficult to sell politically. If Sri Lanka for that matter, any other country in our predicament is not willing to go through an IMF austerity programme with its stringent conditionalities, what options are available for them. Let’s discuss what appears to be the economic management strategy of the current government. With the lockdown of the world economies and disruption of global value-chains, Sri Lankan government was compelled to ‘Close the Economy’ to some degree. Subsequently, the government policy makers seem to be implementing a fairly well-managed import administration scheme and associated measures to ensure enhanced foreign exchange savings. Current import management scheme has selectively targeted non-essential ‘big-ticket’ items.

In order to prevent further deterioration of the debt situation the government seems to be minimizing new borrowings for implementation of numerous development projects with commercial characteristics. Both acceding to IMF austerity programme, as well as, controls imposed by the government will have contractionary impact on the local economy. Of course, second option will reduce the confidence of capital markets, foreign equity investors and even some local enterprises. Generally, IMF programs are sold to a government in-need of balance of payment support on the basis that agreement with the Fund would pave way for the country to achieve a higher sovereign rating and confidence of the investors in ISBs.

Pertinent question here is, as learned economists, professionals and advisors, are they in a position to develop an alternative development strategy for Sri Lanka in order to overcome the current difficulties reducing the severity of the debt burden created primarily through borrowings from ISBs. It appears that the, current administration is developing a strategy that will cause less pain to the people than under an IMF program and have more positive outcomes in terms of output, employment and incomes.

Unfortunately, however, in the past, we have rarely seen Sri Lankan policy makers or even academics develop alternative concepts or strategies instead of repeating what they have learned as classical, neo-classical or Keynesian schools and reinforced by the training programs conducted by multilateral or bilateral lending agencies.

In conclusion, let me quote once again from my recently published article;

“Whatever the reasons are, instead of thinking independently on their own most of our economists parrot their mentors in the west for short-term gains like easy recognition and self-fulfillment PROMOTING THE SAME FORMULA AGRAVATING the vicious circle and perpetuating the misery of our people. Irony is that when a solution is needed the only thing some of our experts are capable of recommending is to seek refuge in borrowing from multilateral or bilateral lending agencies. Most Sri Lankans need to be reminded that, Sri Lanka has already gone under 16-IMF Programs and have reached the current predicament. This reminds us the famous saying attributed to Einstein that “insanity is doing the same thing over and over again and expecting different outcomes’’.

Signs are that the current administration is deviating from the orthodoxy and searching for innovative and pragmatic development path.

(Article is based on a key-note address delivered by the writer at the 08th International Research Conference conducted by the department of Economics and Statistics, University of Peradeniya)

Features

The heart-friendly health minister

by Dr Gotabhya Ranasinghe

Senior Consultant Cardiologist

National Hospital Sri Lanka

When we sought a meeting with Hon Dr. Ramesh Pathirana, Minister of Health, he graciously cleared his busy schedule to accommodate us. Renowned for his attentive listening and deep understanding, Minister Pathirana is dedicated to advancing the health sector. His openness and transparency exemplify the qualities of an exemplary politician and minister.

Dr. Palitha Mahipala, the current Health Secretary, demonstrates both commendable enthusiasm and unwavering support. This combination of attributes makes him a highly compatible colleague for the esteemed Minister of Health.

Our discussion centered on a project that has been in the works for the past 30 years, one that no other minister had managed to advance.

Minister Pathirana, however, recognized the project’s significance and its potential to revolutionize care for heart patients.

The project involves the construction of a state-of-the-art facility at the premises of the National Hospital Colombo. The project’s location within the premises of the National Hospital underscores its importance and relevance to the healthcare infrastructure of the nation.

This facility will include a cardiology building and a tertiary care center, equipped with the latest technology to handle and treat all types of heart-related conditions and surgeries.

Securing funding was a major milestone for this initiative. Minister Pathirana successfully obtained approval for a $40 billion loan from the Asian Development Bank. With the funding in place, the foundation stone is scheduled to be laid in September this year, and construction will begin in January 2025.

This project guarantees a consistent and uninterrupted supply of stents and related medications for heart patients. As a result, patients will have timely access to essential medical supplies during their treatment and recovery. By securing these critical resources, the project aims to enhance patient outcomes, minimize treatment delays, and maintain the highest standards of cardiac care.

Upon its fruition, this monumental building will serve as a beacon of hope and healing, symbolizing the unwavering dedication to improving patient outcomes and fostering a healthier society.We anticipate a future marked by significant progress and positive outcomes in Sri Lanka’s cardiovascular treatment landscape within the foreseeable timeframe.

