News

Interim budget: Prez announces VAT hike from 12% to 15%

* Compulsory tax registration for those above 18

* All above 60 to be retired

* Key tax refoms proposed

* Call for all-party govt. renewed

President Ranil Wickremesinghe, in his capacity as the Finance Minister yesterday (30) presented an interim budget 2022 in parliament. The President said: “The Interim Budget is being presented today to the Parliament, in order to prepare the basic foundation for changing the economic trajectory of our country. This is basic to the formulation of a national economic policy in accordance with the new world order. Based on this foundation, the Budget for the year 2023, will initiate the process of creating a new economy. For the process of creating a new economy, I plan to present a comprehensive set of proposals in the Budget 2023.

In presenting the Interim Budget, I wish to draw your attention to four aspects.

1. Economic Crisis

1.1 On many occasions, I have pointed out the extent and depth of the economic crisis that we are facing. We have not fallen into such an economic abyss in our recent history. Some people in our country do not yet have a real understanding of its severity. When pointing out the difficulties and hardships, they are viewed with sarcasm. They think like crabs that happily lay in the water that is on the fire, until it reaches boiling point. However, there are also those among us who think in a more responsible manner, having understood the gravity of this situation, and resolutely seek to battle in dousing the fire.

2. Causes of the Economic Crisis

2.1 It is a widespread slogan these days to claim that the country has deteriorated for 74 years after independence. Those who engage in chanting these slogans, earlier said that it was the colonial rulers who destroyed the country. This is the reality of slogan-led politics, they put forward slogans at different points in time for their own benefit. Engaging in rhetoric and politicalized economic policies for their own benefit rather than the country, are the main reasons for the collapse of our economy.

2.2 Due to these short-sighted economic practices, the country’s progress has been hampered from time to time. Many of those setbacks occurred in the name of the citizens who also accepted those policies without any criticism.

2.3 From the time the Government nationalized businesses, most of the tax revenue of our country has been spent to cover their losses. Funds which have to be utilized for the necessities of the community, are being wasted on keeping these companies afloat. Government should be formulating policies and implementing them. However, presently the Government does everything and the people also expect such from the country’s administration.

2.4 We have not been following appropriate policies, not only in relation to state enterprises, but also in attracting foreign investments. Continuously there has been no proper use of the nation’s resources, that too in the guise of seeking to protect state assets.

3. Solution to the Economic Crisis

3.1 In order to solve this economic crisis, one of the basic tasks that we need is to extricate from our traditional political perspectives and impartially appraise the reality of the ground situation in the context of the global environment.

3.2 I wish to quote a recent statement made by Mr. Sunil Handunneththi of the JVP “The Government should make policies. The Government does not have a role to engage in commercial ventures.”

3.3 If we can nourish our minds with creative thoughts, according to the current trends of the modern world, then we can solve the economic crisis.

4. Method of Solving the Crisis

4.1 This crisis will not be solved by accusing one another, nor by faulting the past. It can only be solved by adopting short- and long-term plans.

4.2 In this context, we are now adopting the short-term measures. Negotiations with the International Monetary Fund (IMF) have successfully reached its final stage. Discussions on debt restructuring will be held with the main countries that provide loan assistance to our country. The United Nations in collaboration with leading international organizations, is launching a programme to ensure food security. The process of providing daily needs like gas, electricity and fuel without a shortage has been initiated. Schools have opened, and the universities are commencing their academic activities.

4.3 All this reflects that, we are on the correct course in the short term for recovery.

4.4 However, we cannot be complacent. We should prepare a National Economic Policy for implementation continuously at least over a period of 25 years. As I mentioned at the beginning, this Interim Budget forms the basic foundation for the National Economic Policy, which is envisaged to be established through the 2023 Budget.

4.5 This Interim Budget speech, the IMF agreement and the Budget 2023 will set the framework for Economic Stabilization and Revival. Within it, we will set the Road Map.

4.6 Once the discussions with the IMF are concluded, I expect to provide the information on the same to the Parliament.

4.7 We briefly discussed the economic crisis, the cause of the economic crisis, the solution to the economic crisis and the method of solving the economic crisis. Now, I would like to present the Interim Budget and its proposals for your attention.

5. Macro-fiscal Framework

5.1 Our fiscal stabilisation programme envisages government revenue increasing to around 15 percent of GDP by 2025 from the 8.2 percent of GDP as at end 2021.

5.2 The government is targeting a primary surplus more than 2 percent of GDP in 2025 and expects to improve upon this level thereafter.

5.3 We aim to reduce public sector debt from around 110 percent of GDP as at end 2021, to no more than 100 percent of GDP in the medium term.

5.4 It is expected that inflation will be brought back under control to a mid-single digit level in the medium term.

5.5 In line with this, interest rates are also expected to reach a moderate level gradually.

5.6 Once macroeconomic confidence is re-established and foreign exchange reserves are replenished through foreign financing, the adverse pressure on the exchange rate is also expected to abate.

5.7 With the implementation of a series of growth enhancing structural reforms, the medium-term economic growth is expected to return towards 5 percent.

6. Main items in the Interim Budget

6.1 The Interim Budget includes the provisions to accommodate the policy package introduced in January 2022, provisions for strengthening social safety net programmes, additional cost due to increased interest payments in 2022, receipts of foreign assistance through repurposed projects by the World Bank and the Asian Development Bank (ADB), provisions for financing obtained through the Indian Line of Credit and increased cost of fertilizer subsidy, among others.

6.2 As I promised earlier, we have directed around Rs. 300 billion out of capital expenditure and less priority spending allocated in the original budget 2022 for above purposes, including the provision of relief to those who are affected by the economic crisis.

7. Revenue Proposals

7.1 A number of tax reforms pertaining to Income Tax, Value Added Tax (VAT), Telecommunication Levy and Betting and Gaming Levy have been already approved to be implemented. Some of these tax proposals have already been implemented.

7.2 In addition, the VAT rate will be increased to 15 percent from the current rate of 12 percent with effect from 1st September 2022.

7.3 Most revenue proposals introduced in May 2022 will be effective from 1st October 2022.

7.4 The implementation of these proposals will help increase the revenue. It will enable to gradually reduce the quantum of monetary financing for government expenditure.

7.5 The revenue from the above proposals is also included under the revenue estimates presented in the amendments to the 2021 Appropriation Act.

7.6 In addition, it is expected to present new revenue enhancing proposals aiming at Budget 2023.

8. Tax Administration

8.1 In our efforts to increase the revenue, tax administration must play a pivotal role in enhancing the tax collection efficiency, strengthening tax compliance and preventing tax avoidance.

8.2 In addition to the already existing requirements, I propose to introduce compulsory tax registration for all residents who are above 18 years of age without considering their annual income and tax-free thresholds.

