News

Moody’s downgrade ‘unwarranted, erroneous suggesting reckless reaction’

Government wades into battle with facts, figures and projections

In an extraordinary hard-hitting rejoinder to Moody’s downgrade of their Sri Lanka rating from B2 to Caa1 with a stable outlook, the Ministry of Finance, State Ministry of Money, Capital Markets and Public Enterprise Reforms (headed by former Central Bank Governor Ajith Nivard Cabraal) and the Central Bank accused the well-known rating agency of an “unwarranted and erroneous” finding that suggests a “reckless reaction.”

It said that “instead of understanding the economic turnaround as well as awaiting the Budget that is due in November, the downgrade of SL at the beginning of the Economic Revival is inexplicable.”

“This hasty rating action seems similar to the previous premature and reckless downgrades by rating agencies in the immediate aftermath of the ending of the internal conflict in 2009 and during the political impasse at the end of 2018. In both instances, the rating actions were proven to be hasty and erroneous, and those actions only resulted in several investors suffering unnecessary loses and missing out on emerging opportunities.”

“Moody’s rating downgrade fails to recognize and do justice to the ground reality of the ongoing rapid economic recovery backed by vastly improved business confidence arising from the return of political stability and policy stability after a lapse of five years,” the presentation said.

It went on to stress that Sri Lanka, like many of its peers in the emerging market group, experienced initial capital outflows, exchange rate depreciation, showdown in activity and pressure on government finances in response to the effects of the Covid-19 pandemic.

“But, the swiftness with which decisions were taken followed by the landslide victory of the government, enabled Sri Lanka to move along a recovery path towards growth and stability,” it said.

Since May, merchandise exports had bounced back, and by July, had returned to pre-Covid monthly averages of USD one billion, the presentation supported by graphs and charts said.

It argued that SL recognized the probable external sector pressure early, and decisively curtailed non-essential imports in order to prioritize external debt service obligations. The cumulative trade deficit by end December is expected to be around only USD 5.8 billion, significantly down from USD eight billion the previous year.

“The savings on the import bill due to the curtailment of non-essential imports as well as significant reductions in the fuel import bill is expected to be over USD 2.0 billion,” the presentation said.

Discussing the vital tourism sector, it said that although inbound tourist movements are yet not possible given the global pandemic situation, other service exports, including IT services and shipping remain robust. It added that workers’ remittances have recorded a sharp increase in spite of the initial expectations of a slowdown and at current trends, “the cumulative decline in workers remittances is likely to be marginal, compared to previous expectations of a decline of 15%.”

On foreign direct investment, it admitted that FDI inflows had slowed, but the investment pipeline is strengthening. While FDI slowed in the first half of this year (from a peak of USD 2,000 billion in 2018), looking ahead prospects were promising particularly with expected inflows into the Port City project and for new manufacturing projects.

“The expected finalization of new legislation for the Port City within a month will result in the realization of investment by those who have already completed due diligence on such investment,” the presentation said. “Other expected investments include import alternative industries as well as investments by international financial institutions.”

“FDI inflows during 2020 are expected to be over USD 750 million, which is only about USD 400 million less that in 2019. At the start of the pandemic, FDIs were expected to be only around USD 300 million for the year 2020.”

The presentation further said that stock market indices have improved dramatically to pre-Covid levels and are likely to gain further momentum. Also, foreign inflows to the government securities market have already showed signs of resumption and according to initial responses, are likely to increase in the coming months, particularly in the wake of the attractive SWAP arrangements offered by the SL authorities.

With increased emphasis on domestic agriculture, agro-based industries and resource-based industries, domestic economic activities have turned around remarkably and recorded V-shaped recoveries. A bumper Yala crop was expected to follow the bumper Maha. Industrial production has rebounded, electricity generation is normalizing with greater reliance on hydropower generation and the construction sector has gradually gathered pace.

The exchange rate had appreciated sharply since mid-April and remains stable at appreciated levels, allowing the Central Bank to accumulate reserves through market purchases of foreign exchange. Foreign inflows following the Moody’s downgrade enabled the Central Bank to purchase USD 30 million from the forex market on Sept. 29.

The presentation further said that the Debt to GDP ration which increased in recent years is expected to improve in the medium term; that envisaged financing inflows for 2020 favours domestic markets and strategic foreign financing; and that foreign Treasury bills and bonds holdings are likely to attract a substantial volume of investments in coming months.

Other positives outlined includes that official reserves of CBSL had increased to USD 7.4 bn. by end August 2020; a policy environment facilitating high economic growth beyond the recovery stage while preserving macro-economic stability and a “deep and unwavering commitment to our investors.”