Features

A LOVING TRIBUTE TO JESUIT FR. ALOYSIUS PIERIS ON HIS 90th BIRTHDAY

by Fr. Emmanuel Fernando, OMI

Jesuit Fr. Aloysius Pieris (affectionately called Fr. Aloy) celebrated his 90th birthday on April 9, 2024 and I, as the editor of our Oblate Journal, THE MISSIONARY OBLATE had gone to press by that time. Immediately I decided to publish an article, appreciating the untiring selfless services he continues to offer for inter-Faith dialogue, the renewal of the Catholic Church, his concern for the poor and the suffering Sri Lankan masses and to me, the present writer.

It was in 1988, when I was appointed Director of the Oblate Scholastics at Ampitiya by the then Oblate Provincial Fr. Anselm Silva, that I came to know Fr. Aloy more closely. Knowing well his expertise in matters spiritual, theological, Indological and pastoral, and with the collaborative spirit of my companion-formators, our Oblate Scholastics were sent to Tulana, the Research and Encounter Centre, Kelaniya, of which he is the Founder-Director, for ‘exposure-programmes’ on matters spiritual, biblical, theological and pastoral. Some of these dimensions according to my view and that of my companion-formators, were not available at the National Seminary, Ampitiya.

Ever since that time, our Oblate formators/ accompaniers at the Oblate Scholasticate, Ampitiya , have continued to send our Oblate Scholastics to Tulana Centre for deepening their insights and convictions regarding matters needed to serve the people in today’s context. Fr. Aloy also had tried very enthusiastically with the Oblate team headed by Frs. Oswald Firth and Clement Waidyasekara to begin a Theologate, directed by the Religious Congregations in Sri Lanka, for the contextual formation/ accompaniment of their members. It should very well be a desired goal of the Leaders / Provincials of the Religious Congregations.

Besides being a formator/accompanier at the Oblate Scholasticate, I was entrusted also with the task of editing and publishing our Oblate journal, ‘The Missionary Oblate’. To maintain the quality of the journal I continue to depend on Fr. Aloy for his thought-provoking and stimulating articles on Biblical Spirituality, Biblical Theology and Ecclesiology. I am very grateful to him for his generous assistance. Of late, his writings on renewal of the Church, initiated by Pope St. John XX111 and continued by Pope Francis through the Synodal path, published in our Oblate journal, enable our readers to focus their attention also on the needed renewal in the Catholic Church in Sri Lanka. Fr. Aloy appreciated very much the Synodal path adopted by the Jesuit Pope Francis for the renewal of the Church, rooted very much on prayerful discernment. In my Religious and presbyteral life, Fr.Aloy continues to be my spiritual animator / guide and ongoing formator / acccompanier.

Fr. Aloysius Pieris, BA Hons (Lond), LPh (SHC, India), STL (PFT, Naples), PhD (SLU/VC), ThD (Tilburg), D.Ltt (KU), has been one of the eminent Asian theologians well recognized internationally and one who has lectured and held visiting chairs in many universities both in the West and in the East. Many members of Religious Congregations from Asian countries have benefited from his lectures and guidance in the East Asian Pastoral Institute (EAPI) in Manila, Philippines. He had been a Theologian consulted by the Federation of Asian Bishops’ Conferences for many years. During his professorship at the Gregorian University in Rome, he was called to be a member of a special group of advisers on other religions consulted by Pope Paul VI.

Fr. Aloy is the author of more than 30 books and well over 500 Research Papers. Some of his books and articles have been translated and published in several countries. Among those books, one can find the following: 1) The Genesis of an Asian Theology of Liberation (An Autobiographical Excursus on the Art of Theologising in Asia, 2) An Asian Theology of Liberation, 3) Providential Timeliness of Vatican 11 (a long-overdue halt to a scandalous millennium, 4) Give Vatican 11 a chance, 5) Leadership in the Church, 6) Relishing our faith in working for justice (Themes for study and discussion), 7) A Message meant mainly, not exclusively for Jesuits (Background information necessary for helping Francis renew the Church), 8) Lent in Lanka (Reflections and Resolutions, 9) Love meets wisdom (A Christian Experience of Buddhism, 10) Fire and Water 11) God’s Reign for God’s poor, 12) Our Unhiddden Agenda (How we Jesuits work, pray and form our men). He is also the Editor of two journals, Vagdevi, Journal of Religious Reflection and Dialogue, New Series.

Fr. Aloy has a BA in Pali and Sanskrit from the University of London and a Ph.D in Buddhist Philosophy from the University of Sri Lankan, Vidyodaya Campus. On Nov. 23, 2019, he was awarded the prestigious honorary Doctorate of Literature (D.Litt) by the Chancellor of the University of Kelaniya, the Most Venerable Welamitiyawe Dharmakirthi Sri Kusala Dhamma Thera.