8.3 The government is committed to implement the recommendations in the Final Report of the “Presidential Commission of Inquiry into Sri Lanka Customs”. This will strengthen corporate, administrative, and operational processes of Sri Lanka Customs to discharge its responsibilities effectively and efficiently.

9. Non-Tax Revenue

9.1 Measures will be taken to enhance non-tax revenue, including royalties received for government assets. I also propose to take actions to attract foreign investors and/or technology holders to establish joint ventures with Sri Lankan partners for industrial investments with advanced technologies to ensure better utilization of our mineral resources and increase value addition without jeopardizing the interests of the national economy and the sustainable use of resources.

10. Expenditure Management

10.1 At present, measures are being taken to develop a more prudent and evidence-based prioritisation mechanism for capital expenditure projects. Funding will be channelled to priority sectors such as education, healthcare, public transport, public service digitisation, and social protection.

10.2 The effective expenditure management needs better and strong supervision as well. Hence, I propose to introduce required laws to establish a system like Inspector General (IG) in the USA, tasked with making sure government expenditure system is working well and in the way it is intended. The IG will be strongly empowered and will actively engage in protecting the integrity of the government by detecting and preventing fraud, waste, and abuse in government institutions.

10.3 A comprehensive study of movable and immovable properties, including government owned buildings, lands and vehicles will be conducted with a view to optimise the utilisation and to identify potential real estate for income generating activities.

10.4 Consolidation of identified Local Government Authorities

There are 341 Local Government Authorities currently operating in the country consisting of 24 Municipal Councils, 41 Urban Councils and 276 Pradeshiya Sabhas. While there are local government authorities which have ample revenue streams, there are also local government authorities which do not have sufficient sources of revenue. Therefore, in order to provide a more efficient public service and to facilitate efficacies in administration, I propose to merge selected Pradeshiya Sabhas with a Municipal Council or an Urban Council adjacent to them. 22 Pradeshiya Sabhas have been selected for this programme as the initial step. Details are given in the Annexure VII.

In order to making services to be efficient and easier to the public, all the local government authorities should arrange to offer online services to collect the related revenues without any delay. Accordingly, the online revenue collection programme should be implemented in all local government authorities before the end of 2022.

10.5 It is important to review the activities of the project offices and project units that have been established for various purposes as these involve significant number of staff and high amounts of payments. Hence, I propose to appoint a committee to review whether the intended purposes of such offices and units have been met and whether it is necessary to continue such entities and submit recommendations to the Cabinet of Ministers within a period of 3 months.

11. Public Sector Reforms

11.1 As a part of efficient expenditure management, I propose to rationalize the number of government employees. Already, we have allowed those who are willing to take no pay leave for 5 years or so and go abroad or engage in educational activities in the country.

11.2 It has been observed that there has been increasing unrest among unemployed youth as the government had decided to raise the mandatory retirement age of public sector employees to 65 years and that of semi- governmental employees to 62 years. Besides, it has also been reported that the increase in the retirement age has restricted the promotional opportunities available for many public sector and semi-governmental employees.

Accordingly, it is proposed to reduce the retirement age of public sector and semi-governmental employees to 60 years. Those who have been employed beyond 60 years of age at present in the government and semi government sectors will be retired as of 31.12.2022.

11.3 The Director General of Management Services will be tasked to conduct a work study covering the entire public service for the purpose of optimally obtaining services of the primary level employees in the government entities and to submit the report to the Cabinet of Ministers within three months.

11.4 The purchase of fossil fuel-based vehicles for public sector will be suspended from hereafter as a government policy.

As per this policy, only electric-powered vehicles will be purchased for the use of the public sector in the future and the private sector will also be encouraged to use electric vehicles.

In purchasing vehicles for the public sector, suitable categories of vehicles are decided on the basis of the efficiency and prices of the vehicles. This proposal will be implemented step by step and will be completed by 01st January 2026.

12. National Security – 2030

12.1 As a geo-politically important country, Sri Lanka should work with everyone and design our defence policies accordingly to face the emerging realities.

12.2 Hence, I propose to have a review on our defence strategy called “National Security – 2030” to achieve these objectives and to develop capabilities and knowledge of our security forces that would be required in the modern and evolving world.

13. State Owned Enterprises

13.1 Another critical area of reform is the management of state-owned enterprises (SOEs). The major fiscal risks arise from a few key SOEs, particularly in the transportation (SriLankan Airlines) and energy sector (CEB and CPC). These entities face significant losses, negative equity (SLA/CPC), and large volumes of debt that is predominantly owed to the state banks, creating significant financial sector risk.

13.2 Some of the state-owned enterprises have been making losses on continuous basis due to issues of structural nature existed for some time. As these losses cannot be met endlessly from the General Treasury, attention should be paid to find alternative mechanism make them effective. Accordingly, it is proposed to establish the “State-Owned Enterprise Restructuring Unit” to facilitate restructuring of government owned business entities. I propose to allocate Rs. 200 million to implement this proposal.

13.3 In addition, I propose to re-activate the Statement of Corporate Intent (SCI) process for key 50 SOEs, excluding CEB, CPC and Sri Lankan Airlines, as they are under different efforts to restructure, to closely monitor the set targets.

13.4 These difficult but necessary measures pertaining to SOEs will no doubt be challenging to address, but failing to do so would create catastrophic risks, particularly for financial sector stability, and will entail even higher taxation burdens on the public in the future.

14. Fiscal legislative/oversight framework

14.1 The fiscal reforms that have been set out are not alien to us. These issues have long been recognized and until 2019, Sri Lanka was embarking on a path of fiscal stabilisation where many of these reforms were put in place. Unfortunately, these reforms were rolled back, putting the economy on a downward spiral to where we are today. We don’t have any alternative. We must undertake these reforms for the benefit of the future and the betterment of the presently young people.

14.2 Therefore, it is essential that whatever reforms we put in place today are shielded from myopic and stubborn decision making that derails the economic recovery that we all hope to see. Towards this end, we will introduce new legislation under a Public Finance Management Act (PFM Act) that will include stronger Fiscal Rules.

14.3 A “Parliamentary Committee on Ways and Means” will be established to closely deal with issues and make proposals in raising government revenue.

15. Disposal of scrap materials accumulated in public sector institutions

It is found that a large amount of scrap material are piled up in many government institutions due to non-removal/disposal of the same for a long time. Besides, the government is losing a lot of revenue that could be obtained by selling the scrap material.

Accordingly, a committee consisting of three government officials including Comptroller General of the General Treasury, will be appointed to supervise and implement the entire process of the disposal of scrap.

16. Establishment of a National Debt Management Agency (NDMA)

The government debt management related activities are carried out by the Central Bank of Sri Lanka, External Resources Department, National Budget Department and the Treasury Operations Department at present. As it is important to pay special attention to the management of public debt, an independent National Debt Management Agency (NDMA) will be set up under the General Treasury in lieu of current arrangement in this respect.

