Business

Green bonds gain traction in Sri Lanka

By Securities and Exchange Commission of Sri Lanka

(Continued from Yesterday)

Qualification Criteria for Green Bonds

The International Capital Market Association’s (ICMA) Green Bond Principles (GBP) and the Climate Bonds Initiative’s (CBI) Climate Bond Standards (CBS) help to determine whether a bond qualifies as green or not. Usually, green bonds must undergo a third party verification/certification to establish that the proceeds are funding projects that generate environmental benefits. The four Green Bonds Principles that define a green bond relate to:

Use of proceeds: the issuer should declare the eligible green project categories it intends to support. It should also provide a clear definition of the environmental benefits connected to the project(s) financed by the proceeds.

Process for project evaluation and selection: the issuer should outline the investment decision making process it follows to determine the eligibility of individual investments using the green bond’s proceeds.

Management of proceeds: the proceeds should be moved to a sub portfolio or otherwise attested to by a formal internal process that should be disclosed.Reporting: the issuer should report at least annually on the investments made from the proceeds, detailing wherever possible the environmental benefits accrued with quantitative/qualitative indicators.

Green Bond Issuances by the Emerging and Developing Economy Segment

Emerging Market and Developing EMDE Green Bonds Issued by Non

(EMDE) Green Bond Issuances by Sector financial corporates, 2021

Cumulative Emerging Market Green Bond Issuances From 2012-2021 ($mn)

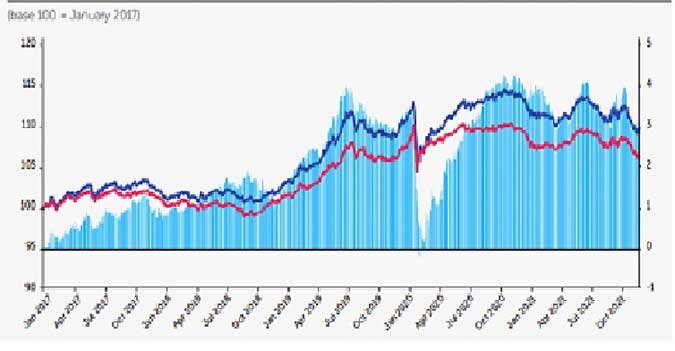

Total Return Performance of Global Green Bonds vs. Global Aggregates

Benefits of Issuing Green Bonds

- Benefits for issuers can include:

- Improve investor diversification

- Enhance issuer reputation

- Provide an additional source of sustainable financing

- Increase alignment regarding the durability of instruments and the project lifecycle

- Attract strong investor demand, which can lead to high oversubscription and pricing benefits

- Can facilitate the establishment of public private partnerships that might accelerate the pace of green investment and lead to the adoption of new technologies.

Benefits for investors can include:

- Comparable financial returns with the addition of environmental and/or social benefits

- Satisfy ESG requirements for sustainable investment mandates

- Contribute to national climate adaptation, food security, public health, energy supply, amongst others

- Enable direct investment in the ‘greening’ of brown sectors and social impact activities

- Increased transparency and accountability on the use and management of proceeds, becoming an additional risk management tool

- Green bonds can help mitigate climate change-related risks in the portfolio due to changing policies such as carbon taxation which could lead to stranded assets. Instead, a green bond invests in climate-friendly assets, such as green buildings, renewable energy, that over time bear a lower credit risk.

Potential for Introducing Green Financing Initiatives in Sri Lanka

Presently, more corporate bodies are interested in moving towards green projects/initiatives in order to ensure sustainable development in their businesses while ensuring the protection of the environment and wellbeing of the society. Green Bonds will broad base investment opportunities available for investors and provide an avenue for the companies who are interested in engaging in green projects. This would offer investment opportunities to groups (both local and foreign) who are interested in investing in green projects which would benefit the overall Capital Market.

In year 2022, the Central Bank of Sri Lanka (CBSL) launched a green taxonomy in partnership with the International Finance Corporation (IFC) that defines and categorizes economic activities that are environmentally sustainable, and would aide in providing a holistic strategy to integrate sustainability into the country’s financial system.

The Colombo Stock Exchange (CSE) is already registered under the Sustainable Stock Exchanges (SSE) initiative and is currently working on ESG related initiatives under the guidance of the Securities and Exchange Commission of Sri Lanka (SEC). The SSE initiative provides a peer to peer learning platform for exploring how exchanges in collaboration with investors, regulators, and companies can encourage sustainable investment and enhance corporate transparency, and performance on ESG.

Steps Taken by the SEC for Introducing Green Bonds and Facilitating Sustainable Finance Initiatives

The introduction of Green Bonds to the Sri Lankan Capital Market would enable listed entities to raise capital for Green projects adhering to international principles applicable. This would not only expand the supply side but also open up avenue for getting much needed foreign inflows to the country from foreign funds.

Moreover, in June 2022 to enhance the awareness building initiatives in relation to ESG, a MOU was signed between the SEC, CSE and the Chartered Financial Analysts (CFA) Society. The MOU broadly intended to establish a collaborative relationship to promote awareness of ESG among Sri Lankan investors to enhance investor protection, encourage capital market practitioners to introduce ESG into their investment research and valuation process to keep abreast with challenging global trends and ensure that the professional standards and integrity are maintained in the Sri Lankan capital market.

In August 2022, to promote ESG reporting by listed companies, the SEC, CSE and the Institute of Chartered Accountants of Sri Lanka (ICASL) entered in to a Memorandum of Understanding (MOU) which broadly covered areas on building awareness on integrated reporting, corporate governance, sustainability and any other related areas for the benefit of corporates and the users of financial statements/corporate reports.

In addition the SEC developed a policy and regulatory framework governing Green Bonds in consultation with Technical Experts from the Asian Development Bank (ADB) and the CSE and in April 2023, the SEC Commission approved rules for issuing Green Bonds.

Presently, the CSE under the guidance of the SEC is completing the groundwork for launching a green index. A green index would help investors assess and integrate sustainable financing considerations in their investment process and portfolio.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”