Business

Oil supply tightens in Europe over Red Sea disruptions

The structure of the global benchmark Brent crude futures market and some physical markets in Europe and Africa have been reflecting tighter supply partly over concerns about shipping delays as vessels avoid the Red Sea due to missile and drone attacks.

The disruptions – which have been the largest to global trade since the COVID-19 pandemic – have combined with other factors such as rising Chinese demand to increase competition for crude supply that does not have to transit the Suez Canal, and analysts say this is most evident in European markets.

In a sign of tighter supply, the market structure of Brent – which is used to price nearly 80 percent of the world’s traded oil – hit its most bullish in two months on Friday, as tankers diverted from the Red Sea following recent air strikes by the United States and United Kingdom on targets in Yemen.

In response to Israel’s war on Gaza, rebels from the Iran-aligned group that controls northern Yemen and its western coastline have launched a wave of assaults on ships in the Red Sea.

By targeting vessels with perceived links to Israel, the Houthis are attempting to force Tel Aviv to stop the war and allow humanitarian aid into the Gaza Strip.

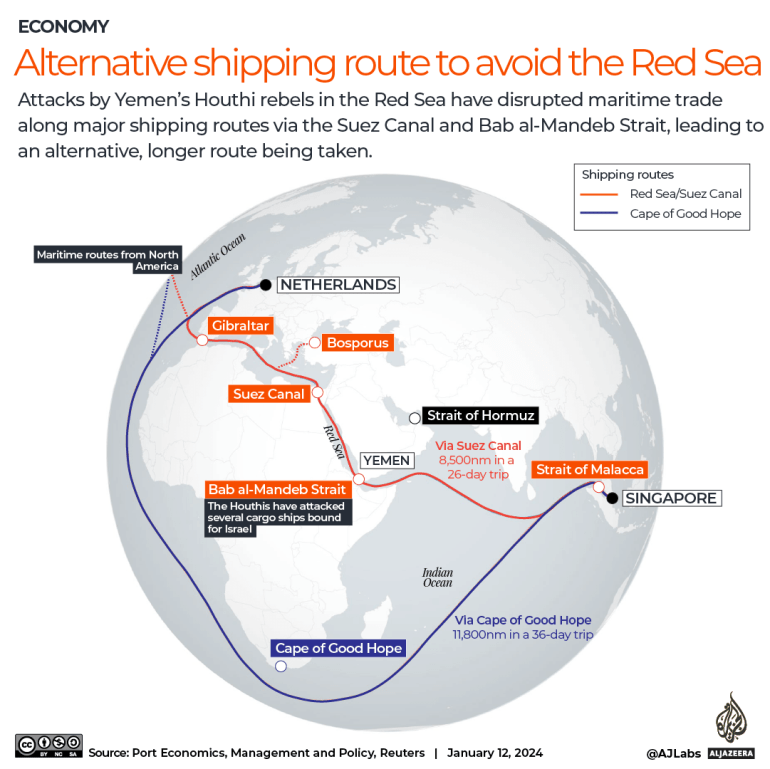

Houthi activity has so far been concentrated in the narrow strait of Bab al-Mandeb, which connects the Gulf of Aden to the Red Sea. Approximately 50 ships sail through the strait every day, heading to and from the Suez Canal – a central artery for global trade.

Some of the world’s largest shipping companies have suspended transit in the region, forcing vessels to sail around the Cape of Good Hope in Southern Africa. The lengthier route has raised freight rates due to higher fuel, crew and insurance costs.

“Brent is the most impacted futures contract when it comes to Red Sea/Suez Canal disruptions,” Viktor Katona, lead crude analyst at Kpler, told the Reuters news agency. “So who suffers the most on the physical front? Undoubtedly, it is European refiners.”

The premium of the first-month Brent contract to the six-month contract LCOc1-LCOc7 rose to as much as $2.15 a barrel on Friday, the highest since early November. This structure, called backwardation, indicates a perception of tighter supply for prompt delivery.

Less Middle Eastern crude is heading to Europe, with the volume nearly halved to about 570,000 barrels per day (bpd) in December from 1.07 million bpd in October, Kpler data showed.

Ships travelling through the Suez Canal have taken on greater strategic significance since the war in Ukraine, as sanctions against Russia have made Europe more dependent on oil from the Middle East, which supplies one-third of the world’s Brent crude.

But it’s challenging to measure the impact of Red Sea shipping separately, one crude trader told Reuters. “It’s a strong market everywhere, but people are very nervous.”

Other developments have also tightened the European crude market including a drop in Libyan supply due to protests, the first such disruption for months, and lower Nigerian exports.

Angolan crude, which also heads to Europe without having to pass through the Suez Canal, is seeing higher demand from China and India because of issues around Iranian and Russian crude, reducing the supply that could come to Europe.

China’s oil trade with Iran has stalled as Tehran withholds shipments and demands higher prices, while India’s imports of Russian crude have fallen due to currency challenges, although India attributed the drop to unattractive prices.

Meanwhile, Russia leapfrogged Saudi Arabia to become China’s top crude oil supplier in 2023, data showed on Saturday, as the world’s biggest crude importer defied Western sanctions over Russia’s 2022 invasion of Ukraine to buy vast quantities of discounted oil for its processing plants.

Russia shipped a record 107.02 million metric tonnes of crude oil to China last year, equivalent to 2.14 million bpd, the Chinese customs data showed, far more than other major oil exporters such as Saudi Arabia and Iraq.

Imports from Saudi Arabia, previously China’s largest supplier, fell 1.8 percent to 85.96 million tonnes, as the Middle East oil giant lost market share to cheaper Russian crude.

(Aljazeera)

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”