News

US sports envoys to Lanka to champion youth development

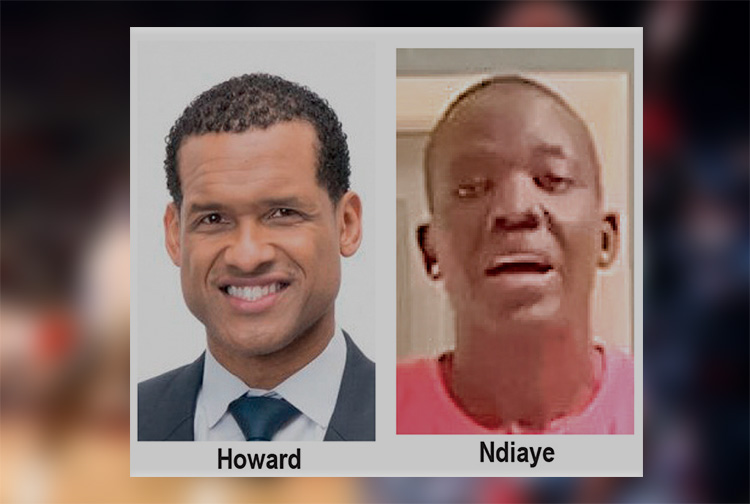

The U.S. Embassy in Colombo welcomed the U.S. Sports Envoys to Sri Lanka, former National Basketball Association (NBA) and Women’s National Basketball Association (WNBA) players Stephen Howard and Astou Ndiaye, from June 8 through 14.

The Public Diplomacy section of the U.S. Embassy said that it would launch a weeklong basketball program intended to harness the unifying power of sports, made possible through collaboration with Foundation of Goodness and IImpact Hoop Lab.

While in Sri Lanka, Howard and Ndiaye, both retired professional basketball players, will conduct a weeklong program, Hoops for Hope: Bridging Borders through Basketball. The Sports Envoys will lead basketball clinics and exhibition matches and engage in leadership sessions in Colombo and Southern Province for youth aged 14-18 from Northern, Uva, Eastern and Western Provinces, offering skills and leadership training both on and off the court. The U.S. Envoys will also share their expertise with the Sri Lanka Basketball Federation, national coaches, and players, furthering the development of basketball in the country. Beyond the clinics, they will collaborate with Sri Lankan schoolchildren to take part in a community service project in the Colombo area.

“We are so proud to welcome Stephen and Astou as our Sports Envoys to Sri Lanka, to build on the strong people-to-people connections between the United States and Sri Lanka,” said U.S. Ambassador Julie Chung. “The lessons that will be shared by our Sports Envoys – communication, teamwork, resilience, inclusion, and conflict resolution – are essential for leadership development, community building, equality, and peace. The U.S. Sports Envoy program is a testament to our belief that sports can be a powerful tool in promoting peace and unity.”

News

Rahuman questions sudden cancellation of leave of CEB employees

SJB Colombo District MP Mujibur Rahuman in parliament demanded to know from the government the reasons for CEB suspending the leave of all its employees until further notice from Thursday.

MP Rahuman said that the CEB has got an acting General Manager anew and the latter yesterday morning issued a circular suspending leave of all CEB employees with immediate effect until further notice.

“We demand that Minister Kanchana Wijesekera should explain this to the House. This circular was issued while this debate on the new Electricity Amendment Bill was pending. There are many who oppose this Bill. The Minister must tell parliament the reason for the urge to cancel the leave of CEB employees,” the MP said.However, Speaker Mahinda Yapa Abeywardena prevented Minister Wijesekera responding to the query and said that the matter raised by MP Rahuman was not relevant.

News

CIPM successfully concludes 8th Annual Symposium

The Chartered Institute of Personnel Management (CIPM) successfully concluded the 8th Annual CIPM Symposium, which took place on 31st May 2024. Themed “Nurturing the Human Element—Redefining HRM in a Rapidly Changing World,” the symposium underscored the pivotal role of human resource management (HRM) in today’s dynamic global landscape. Since its inception in 1959, CIPM has been dedicated to advancing the HR profession through education, professional development, and advocacy, solidifying its position as Sri Lanka’s leading professional body for HRM.

Ken Vijayakumar, the President of the CIPM, graced the occasion as the chief guest. The symposium commenced with the welcome address by the Chairperson, Prof. Arosha Adikaram, followed by the Web Launch of the Symposium Proceedings and Abstract Book by the CIPM President. The event featured distinguished addresses, including a speech by Chief Guest Ken Vijayakumar, President of CIPM, and an address by Guest of Honor Shakthi Ranatunga, Chief Operating Officer of MAS Holdings Pvt. Ltd., Sri Lanka.

The symposium also featured an inspiring keynote address by Prof. Mario Fernando, Professor of Management and Director of the Centre for Cross Cultural Management (CCCM) at the University of Wollongong, Australia.

Vote of Thanks of the inauguration session was delivered by Dr. Dillanjani Weeratunga, Symposium Co-chair.

The symposium served as a comprehensive platform for researchers to present their findings across a wide range of critical topics in HRM. These included Cultural Diversity and Inclusion, Talent Development and Retention, Ethical Leadership and Corporate Social Responsibility, Adapting to Technological Advancements, Mental Health and Well-being at Work, Global Workforce Challenges, Employee Empowerment, and Reskilling and Upskilling.

The plenary session was led by Prof. Wasantha Rajapakse. Certificates were awarded to the best paper presenters during the valedictory session, followed by a vote of thanks delivered by Kamani Perera, Manager of Research and Development.

The annual symposium of CIPM was a truly inclusive event, attracting a diverse audience that spanned undergraduates, graduates, working professionals, research scholars and lecturers. This widespread interest highlights the symposium’s significance in the field of HRM, offering a unique opportunity for everyone to network and learn from scholarly brains.The CIPM International Research Symposium was sponsored by Hambantota International Port, Sri Lanka Institute of Information Technology (SLIIT), E B Creasy & Co. PLC, and Print Xcel Company.