News

‘Flexible exchange rate’ negates vehicle import relaxation

ECONOMYNEXT –Sri Lanka cannot relax an import ban on vehicles, State Minister of Finance Ranjith Siyambalapitiya said, after the rupee fell steeply from around 191 to 220 level due to the operation of an inconsistent peg with one sided buying.

The flexible exchange rate, concocted by Western mercantilists and peddled to countries without a doctrinal foundation in sound money, which is neither a clean float nor hard peg, critics have said.Under IMF programs in particular, central banks which had busted up reserves by mis-targeting rates are encouraged to buy dollars (creating new money) but not to sell.

As a result, there is no mechanism to match timing differences between inflows and domestic credit, other than the net open position of banks.Third world monetarily unstable central banks also limit NOPs.In this instance the rupee was appreciating steeply in the days before, amid generally good monetary policy by the central bank in the past two months, which discourages plus positions.

If the central bank does not sell back some of the dollars it bought, liquidity is not tightened; there could be a short-term mismatch, or an exchange policy error. In May the central bank had bought 662.5 million US dollars.Under the flexible exchange rate, interventions are delayed, triggering a sudden shift from a peg to a floating regime until the market is in full panic mode with importers scrambling to cover, which is defined as ‘excessive volatility’.

There was a 70 to 80 million US dollar oil bill and the central bank had bought dollars, Siyambalapitiya said.As the rupee weakened other parties had also bought dollars, fearing a further weakening. This is normal, he claimed.

“If an allocation for oil for 70-80 million dollars created affected the value of the rupee in this manner, items like vehicles, which require more dollars, have to be considered very carefully,” Siyambalapitya said in the statement.

“Therefore, we cannot give permission to import cars now.”

The central bank eventually intervened in the market and several banks gave the dollars to the bank concerned to cover the import bill.Critics say the ad hoc flexible exchange rate, coupled with flexible inflation targeting is perhaps one of the deadliest monetary regimes ever devised.

Under the regime, interest rates are cut as soon as inflation comes down from the previous crises.Inflation nears zero about 12 to 18 months after rates are hiked to correct reserve losses, just as domestic credit starts to pick up.

Analysts have warned that an IMF, net international reserve target (requiring pegging and exchange policy) and a monetary policy consultation clause (which require floating and monetary policy only) are in fundamental conflict.

When rates are cut, and if they are enforced with overnight or term reverse repo injections, the currency slides again, and monetary policy errors are compensated with depreciation, resulting in public discontent, mass rejection of free markets, a failed reform agenda, and the ouster of (usually) reformist leaders.

While short term exchange policy errors can be corrected with interventions, monetary policy errors cannot be corrected by interventions which are sterilized with new money to maintain the fixed policy rate, analysts say.In the case of a country that restructured debt, the money and exchange policy conflicts may lead to a second default.

A ‘flexible exchange rate episode in March 2020 led to a loss of market access, earlier they have led to downgrades.In order to continue mis-targeting rates and avoid correcting them, economic bureaucrats persuade politicians to impose exchange and import controls, analysts say. The current Import and Export Control Law was brought in 1969 in the wake of two back to back IMF programs.

News

US sports envoys to Lanka to champion youth development

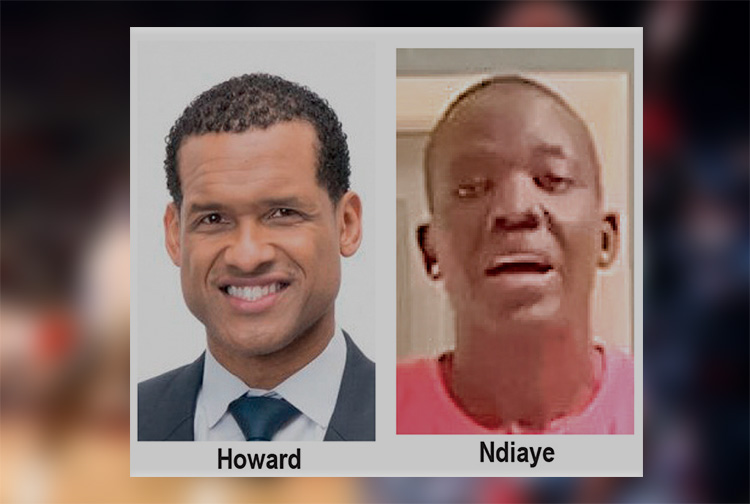

The U.S. Embassy in Colombo welcomed the U.S. Sports Envoys to Sri Lanka, former National Basketball Association (NBA) and Women’s National Basketball Association (WNBA) players Stephen Howard and Astou Ndiaye, from June 8 through 14.