17. Establishment of National Agency for Public Private Partnership (NAPPP)

A national agency will be established for the purpose of identifying and facilitating investment to be undertaken in partnership with the public and private sector. I propose to allocate Rs. 250 million for the implementation of this proposal.

18. Monetary and financial sector

18.1 The new Central Bank Act will be implemented as a key legislation to strengthen the monetary sector in the country. This legislation would provide the framework for effective implementation of inflation targeting and prevent monetary financing of the budget deficit – what is commonly known as money printing.

The new law insulates the Central Bank of Sri Lanka from politicisation of monetary policy decisions.

Given the weak government revenue and lack of net foreign financing of the budget, it is inevitable that a limited level of monetary financing would continue until tax policy measures help improve the government cash flow and the IMF programme unlocks foreign financing for the budget.

18.2 Allotment of 20 percent shareholding in state banks to the depositors and staff of those banks In order to meet recapitalization requirement borne out due to increase in interest rates, rising NPLs, loan settlement issues faced by businesses due to economic crisis, and liquidity issues faced by the state banks, it is proposed to allow 20 percent of shareholding of the Bank of Ceylon and People’s Bank by their depositors and staff.

It is noted that government’s ability to provide additional capital at this stage to the state banks is very limited given the lack of fiscal space.

19. Social welfare

19.1 The Welfare Benefits Act became law in 2002, but it has not properly implemented thus far. The Welfare Benefits Board has now been activated and the data collection to establish the database or the social registry is progressing. A new mechanism for identifying beneficiaries through objective and verifiable criteria has also been established. It will ensure that transparent laws and systems are in place. With the completion of this work, the welfare programmes will be better targeted and cash transfers will be made directly to bank accounts of beneficiaries.

19.2 I am well aware of the difficulties faced by many due to the ongoing crisis. That’s why I decided to cut some of the capital expenditure and find room to provide enhanced support for vulnerable communities.

19.3 As you are aware, the government spent additional amount of about Rs. 31,000 million approximately from May to July 2022 to provide an additional monthly allowance as urgent assistance to those who have affected due to loss of employment, decline in agriculture output and inability to cultivate due to many reasons.

I propose to continue this programme for further four months to reduce the pressure of the economic crisis on the affected people mentioned above.

I also propose to provide additional monthly allowance of Rs. 2,500 for pregnant mothers in addition to Rs. 20,000 already provided for them.

It has been reported that there are about 61,000 food insecure families, which need urgent assistance. I will provide Rs. 10,000 per family for a period of further four months.

19.4 For all the above programmes, I will allocate Rs. 46,600 million for a period of 4 months.

19.5 The recent increase in the kerosene prices has created difficulties for the owners of small boats which are used for fishing industry and for those who in the plantation areas that has no electricity services. I will provide a subsidy for these areas.

19.6 Rs. 133 billion has been allocated under the World Bank loan assistance for the implementation of programs with the view of reducing the impact of the current economic crisis and restoring social stability.

Accordingly, I have obtained approval through the Supplementary Estimate presented to Parliament before presenting this budget to provide immediate relief to around 3.2 million people affected by the current economic situation.

Under this, monthly Samurdhi allowance has been increased to an amount ranging between Rs. 5,000 to Rs. 7,500 per month for approximately 1.7 million currently Samurdhi receiving families. Apart from that, an assistance of Rs. 5,000 was provided per month temporarily to around 726,000 families who were in the waiting list for expecting Samurdhi benefits.

Also, the allowance paid for the elderly, disabled, and kidney patients was increased to an amount ranging between Rs. 5,000 to Rs. 7,500. Further, the temporary assistance of Rs. 5,000 was arranged for the people who are in the waiting lists in anticipation of receiving this assistance.

In addition to the above concessions provided under this project, US dollars 110 million (Rs. 40 billion) has been allocated for the import of Urea required for paddy cultivation in the 2022/2023 “Maha” season, and fertilizer procurement is already underway. I believe that this will enable the paddy farmers to get a good harvest in the coming season and thus will be able to get rice at a reasonable price for the rice consumers.

Further, under this loan facility, domestic cooking gas was imported and distributed in the country during a short time duration to overcome the domestic gas shortage that had arisen in the country due to the current shortage of foreign exchange. Also, we are working to meet the domestic gas requirement without shortage in the future as well. It is intended to spend about US dollars 70 million (Rs. 25 billion) from this loan assistance for that.

That is in addition to the concessions mentioned in Section 19.3 above.

20. Introduction of new laws / revision of laws

20.1 In order to stabilize the economy and facilitate the growth process, it is proposed to make appropriate revisions and introduce new laws to make reforms expeditiously in a short period of time as given below.

(a) New Laws

i. Food Security Bill

ii. Public Asset Management Bill

iii. Economic Stabilisation Bill

iv. Offshore Economic Management Bill

v. Public Service Employment Bill

vi. Public Finance Management Bill

vii. The Recovery of Possession of the Premises Given on Lease (Special Provisions) Bill

viii. Contributory National Pension Fund Bill

ix. Agency for Overseas Sri Lankans Bill

(b). Revision of Laws

i. Amendments to Agrarian Development Act

ii. Amendments to Excise Ordinance

iii. Amendments to Finance Act

iv. Amendments to Foreign Exchange Act

20.2 We will discuss with all stakeholders to introduce a more realistic mechanism than Termination of Employment of Workman Act (TEWA) to handle employees who lose their jobs due to the crisis.

20.3 Chapter 11 of the Bankruptcy Code of the United States and introduction of similar provisions to Sri Lanka Chapter 11 of the US bankruptcy Code of the United States contains provisions on how to reorganize businesses in distress due to indebtedness. Bankruptcy alone is not a reason to close the business and there are ways to reorganize the business by restructuring the assets and liabilities and by getting rid of the indebtedness while staying alive in the business. New laws in similar lines should be enacted for Sri Lanka as well.

21. Agriculture

21.1 The number of paddy farmers with 2 hectares or less who are in repayment arrears of cultivation loans given by the state banks as of 31.05.2022 due to the decrease in harvest, lack of fertilizers, agro-chemicals and inputs, abandonment of cultivation, etc., was 28,259. Aimed at strengthening of the farmers and freeing them from debt burden, actions are being taken to write off the outstanding loan amounting to Rs. 688 million (excluding interest) which is currently in default to the state banks. The money to be writing off will be paid back to the respective banks in two years in a phased manner so as not to put added pressure on the cash flow of the General Treasury. Accordingly, the respective banks should arrange to write off the interest relating to such loans. I propose to allocate Rs. 350 million for the implementation of this proposal.