Fr. Aloy continues to be a promoter of Gospel values and virtues. Justice as a constitutive dimension of love and social concern for the downtrodden masses are very much noted in his life and work. He had very much appreciated the commitment of the late Fr. Joseph (Joe) Fernando, the National Director of the Social and Economic Centre (SEDEC) for the poor.

In Sri Lanka, a few religious Congregations – the Good Shepherd Sisters, the Christian Brothers, the Marist Brothers and the Oblates – have invited him to animate their members especially during their Provincial Congresses, Chapters and International Conferences. The mainline Christian Churches also have sought his advice and followed his seminars. I, for one, regret very much, that the Sri Lankan authorities of the Catholic Church –today’s Hierarchy—- have not sought Fr.

Aloy’s expertise for the renewal of the Catholic Church in Sri Lanka and thus have not benefited from the immense store of wisdom and insight that he can offer to our local Church while the Sri Lankan bishops who governed the Catholic church in the immediate aftermath of the Second Vatican Council (Edmund Fernando OMI, Anthony de Saram, Leo Nanayakkara OSB, Frank Marcus Fernando, Paul Perera,) visited him and consulted him on many matters. Among the Tamil Bishops, Bishop Rayappu Joseph was keeping close contact with him and Bishop J. Deogupillai hosted him and his team visiting him after the horrible Black July massacre of Tamils.

Features

A fairy tale, success or debacle

Sri Lanka-Singapore Free Trade Agreement

By Gomi Senadhira

senadhiragomi@gmail.com

“You might tell fairy tales, but the progress of a country cannot be achieved through such narratives. A country cannot be developed by making false promises. The country moved backward because of the electoral promises made by political parties throughout time. We have witnessed that the ultimate result of this is the country becoming bankrupt. Unfortunately, many segments of the population have not come to realize this yet.” – President Ranil Wickremesinghe, 2024 Budget speech

Any Sri Lankan would agree with the above words of President Wickremesinghe on the false promises our politicians and officials make and the fairy tales they narrate which bankrupted this country. So, to understand this, let’s look at one such fairy tale with lots of false promises; Ranil Wickremesinghe’s greatest achievement in the area of international trade and investment promotion during the Yahapalana period, Sri Lanka-Singapore Free Trade Agreement (SLSFTA).

It is appropriate and timely to do it now as Finance Minister Wickremesinghe has just presented to parliament a bill on the National Policy on Economic Transformation which includes the establishment of an Office for International Trade and the Sri Lanka Institute of Economics and International Trade.

Was SLSFTA a “Cleverly negotiated Free Trade Agreement” as stated by the (former) Minister of Development Strategies and International Trade Malik Samarawickrama during the Parliamentary Debate on the SLSFTA in July 2018, or a colossal blunder covered up with lies, false promises, and fairy tales? After SLSFTA was signed there were a number of fairy tales published on this agreement by the Ministry of Development Strategies and International, Institute of Policy Studies, and others.

However, for this article, I would like to limit my comments to the speech by Minister Samarawickrama during the Parliamentary Debate, and the two most important areas in the agreement which were covered up with lies, fairy tales, and false promises, namely: revenue loss for Sri Lanka and Investment from Singapore. On the other important area, “Waste products dumping” I do not want to comment here as I have written extensively on the issue.

1. The revenue loss

During the Parliamentary Debate in July 2018, Minister Samarawickrama stated “…. let me reiterate that this FTA with Singapore has been very cleverly negotiated by us…. The liberalisation programme under this FTA has been carefully designed to have the least impact on domestic industry and revenue collection. We have included all revenue sensitive items in the negative list of items which will not be subject to removal of tariff. Therefore, 97.8% revenue from Customs duty is protected. Our tariff liberalisation will take place over a period of 12-15 years! In fact, the revenue earned through tariffs on goods imported from Singapore last year was Rs. 35 billion.

The revenue loss for over the next 15 years due to the FTA is only Rs. 733 million– which when annualised, on average, is just Rs. 51 million. That is just 0.14% per year! So anyone who claims the Singapore FTA causes revenue loss to the Government cannot do basic arithmetic! Mr. Speaker, in conclusion, I call on my fellow members of this House – don’t mislead the public with baseless criticism that is not grounded in facts. Don’t look at petty politics and use these issues for your own political survival.”

I was surprised to read the minister’s speech because an article published in January 2018 in “The Straits Times“, based on information released by the Singaporean Negotiators stated, “…. With the FTA, tariff savings for Singapore exports are estimated to hit $10 million annually“.