The Public Diplomacy section of the U.S. Embassy said that it would launch a weeklong basketball program intended to harness the unifying power of sports, made possible through collaboration with Foundation of Goodness and IImpact Hoop Lab.

While in Sri Lanka, Howard and Ndiaye, both retired professional basketball players, will conduct a weeklong program, Hoops for Hope: Bridging Borders through Basketball. The Sports Envoys will lead basketball clinics and exhibition matches and engage in leadership sessions in Colombo and Southern Province for youth aged 14-18 from Northern, Uva, Eastern and Western Provinces, offering skills and leadership training both on and off the court. The U.S. Envoys will also share their expertise with the Sri Lanka Basketball Federation, national coaches, and players, furthering the development of basketball in the country. Beyond the clinics, they will collaborate with Sri Lankan schoolchildren to take part in a community service project in the Colombo area.

“We are so proud to welcome Stephen and Astou as our Sports Envoys to Sri Lanka, to build on the strong people-to-people connections between the United States and Sri Lanka,” said U.S. Ambassador Julie Chung. “The lessons that will be shared by our Sports Envoys – communication, teamwork, resilience, inclusion, and conflict resolution – are essential for leadership development, community building, equality, and peace. The U.S. Sports Envoy program is a testament to our belief that sports can be a powerful tool in promoting peace and unity.”

News

Rahuman questions sudden cancellation of leave of CEB employees

SJB Colombo District MP Mujibur Rahuman in parliament demanded to know from the government the reasons for CEB suspending the leave of all its employees until further notice from Thursday.

MP Rahuman said that the CEB has got an acting General Manager anew and the latter yesterday morning issued a circular suspending leave of all CEB employees with immediate effect until further notice.

“We demand that Minister Kanchana Wijesekera should explain this to the House. This circular was issued while this debate on the new Electricity Amendment Bill was pending. There are many who oppose this Bill. The Minister must tell parliament the reason for the urge to cancel the leave of CEB employees,” the MP said.However, Speaker Mahinda Yapa Abeywardena prevented Minister Wijesekera responding to the query and said that the matter raised by MP Rahuman was not relevant.

News

CIPM successfully concludes 8th Annual Symposium

The Chartered Institute of Personnel Management (CIPM) successfully concluded the 8th Annual CIPM Symposium, which took place on 31st May 2024. Themed “Nurturing the Human Element—Redefining HRM in a Rapidly Changing World,” the symposium underscored the pivotal role of human resource management (HRM) in today’s dynamic global landscape. Since its inception in 1959, CIPM has been dedicated to advancing the HR profession through education, professional development, and advocacy, solidifying its position as Sri Lanka’s leading professional body for HRM.

Ken Vijayakumar, the President of the CIPM, graced the occasion as the chief guest. The symposium commenced with the welcome address by the Chairperson, Prof. Arosha Adikaram, followed by the Web Launch of the Symposium Proceedings and Abstract Book by the CIPM President. The event featured distinguished addresses, including a speech by Chief Guest Ken Vijayakumar, President of CIPM, and an address by Guest of Honor Shakthi Ranatunga, Chief Operating Officer of MAS Holdings Pvt. Ltd., Sri Lanka.

The symposium also featured an inspiring keynote address by Prof. Mario Fernando, Professor of Management and Director of the Centre for Cross Cultural Management (CCCM) at the University of Wollongong, Australia.

Vote of Thanks of the inauguration session was delivered by Dr. Dillanjani Weeratunga, Symposium Co-chair.

The symposium served as a comprehensive platform for researchers to present their findings across a wide range of critical topics in HRM. These included Cultural Diversity and Inclusion, Talent Development and Retention, Ethical Leadership and Corporate Social Responsibility, Adapting to Technological Advancements, Mental Health and Well-being at Work, Global Workforce Challenges, Employee Empowerment, and Reskilling and Upskilling.

The plenary session was led by Prof. Wasantha Rajapakse. Certificates were awarded to the best paper presenters during the valedictory session, followed by a vote of thanks delivered by Kamani Perera, Manager of Research and Development.

The annual symposium of CIPM was a truly inclusive event, attracting a diverse audience that spanned undergraduates, graduates, working professionals, research scholars and lecturers. This widespread interest highlights the symposium’s significance in the field of HRM, offering a unique opportunity for everyone to network and learn from scholarly brains.The CIPM International Research Symposium was sponsored by Hambantota International Port, Sri Lanka Institute of Information Technology (SLIIT), E B Creasy & Co. PLC, and Print Xcel Company.