21.2 We must ensure that agriculture and entrepreneurship are fused together. We should make sure we understand problems and rethink to promote our agriculture. The youth are quick to adopt new technologies. They can use innovative tools and improve efficiency across the value chain. In this context, I propose to establish Youth Agriculture Companies and link them with 331 Divisional Federation of Youth Clubs to get maximum results. Rs. 250 million will be allocated for this proposal.

21.3 It is important to develop agriculture value chains as well. For this purpose, I propose to strengthen the Domestic Agriculture Development (DAD) Value Chain Programme. The DAD pilot phase (DAD PP) is being implemented by CBSL with its own funds (Rs. 1 billion) and it is expected to expand the program in 2023 with the assistance of the development partners, while encouraging the production for the overseas market.

21.4 There is a strong need to enhance domestic dairy production. Therefore, it is prudent to implement a National Programme with the support of all stakeholders through a project that will be funded by government or a development partner. Since the productivity in the highland climate is higher, the unutilized or low productivity lands of plantations could also be utilized for this project. I propose to allocate Rs. 200 million for this initially.

21.5 Since there is a shortage of seeds and planting material due to the decrease in the cultivated area and yield in the past, the Department of Agriculture and government farms should implement an urgent programme to supply the necessary seeds and planting material to the farmers. Accordingly, I propose to allocate Rs. 400 million to the Department of Agriculture to produce the necessary seeds and planting materials.

21.6 Utilizing unemployed youth for the productive use of the existing government lands. With the aim of efficiently and productively using government land for agriculture and livestock under the strategy for encouraging export-oriented agriculture, the government lands will be used efficiently and unemployed youth will be directed for that purpose.

Accordingly, it is expected that 20 acres of land will be allotted to currently unemployed youth groups (groups of about 10 members) in the area where the identified lands are located for the purpose. I propose to allocate Rs. 50 million to implement this proposal.

21.7 I also propose to introduce a “National Food Security Programme” covering broad areas, including the enhancement of production, collection, storage, and distribution of food, as well the provision of food to those who do not have the capacity, to ensure food security and implement the same as a national priority.

21.8 Revision of Agricultural Insurance Programme Although the farmers have actively contributed to the program by providing insurance premiums from the beginning of the implementation of the agricultural insurance program, it appears that the government currently bears all the funds related to this insurance.

Accordingly, it should be reviewed whether it is necessary to continue the present system or whether it is possible to provide the relevant facilities to the farmers under another convenient system.

22. Research and Development (R&D)

Improving R&D is important to improve Sri Lanka’s global competitive ranking in order to be successful.

I propose Rs. 100 million to establish a mechanism to promote R&D and commercialize the same, particularly with the startup culture, with the assistance of local universities and technological institutes.

23. Promotion of local packaging products

There is a need to reduce wastage of agricultural produce by way of improving the marketing and storage time. Therefore, food packaging industries using local raw materials should also be promoted to preservation and marketing of agricultural produce.

Accordingly, 50 percent import duty concession is offered on import of advanced new technology equipment/accessories for food packaging. Apart from this, the Palmyra Development Board, National Design Center and Export Development Board should jointly introduce new packaging programme and contribute to the promotion of the export market through innovative packaging.

I propose to allocate Rs. 250 million to implement this proposal.

24. Promotion of tourism industry

24.1 In order to attract more tourists from September this year, the Ministry of Tourism should organize special programmes with the support of the Tourist Board and other institutions related to the tourism industry. Here, it is necessary to target the cultural /religious events that are unique to different races to be held in Sri Lanka in the future. Considering the importance of this industry, by the end of 2023, the number of tourist arrivals per year should be increased to more than 25 lakhs as the target.

In addition, special attention should be paid to attract high-end tourists.

Also, a five-member committee, representing various sectors, should be appointed to present a report focusing on the identification of new places of tourist attractions and the improvement of related facilities and a report containing their recommendations to be presented in a month for onward actions. I propose to allocate Rs. 300 million to implement these proposals.

25. Facilities from the Climate Fund

25.1 As there is a trend of increasing accidents, disasters and property damage due to weather and climate related effects in Sri Lanka, suitable measures should be taken urgently to reduce the climate effects.

25.2 For that, the Ministry in charge of the subject of environment should prepare a suitable program and obtain necessary support from the Climate Fund and implement a mitigation program accordingly.

26. Expanding higher education opportunities

26.1 Many countries in the world have opened educational opportunities to foreign students in a manner to build their foreign reserves. In the South Asian region, Bangladesh, India and Nepal have already opened up their countries to foreign students to build up their foreign reserves. Accordingly, Sri Lanka also needs to encourage private investment to provide educational opportunities to foreign students.

Hence, I propose to facilitate the establishment of branch campuses in Sri Lanka, particularly focusing on Science, Technology, Engineering and Mathematics (STEM) subjects as well as finance, information technology and medicine. For this purpose, the government will provide all facilities through the Board of Investment (BOI) to establish such branch campuses as per the provision laid down in the Companies Act and Universities Act and other applicable legal provisions subject to amend them when and where necessary.

The creation of space for private investment in higher education will free up government resources that will enable the state to ensure that free education is preserved and in fact expanded beyond present levels. Scholarships will also be provided to Sri Lankan students to study in these universities.

26.2 I also propose to open a branch campus of the Kotalawala Defence University (KDU) in Kurunegala.

27. Facilitating new jobs based on skills

27.1 In the Sri Lankan labor market, there are a large number of people who are employed without any previous training and are employed by getting skills through work.

27.2 There is a need to provide more training and qualification to this group, including relevant theoretical knowledge. Through this, the productivity of work will grow, and businesses will be able to gain a competitive position in the global context by having skilled staff. Also, the job seekers will be able to find more effective employment opportunities as well as foreign employment opportunities.

27.3 As a result of the negative impact of the COVID-19 pandemic and the economic recession, there are people who are losing their jobs, so there is a need to train them for new job opportunities. Support level staff working in free trade zone factories from rural areas tend to return to the countryside after working for about five years. Here, women often lose job opportunities and men are engaged in informal jobs.

27.4 Accordingly, it is necessary to provide further training to be able to get a new job based on the skills acquired in the jobs engaged in free trade zones.

27.5 Accordingly, it will be possible under this system to train and provide NVQ certificates from the selected vocational training institutes (Youth Corps, VTA, NAITA,) and TVEC, which is the regulatory body in the vocational training sector.

27.6 I propose to allocate Rs. 200 million to implement this proposal.

28. Ensuring the employment security of the community engaged in Micro- scale self-employment / Livelihood occupations

28.1 Many people in the community living in urban and rural areas are engaged in micro-scale self-employment / livelihood occupations. By providing part- time or short-term formal training in technology and innovation for life occupations to this community, the productivity, safety and health of those jobs will increase, and the quality of products will also improve. For this purpose, it is proposed to establish a community unit in every Vocational Training Center operating under the government to empower the community and the technical services that are not available in the training center will be obtained from outside and training facilities will be provided to the community.