As the annual tariff savings (that is the revenue loss for Sri Lanka) calculated by the Singaporean Negotiators, Singaporean $ 10 million (Sri Lankan rupees 1,200 million in 2018) was way above the rupees’ 733 million revenue loss for 15 years estimated by the Sri Lankan negotiators, it was clear to any observer that one of the parties to the agreement had not done the basic arithmetic!

Six years later, according to a report published by “The Morning” newspaper, speaking at the Committee on Public Finance (COPF) on 7th May 2024, Mr Samarawickrama’s chief trade negotiator K.J. Weerasinghehad had admitted “…. that forecasted revenue loss for the Government of Sri Lanka through the Singapore FTA is Rs. 450 million in 2023 and Rs. 1.3 billion in 2024.”

If these numbers are correct, as tariff liberalisation under the SLSFTA has just started, we will pass Rs 2 billion very soon. Then, the question is how Sri Lanka’s trade negotiators made such a colossal blunder. Didn’t they do their basic arithmetic? If they didn’t know how to do basic arithmetic they should have at least done their basic readings. For example, the headline of the article published in The Straits Times in January 2018 was “Singapore, Sri Lanka sign FTA, annual savings of $10m expected”.

Anyway, as Sri Lanka’s chief negotiator reiterated at the COPF meeting that “…. since 99% of the tariffs in Singapore have zero rates of duty, Sri Lanka has agreed on 80% tariff liberalisation over a period of 15 years while expecting Singapore investments to address the imbalance in trade,” let’s turn towards investment.

Investment from Singapore

In July 2018, speaking during the Parliamentary Debate on the FTA this is what Minister Malik Samarawickrama stated on investment from Singapore, “Already, thanks to this FTA, in just the past two-and-a-half months since the agreement came into effect we have received a proposal from Singapore for investment amounting to $ 14.8 billion in an oil refinery for export of petroleum products. In addition, we have proposals for a steel manufacturing plant for exports ($ 1 billion investment), flour milling plant ($ 50 million), sugar refinery ($ 200 million). This adds up to more than $ 16.05 billion in the pipeline on these projects alone.

And all of these projects will create thousands of more jobs for our people. In principle approval has already been granted by the BOI and the investors are awaiting the release of land the environmental approvals to commence the project.

I request the Opposition and those with vested interests to change their narrow-minded thinking and join us to develop our country. We must always look at what is best for the whole community, not just the few who may oppose. We owe it to our people to courageously take decisions that will change their lives for the better.”

According to the media report I quoted earlier, speaking at the Committee on Public Finance (COPF) Chief Negotiator Weerasinghe has admitted that Sri Lanka was not happy with overall Singapore investments that have come in the past few years in return for the trade liberalisation under the Singapore-Sri Lanka Free Trade Agreement. He has added that between 2021 and 2023 the total investment from Singapore had been around $162 million!

What happened to those projects worth $16 billion negotiated, thanks to the SLSFTA, in just the two-and-a-half months after the agreement came into effect and approved by the BOI? I do not know about the steel manufacturing plant for exports ($ 1 billion investment), flour milling plant ($ 50 million) and sugar refinery ($ 200 million).

However, story of the multibillion-dollar investment in the Petroleum Refinery unfolded in a manner that would qualify it as the best fairy tale with false promises presented by our politicians and the officials, prior to 2019 elections.

Though many Sri Lankans got to know, through the media which repeatedly highlighted a plethora of issues surrounding the project and the questionable credentials of the Singaporean investor, the construction work on the Mirrijiwela Oil Refinery along with the cement factory began on the24th of March 2019 with a bang and Minister Ranil Wickremesinghe and his ministers along with the foreign and local dignitaries laid the foundation stones.

That was few months before the 2019 Presidential elections. Inaugurating the construction work Prime Minister Ranil Wickremesinghe said the projects will create thousands of job opportunities in the area and surrounding districts.

The oil refinery, which was to be built over 200 acres of land, with the capacity to refine 200,000 barrels of crude oil per day, was to generate US$7 billion of exports and create 1,500 direct and 3,000 indirect jobs. The construction of the refinery was to be completed in 44 months. Four years later, in August 2023 the Cabinet of Ministers approved the proposal presented by President Ranil Wickremesinghe to cancel the agreement with the investors of the refinery as the project has not been implemented! Can they explain to the country how much money was wasted to produce that fairy tale?

It is obvious that the President, ministers, and officials had made huge blunders and had deliberately misled the public and the parliament on the revenue loss and potential investment from SLSFTA with fairy tales and false promises.

As the president himself said, a country cannot be developed by making false promises or with fairy tales and these false promises and fairy tales had bankrupted the country. “Unfortunately, many segments of the population have not come to realize this yet”.

(The writer, a specialist and an activist on trade and development issues . )