Business

Ideahub drives HNB’s digital strategy

Ideahub completes years as the primary digital partner of HNB, Sri Lanka’s largest private-sector commercial bank. Since its appointment in 2019, ideahub has driven and supported the digital transformation of HNB’s retail business. The appointment in 2019 was the culmination of ideahub’s engagement with HNB since 2018, starting with the implementation of the primary customer touch points of the multi-award-winning bank. Their partnership with ideahub has helped HNB provide a unique and signature service to their customers which won the LankaPay Technnovation Award 2023 for the Bank of the Year for Excellence in Customer

Symphony powers digitalisation of HNB

HNB’s retail banking segment operates on ideahub’s fully integrated, secure and easily customisable Symphony platform that amalgamates the domains of PayTech, Banktech, LifeTech and Reward Tech. The SOLO Digital Wallet, and the Internet and Mobile Banking platforms HNB customers use are all components of Symphony, uniquely tailored and branded for HNB. Now a robust and highly dependable platform, Symphony’s progress spans over 10 years with operational input from industry-leading customers in South Asia region and Australia, including HNB, Dialog Axiata and PiPay of Cambodia going into its development.

Symphony is to HNB digital strategy like the final painting is to the concept in an artist’s mind, It has contributed to the steady growth of HNB’s retail banking business by making its operations faster, more secure, simpler and more reliable. This is clearly evident as more than 50% of Fixed Deposits are opened through the Digital Platform.

A holistic platform for Banks, FinTech and Telcos

The applications in the symphony ecosystem cover primary aspects of business in the financial and telecom industries. The digital touchpoints enable users to access their accounts, purchase products from merchants, pay utility bills and connect to payment gateways such as credit and debit card services. They can chat with friends and send and receive digital gifts. Merchants can feature their product catalogues, and provide offers and discounts. The customer loyalty plugin available on Symphony is a unique and important feature that is not found in its international competition. Financial institutions can deliver line-of-business and added services to their retail customers and partner with Symphony, for a fraction of the cost of competitive products.

ConnectTech – Seamless Integration with SpiderCraft middleware

Symphony has pre-configured connectors to fuse with industry-standard interfaces and systems easily and speedily, providing a seamless user experience for all users on the platform. This is made possible by ideahub’s proprietary state-of-the-art integration middleware, SpiderCraft which helps Symphony Interoperate with business-critical new and legacy payment interfaces used by the client organisation.

SecureTech – Industry-standard security

At the core of the platform are security, identification, authentication, fraud management, role definition and permission management features. Symphony is compliant with the widely accepted PCI DSS security standard in the industry. The platform has been designed and implemented with enterprise-grade security standards in each tier of the architecture. The data at rest and transit are encrypted with the assistance of enterprise-grade Hardware Secure Modules.

Predictive capability and machine learning led revenue opportunities

Symphony’s capabilities of cross-functionality and coordination coupled with data mining and analytical tools help the client organisation garner revenue from multiple channels thereby improving revenue growth

HNB broadening their reach to non-HNB banking customers by separating the banking and non-banking services on Symphony through the “digital layer” or “DL”. It is a great example of cross-functionality coordination. This separation in the architectural layer working between Symphony and the customer interfaces is invisible to the user. Maintaining the two groups on the same platform allows the bank to analyse user data across both groups- an advantage, in addition to cost efficiency and giving a seamless experience to the customers.

The machine learning capability of Symphony enables it to provide its users with an intuitive user-centric experience eliminating the frustrations they might usually encounter with other tech platforms. says Symphony is not just for banks, but for any financial services organisation or telcos looking for their own, branded digital payment platform.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

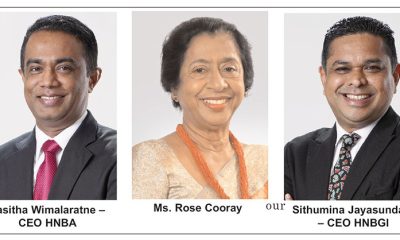

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”