28.2 Accordingly, work is being done to provide formal training in food and beverage preparation, fish drying and vegetable dehydrating, sewing knitting, beeralu weaving, brass industry and Black Smithing as livelihood around the training center, online self-employments based on the Gig economy and other life occupations. After the training, a certificate is also being provided.

28.3 After formal training, the currently engaged profession can be done effectively and efficiently, so food and other products can be provided in quality. Through that, it is possible to confirm their job security and improve their businesses.

28.4 I will allocate Rs. 200 million to implement this proposal.

29. Use of railway facilities for vegetable and fruit transportation to make the supply chain more efficient.

29.1 The transport of vegetables, fruits, flowers and tea products from the upland areas to Colombo and urban areas is important to the farmer, the producer, the trading community as well as the consumer while preserving the freshness. Hence, it is necessary to encourage the transportation of these goods by railway. Through this, waste, delays and costs can be minimized and an additional revenue will come to the Sri Lanka Railways.

29.2 As a starting point, a train with relevant facilities should be deployed to transport vegetables, fruits and other products from Hali Ela Railway Station to Colombo Fort Railway Station. Cargo loading facilities should be improved in relevant railway stations for this purpose, a system should be implemented with the participation of cooperatives and private entrepreneurs to establish cargo collection centers and provide transport facilities from those centers to the respective railway stations.

29.3 Sri Lanka Railways should work to implement a suitable program to encourage wholesalers to transport goods from Colombo to Badulla.

29.4 I propose to allocate Rs. 200 million to implement this proposal.

30. Private investment to improve quality and efficiency of the railway

30.1 Since providing efficient and high-quality transport service to the people is a priority task of the government, it is expected that private sector investments will be used for the development of the railway transport service using the existing infrastructure under this program.

30.2 Accordingly, it is expected to develop the Kelaniweli train service as a pilot project. The selection of investor/s will be based on competitive bidding process.

31. Trade and investment

31.1 The government’s macroeconomic reform programme will focus on re- engaging with the global economy to tap into regional and global value chains to enhance exports and export oriented FDI.

31.2 Accordingly, the government will gradually phase out the high trade barriers in the form of para-tariffs. This will be done in conjunction with a Trade Adjustment Programme to support industries and workers adversely affected by such tariff liberalization.

31.3 The government will provide renewed support to the National Export Strategy, a well thought out framework of export support that was developed through broad stakeholder consensus in 2018.

31.4 We will resume efforts towards engaging broader regional trade agreements in order to link into regional value chains which have been the driver of export growth in the South East Asian region in particular.

31.5 The Government will facilitate the expansion of renewable energy sources to enhance availability and reduce the cost of energy generation in Sri Lanka by allocation of necessary land and through the necessary operational restructuring of the CEB.

31.6 The government being the owner of around 80 percent of land will take measures to facilitate access to land with suitable utilities for domestic and foreign investment. We will implement a programme to award title deeds for lands previously handed over under numerous grants.

31.7 I also like to propose to establish an “Office for Overseas Sri Lankans”, which will act as a central point of coordination to obtain the support of Sri Lankans who are living abroad to the country. This office will encompass various organisations of the Sri Lankans across the globe and focus mainly on attracting investments, promoting tourism and similar matters. In order to support this, an “Overseas Sri Lankan’s Fund” will also be established. It is expected to get the support of all Sinhala, Tamil, Muslim, Burgher and other Sri Lankans who live abroad for this programme.

32. Manufacture of electric bicycles

Manufacturing of electric bicycles should be encouraged as a local industry with a view to reducing fossil fuel consumption.

Therefore, tax concessions will be provided for imported accessories/parts required in the manufacture of electric bicycles locally with more than 50 percent value addition.

33. Strengthening governance and fighting corruption

A comprehensive legal framework will be established to strengthen governance and fight corruption. This framework will strengthen the asset declaration system and increase independence of the Commission to Investigate Allegations of Bribery or Corruption. Further, I propose to promote technology infused systems to eliminate grounds for corruption and create transparency.

34. The End

34.1 We will prepare the foundation for the journey of creating a revitalized economy through these proposals. I would like to draw your attention to another particular issue.

34.2 As I have mentioned on several previous occasions, our aim is to create a surplus in the primary budget by the year 2025. Our effort is to stabilize the economic growth rate. Our aspiration is to establish a solid economic foundation by the year 2026. As at end 2021, public debt is about 110 percent of the Gross Domestic Product (GDP). Our target is to bring this down to less than 100 percent in the medium term.

34.3 If we build the nation and its populace based on the National Economic Policy, we would be able to become a fully developed country by the year 2048, when we celebrate the 100th anniversary of independence.

34.4 We can no longer be a nation dependent on loan assistance. We can also no longer be used as a tool of interference by other countries with strong economies. All of our collective vision should be to make our country strong and stable, in order to stand independently. We must strive to bring business entities of our country to a competitive level in the global market. We must pursue to capture a share of the global market on agricultural exports. We should seek to create a disciplined, knowledgeable society, that provides right opportunities to maintain social justice.

34.5 All this can be achieved, only if we work together in unity with common consent. I reiterate the invitation to all the parties represented in this Parliament to join an All-Party Government, since this unprecedented situation is the responsibility of us all, and therefore need to prioritize the necessities of the country and the nation.

34.6 Some parties say that they will not join an All-Party Government due to action by the Government which they cannot condone. Others express a reluctance to join due to their opposition to the policies. In this instance, I wish to emphasize that, I am not the person who decides the actions or policies of an All-Party Government. It is not an administration of a single person or a single party, and will be established according to the consent of all stakeholders of the government. Therefore, I reiterate that, if there are policies or practices which you do not condone, then you have the right and mandate to change them within an All-Party Government.

34.7 Therefore, I request all of you in this House and all the citizens of the country, to put aside your personal political goals and unite in the context of the national cause of rebuilding the country and the nation. If we all come together, we will be able to uplift our Motherland, and create a nation that competes and moves forward with the ever-changing world. If we miss these opportunities, we will be marginalized globally.

34.8 I would like to remind you, the line of the lyrics ‘Aaji Thapara Lahila’ written by Bandara Eheliyagoda for a teledrama produced for the Mahapola Scholarship Fund.

‘Apa pamanada ekathena karakenne – Apa thanikara lokaya diva yanne’

34.9 So, let’s get together for the country, without spinning in one place anymore. Let’s create a knowledgeable society with a strong economy that can run forward together with the world.

Thank you.

Annexure I

Summary of the Budget Estimates 2022 (Revised)

Rs. Billion

Item

2021

2022 Budget

Original Est.

Revised Est.

Total Revenue and Grants

1,464

2,223

2,094

Total Revenue

1,457

2,213

2,084

Tax Revenue

1,298

1,987

1,852

Income Tax

302

496

558

Taxes on Goods and Services

646

1,031

972

Taxes on External Trade

350

460

322

Non Tax Revenue

159

226

232

Grants

7

10

10

Total Expenditure

3,522

3,851

4,427

Recurrent

2,748

2,935

3,620

Salaries and Wages

846

968

995

Other Goods and Services

169

189

225

Interest

1,048

1,115

1,379

Subsidies and Transfers

685

663

1,021

Public Investment

790

931

1,072

Other

(15)

(15)

(265)

Revenue Surplus (+)/Deficit(-)

(1,290)

(722)

(1,536)

Primary Surplus (+)/Deficit(-)

(1,010)

(513)

(954)

Budget Surplus (+)/Deficit(-)

(2,058)

(1,628)

(2,333)

Total Financing

2,058

1,628

2,333

Total Foreign Financing

(14)

(179)

342

Foreign Borrowings-Gross

517

508

717

Project and Programme Loans

352

358

467

Foreign Commercial

165

150

250

Debt Repayment

(531)

(687)

(375)

Total Domestic Financing

2,072

1,807

1,991

Non – Bank Borrowings

1,898

1,397

2,672

Sri Lanka Development Bond

(68)

(91)

(357)

Bank Borrowings and Other

242

501

(323)

Revenue and Grants/GDP (%)

8.3

12.0

8.8

Total Revenue/GDP (%)

8.2

12.0

8.7

Tax Revenue/GDP

7.3

10.7

7.8

Non Tax Revenue/GDP (%)

0.9

1.2

1.0

Grants/GDP (%)

0.04

0.05

0.04

Total Expenditure/GDP (%)

19.9

20.8

18.6

Recurrent Expenditure/GDP (%)

15.5

15.9

15.2

Non Interest/ GDP (%)

9.6

9.8

9.4

Interest/ GDP (%)

5.9

6.0

5.8

Public Investment/ GDP (%)

4.5

5.0

4.5

Revenue Surplus (+)/Deficit (-) GDP (%)

(7.3)

(3.9)

(6.4)

Primary Surplus (+)/Deficit (-) GDP(%)

(5.7)

(2.8)

(4.0)

Budget Surplus (+)/Deficit (-) GDP(%)

(11.6)

(8.8)

(9.8)

Compiled by Department of Fiscal Policy

Annexure II

Gross Borrowings Requirement – Budget Estimates 2022 (Revised) (Provisioning for Accounting Transactions)

Item

Rs. Billion

Total Receipts other than Government Borrowings

2,384

Total Payments Including Debt Repayments

6,222

Provision for Advanced Accounts

6

Total Gross Borrowing Requirement to be recorded in Government Accounts

3,844

O/W Total Debt Repayments

1,510

Compiled by the Department of Fiscal Policy, Department of National Budget and Department of Treasury Operations

Annexure III

Expenditure Proposals

No.

Proposal

Allocation (Rs. million)

1.

Social Safety Net programme

46,600

2.

Supply of seeds and planting materials

400

3.

Payment for crop damages

350

4.

Promotion of tourism industry

300

5.

Establishing Youth Agriculture Companies

250

6.

Establishment of a National Agency of Public Private Partnership (NAPPP)

250

7.

Promotion of local packaging products

250

8.

Promotion of domestic dairy production

200

9.

Facilitating new skill based jobs

200

10.

Railway facilities for vegetable and fruit transportation

200

11.

Research and development

100

12.

Youth entrepreneurship for agriculture and animal production

50

13.

Other subsidies and relief

5,000

Annexure IV

Provisions for the implementation of key Welfare and Subsidy Programmes

Programme

2022

Revised Estimate

(Rs. million)

Relief for the affected people from the difficult economic condition

133,000

Monthly Samurdhi Relief Allowance

55,500

Financial Support for Elders

13,583

Support for low-income Disabled Persons

4,860

Financial Support for Kidney Patients

2,642

“Ranaviru Mapiya Rakawaran” Allowance

2,350

Property Loan Interest subsidy to the Public Servants

2,796

Subsidy for the running busses on unremunerated routes

3,000

Pensions

317,974

Service compensation for Death and injured Soldiers

42,500

Medical Supplies for Hospitals

77,737

Health Insurance for School Children (Suraksha)

2,000

Agrahara Insurance Scheme for Pensioners

1,008

Farmer Pension

4,220

Free School Text Books

2,400

Free School Uniforms

2,000

Shoes for Students of Schools in difficult areas

900

Grade 5 Scholarships

938

Mahapola and Bursaries

2,495

Subsidy Loan Scheme for the Students who were unable to get admission

in to the State Universities

397

School & Higher Education Season Tickets

6,400

Thriposa Programme

2,000

Nutritional Food Package for Expectant Mothers (Poshana Malla)

4,000

School Nutritional Food Program

4,000

Morning Meal for Pre-School Children

150

Fertilizer Subsidy

98,400

Subsidies for Tea, Rubber, Coconut and other crops

2,240

Interest subsidy for Senior Citizen’s Accounts

10,000

Housing Subsidy under Urban Regeneration Programme

4,900

Subsidized Loan Scheme

2,350

Annexure V

Proposed relief to families affected by difficult economic condition

Programme

Current Benefit

Proposed Benefit for the next 04 months

Expected Expenditure (Rs. Mn.)

Monthly Samurdhi Allowance

Monthly allowance of Rs. 420/- to Rs.4,500/-

Monthly Minimum payment of Rs. 3,000/- to a maximum payment of Rs. 3,100/-

20,728

Allowance for elders

Monthly allowance of Rs. 2,000/- for over 70 years of age and Monthly allowance of Rs. 5,000/- for over 100 years of age

Monthly payment of Rs. 3,000/- for elders over 70 years and Monthly payment of Rs. 2,500/- for elders over 100 years

2,980

Support for low-income Disabled Persons

Rs. 5,000/-

Monthly payment of Rs. 2,500/-

236

Allowance for Kidney Patients

Rs. 5,000/-

Monthly payment of Rs. 2,500/-

212

Relief for the affected people from the difficult economic condition (Allowance for those who are not currently receiving Samurdhi, elderly, disabled or kidney allowances but are on the waiting list)

Rs. 5,000/- has been granted for the month of May, June and July

Payment of Rs. 5,000/-

for further 4 months

17,354

Nutritional Food Package for expectant Mothers

Rs. 20,000/- allowance are being paid

Monthly payments of Rs. 2,500/-

2,650

Families identified for immediate relief

–

Monthly payment of Rs. 10,000/-

2,440

Annexure VI

Reasons for the Increase in Expenditure in the 2022 Revised Budget

Considering the prevailing economic crisis that has its roots in fiscal weakness, it is essential that fiscal management is conducted in a prudent and disciplined manner. Whilst revenue enhancement is the primary lever of fiscal consolidation, it is equally important to manage expenditure. Towards this end, the government has taken several measures to reduce public expenditure, particularly through the reduction of capital expenditure by postponing non- urgent expenditure, and re-purposing project expenditure towards urgent social protection spending. Through these efforts, approximately Rs.300 billion has been reduced from the original estimated capital and less priority spending, with spending being limited to urgent works and essential foreign funded multilateral project spending.

Recurrent expenditure has also been limited by measures introduced in the circular issued by the General Treasury on 26th April 2022. This circular imposes disciplines on recruitments, overtime payments, vehicle and fuel usage, among others. However, Sri Lanka’s government expenditure is largely non-discretionary, with the spending on interest payments and salaries alone accounting for 1.3 times of the government revenue in 2021 making it difficult to make meaningful reductions in recurrent expenditure.

In spite of the measures taken to minimise public expenditure, there is an increase in expenditure in the 2022 revised budget compared to the original expenditure estimate in the 2022 budget approved in December 2021, and it is important to outline the reasons as to why this is the case.

1. Accounting for previously unbudgeted expenditure measures

In January 2022, the government took a decision to provide an additional allowance for government employees and pensioners of Rs. 5,000 per month. This was previously not included in the 2022 budget as approved by Parliament in December 2021. The cost of these allowances amounts to Rs. 80 billion for about 1.4 million government employees and about Rs. 40 billion for 675,000 pensioners. This increase was approved through a Supplementary Estimate in Parliament on 8th June 2022 and is reflected as an increase in expenditure in the revised budget accordingly.

2. Higher procurement costs due to rising prices in a high inflation environment

With inflation reaching 60.8% by July 2022 (CCPI based), the costs of all goods and services has increased significantly compared to the costs assumed in the original budget estimates, resulting in higher costs for government procurement as well. This is reflected in items such as fuel where the cost has increased by Rs. 11 billion in spite of reduced usage, medical supplies (Rs. 9 billion increase), and diet for hospitals, armed forces, prisons etc. (Rs. 20 billion increase).

3. Increased allocations for social protection measures

Considering the rising costs of essential items, increased utility prices, and elevated economic risks for vulnerable communities, the government has enhanced payments to Samurdhi beneficiaries which has resulted in an increase in expenditure of Rs. 14.5 billion.

Furthermore, Sri Lanka’s development partners, such as the World Bank, have re-purposed project funds, that were hitherto unbudgeted, towards essential social protection needs. This expenditure results in higher expenditure in the revised budget amounting to;

Medicines and basic health needs: Rs. 16.6 billion

Fertiliser: Rs. 36.5 billion

Cooking gas: Rs. 23.2 billion

Additional cash transfers for vulnerable communities: Rs. 56.2 billion

4. Allocations for chemical fertiliser

Considering the change in government policy regarding fertiliser, fresh allocations were required for the procurement of chemical fertiliser and to settle outstanding payments to fertiliser suppliers. Funds were also allocated to compensate farmers who faced losses due to the unavailability of fertiliser. These measures related to fertiliser result in expenditure increasing by Rs. 63 billion.

5. Higher interest costs

Whilst there is some reduction in the foreign interest cost due to the suspension of interest payments on affected foreign debt as per the Interim Debt Policy, these reductions are significantly outweighed by the impacts of higher market interest rates and currency depreciation. As at end 2021, the yield on a 3 month Treasury bill was 8.2% whereas by mid- August 2022, this had increased to 29.4%, causing a significant increase in the government’s short term domestic interest costs. Furthermore, with the depreciation of the currency to around Rs. 360 to the US dollar, the rupee value of the unaffected foreign debt interest service cost has also increased significantly. The increase in interest cost adds approximately Rs. 263 billion to expenditure in the revised budget 2022.

6. Accounting for onlending under the Indian Credit Line

The Indian credit lines for the purchase of fuel are required to be classified as onlending from the government of Sri Lanka to the Ceylon Petroleum Corporation (CPC). Accordingly, the funds drawn down for this purpose must be accounted for in the budget and therefore Rs. 250 billion has been recognized as expenditure in the 2022 revised budget. These funds will be repaid by the CPC to the General Treasury.

7. Financing CEB payments to the CPC

Given the increase in cost of fuel and the delays in adjustment of electricity pricing, the liabilities of Ceylon Electricity Board (CEB) owed to the CPC have increased significantly. This created financial pressure on both entities, and the CPC would not have been able to continue supplying the CEB if the CEB did not settle part of the liabilities to the CPC. In order to facilitate this transaction and thus prevent additional disruptions to electricity supply to the country, the General Treasury allocated funds for the CEB to settle part of its liability to CPC. This resulted in an increase in expenditure by Rs. 86 billion as reflected in the revised budget.

Key Spending Items Causing the Increase in Expenditure in Revised Budget 2022

Spending Item

Increase in Revised Budget 2022

(Rs. Billion)

Interest Expenditure (R)

263

Social Protection (including World Bank re-purposed funds) (R)

163

Public sector allowance from January 2022 (R)

80

Fertiliser payments (R)

63

Pension allowance from January 2022 (R)

40

Procurement cost escalation (food, medicine, fuel etc.) (R)

40

On-lending Indian Line of Credit (C)

250

Transfer to CEB for CPC liability settlement (C)

86

Recurrent Spending (R) Capital Spending (C)

Annexure VII

The List of local government authorities which are identified for consolidation in related to proposal no. 10.4

i. Nuwara Eliya Municipal Council with Nuwara Eliya Pradeshiya Sabha

ii. Matale Municipal Council with Matale Pradeshiya Sabha

iii. Dambulla Municipal Council with Dambulla Pradeshiya Sabha

iv. Chilaw Urban Council with Chilawa Pradeshiya Sabha

v. Puttalam Urban Council with Puttalam Pradeshiya Sabha

vi. Kurunegala Municipal Council with Kurunegala Pradeshiya Sabha

vii. Kuliapitiya Urban Council with Kuliapitiya Pradeshiya Sabha

viii. Polonnaruwa Municipal Council with Polonnaruwa Pradeshiya Sabha

ix. Gampaha Municipal Council with Gampaha Pradeshiya Sabha

x. Minuwangoda Urban Council with Minuwangoda Pradeshiya Sabha

xi. Beruwala Urban Council with Beruwala Pradeshiya Sabha

xii. Panadura Urban Council with Panadura Pradeshiya Sabha

xiii. Weligama Urban Council with Weligama Pradeshiya Sabha

xiv. Hambantota Municipal Council with Hambantota Pradeshiya Sabha

xv. Tangalle Urban Council with Tangalle Pradeshiya Sabha

xvi. Badulla Municipal Council with Badulla Pradeshiya Sabha

xvii. Bandarawela Municipal Council with Bandarawela Pradeshiya Sabha

xviii. Haputale Urban Council with Haputale Pradeshiya Sabha

xix. Balangoda Urban Council with Balangoda Pradeshiya Sabha

xx. Kegalle Municipal Council with Kegalle Pradeshiya Sabha

xxi. Mannar Municipal Council with Mannar Pradeshiya Sabha

xxii. Trincomalee Municipal Council with Trincomalee Town and Gravets

News

US sports envoys to Lanka to champion youth development

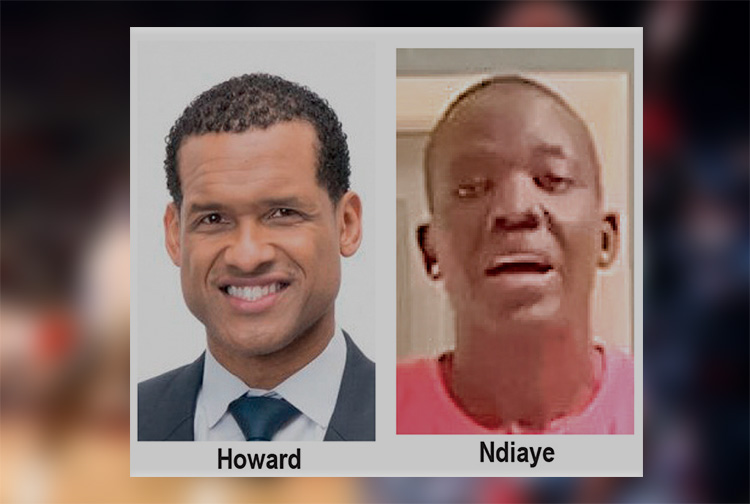

The U.S. Embassy in Colombo welcomed the U.S. Sports Envoys to Sri Lanka, former National Basketball Association (NBA) and Women’s National Basketball Association (WNBA) players Stephen Howard and Astou Ndiaye, from June 8 through 14.

The Public Diplomacy section of the U.S. Embassy said that it would launch a weeklong basketball program intended to harness the unifying power of sports, made possible through collaboration with Foundation of Goodness and IImpact Hoop Lab.

While in Sri Lanka, Howard and Ndiaye, both retired professional basketball players, will conduct a weeklong program, Hoops for Hope: Bridging Borders through Basketball. The Sports Envoys will lead basketball clinics and exhibition matches and engage in leadership sessions in Colombo and Southern Province for youth aged 14-18 from Northern, Uva, Eastern and Western Provinces, offering skills and leadership training both on and off the court. The U.S. Envoys will also share their expertise with the Sri Lanka Basketball Federation, national coaches, and players, furthering the development of basketball in the country. Beyond the clinics, they will collaborate with Sri Lankan schoolchildren to take part in a community service project in the Colombo area.

“We are so proud to welcome Stephen and Astou as our Sports Envoys to Sri Lanka, to build on the strong people-to-people connections between the United States and Sri Lanka,” said U.S. Ambassador Julie Chung. “The lessons that will be shared by our Sports Envoys – communication, teamwork, resilience, inclusion, and conflict resolution – are essential for leadership development, community building, equality, and peace. The U.S. Sports Envoy program is a testament to our belief that sports can be a powerful tool in promoting peace and unity.”

News

Rahuman questions sudden cancellation of leave of CEB employees

SJB Colombo District MP Mujibur Rahuman in parliament demanded to know from the government the reasons for CEB suspending the leave of all its employees until further notice from Thursday.

MP Rahuman said that the CEB has got an acting General Manager anew and the latter yesterday morning issued a circular suspending leave of all CEB employees with immediate effect until further notice.

“We demand that Minister Kanchana Wijesekera should explain this to the House. This circular was issued while this debate on the new Electricity Amendment Bill was pending. There are many who oppose this Bill. The Minister must tell parliament the reason for the urge to cancel the leave of CEB employees,” the MP said.However, Speaker Mahinda Yapa Abeywardena prevented Minister Wijesekera responding to the query and said that the matter raised by MP Rahuman was not relevant.

News

CIPM successfully concludes 8th Annual Symposium

The Chartered Institute of Personnel Management (CIPM) successfully concluded the 8th Annual CIPM Symposium, which took place on 31st May 2024. Themed “Nurturing the Human Element—Redefining HRM in a Rapidly Changing World,” the symposium underscored the pivotal role of human resource management (HRM) in today’s dynamic global landscape. Since its inception in 1959, CIPM has been dedicated to advancing the HR profession through education, professional development, and advocacy, solidifying its position as Sri Lanka’s leading professional body for HRM.

Ken Vijayakumar, the President of the CIPM, graced the occasion as the chief guest. The symposium commenced with the welcome address by the Chairperson, Prof. Arosha Adikaram, followed by the Web Launch of the Symposium Proceedings and Abstract Book by the CIPM President. The event featured distinguished addresses, including a speech by Chief Guest Ken Vijayakumar, President of CIPM, and an address by Guest of Honor Shakthi Ranatunga, Chief Operating Officer of MAS Holdings Pvt. Ltd., Sri Lanka.

The symposium also featured an inspiring keynote address by Prof. Mario Fernando, Professor of Management and Director of the Centre for Cross Cultural Management (CCCM) at the University of Wollongong, Australia.

Vote of Thanks of the inauguration session was delivered by Dr. Dillanjani Weeratunga, Symposium Co-chair.

The symposium served as a comprehensive platform for researchers to present their findings across a wide range of critical topics in HRM. These included Cultural Diversity and Inclusion, Talent Development and Retention, Ethical Leadership and Corporate Social Responsibility, Adapting to Technological Advancements, Mental Health and Well-being at Work, Global Workforce Challenges, Employee Empowerment, and Reskilling and Upskilling.

The plenary session was led by Prof. Wasantha Rajapakse. Certificates were awarded to the best paper presenters during the valedictory session, followed by a vote of thanks delivered by Kamani Perera, Manager of Research and Development.

The annual symposium of CIPM was a truly inclusive event, attracting a diverse audience that spanned undergraduates, graduates, working professionals, research scholars and lecturers. This widespread interest highlights the symposium’s significance in the field of HRM, offering a unique opportunity for everyone to network and learn from scholarly brains.The CIPM International Research Symposium was sponsored by Hambantota International Port, Sri Lanka Institute of Information Technology (SLIIT), E B Creasy & Co. PLC, and Print Xcel Company.