News

EPF asked to pay 30% tax unless it participates in domestic debt restructuring process

Banks, which pay taxes over 50%, least affected

By Sanath Nanayakkare

If the Employees’ Provident Fund (EPF) and other pension funds did not wish to participate in the proposed domestic debt restructuring process, there will be an application of higher annual income tax of 30%, Central Bank Governor Dr. Nandalal Weerasinghe said yesterday. The EPF is currently taxed at the rate of 14%.

Dr. Weerasinghe said so, addressing the media in Colombo.Finance Ministry Secretary Dr. R. Samaratunga, Treasury Secretary Mahinda Siriwardena were also present. Dr. Weerasinghe said, “Banking sector has already borne a significant burden of the fiscal adjustment and the economic crisis in several ways. The banking sector has been paying higher tax rates than other corporations.

The total tax burden on the banking sector, which is serving 57 million customer deposits, is more than 50%. Through high tax payment, the banking sector is helping the government’s fiscal consolidation efforts. Further, banks gave moratoriums and faced the brunt of non-performing loans during the Covid-19 pandemic. So, any disturbance to financial system stability could be costly. And disruptions to the banking system will adversely impact the effective transmission of monetary policy. So, the main effort is preserving the 57 million customer deposits in the banks and letting no room for a bank run.

“In contrast, superannuation funds are subject to a tax of 14%. It has been proposed for superannuation bonds to be exchanged for longer term maturity T-Bonds at a coupon rate of 12% until 2025m which will be 9% minimum beyond 2025. So, there is at least 9% return on EPF funds ensured on a long-term basis while there will be no reduction on the current balance of any individual’s EPF. In the event it has to be lowered below 9%, the Treasury has agreed to fill the balance.

“If superannuation funds don’t want to take part in this process, they will be liable to be taxed at 30% instead of the current 14%.”

The minimum participation requirement for EPF is set at 50% for outstanding bonds maturing in 2023 and 100% of bonds maturing between 2024 and 2032, according to CBSL.

Speaking further the CBSL Governor said:

“What we expect from this is to bring the government debt stock to a sustainable level within 10 years as per the agreement with the IMF. The number one benchmark in this context is reducing the public debt to GDP to 95 % from 128%. Secondly, the Gross Financing Needs (GFN) of the government needs to be reduced to below 13% of GDP from 34.6 % of GDP between now and 2032. Thirdly, Foreign Debt Servicing needs to be reduced to below 4.5 % of GDP from the current 9.4 % of GDP within the same period. If these targets are achieved, it should help close external financing gaps of USD 16.9 billion. For this, we need to restructure loans obtained from official bilateral creditors such as Japan and China.

Then there is the need for restructuring international sovereign bonds (ISBs) and negotiations are underway for these two elements. Our foreign exchange debt service target is set at 4.5% max. of GDP in 2027-2032. Thirdly, it is important to restructure domestic debt in some form and that is why we are presenting a plan to execute it. One available option in optimizing government debt is to increase taxes and improve the Primary Account Balance. These measures have already been taken. So, the remaining option is restructuring government debt stock through optimization of Treasury Bills and Treasury Bonds. At present Treasury Bill stock is worth LKR 4.1 trillion. 62.4 % of it is owned by the Central Bank of Sri Lanka (CBSL). CBSL has already agreed that its holdings of Treasury Bills would be converted to Treasury Bonds because this will help reduce gross financing needs of the government. And there are

Treasury Bonds worth of Rs. 8.7 trillion of which 20.5% is from superannuation funds including the Employee Provident fund (EPF); 36% from the banks and the balance from insurance funds and other private funds. So, we are looking at the best solution which can protect the banks, depositors and the EPF. That’s why CBSL has agreed to take part in these domestic debt optimization negotiations,” Dr. Weerasinghe said.

News

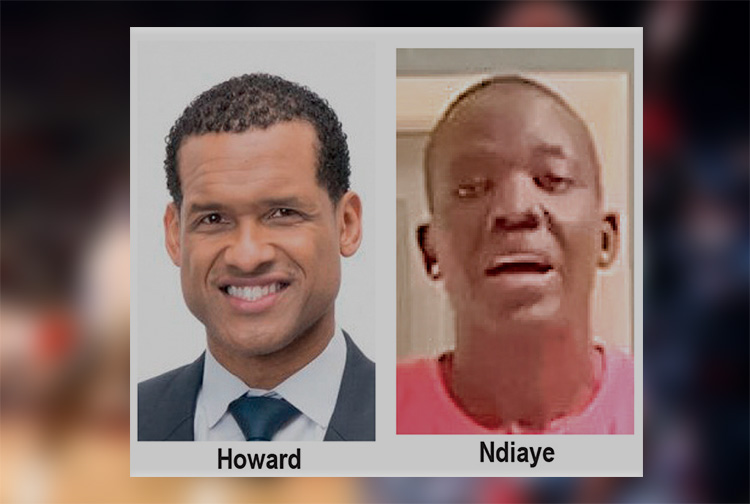

US sports envoys to Lanka to champion youth development

The U.S. Embassy in Colombo welcomed the U.S. Sports Envoys to Sri Lanka, former National Basketball Association (NBA) and Women’s National Basketball Association (WNBA) players Stephen Howard and Astou Ndiaye, from June 8 through 14.

The Public Diplomacy section of the U.S. Embassy said that it would launch a weeklong basketball program intended to harness the unifying power of sports, made possible through collaboration with Foundation of Goodness and IImpact Hoop Lab.

While in Sri Lanka, Howard and Ndiaye, both retired professional basketball players, will conduct a weeklong program, Hoops for Hope: Bridging Borders through Basketball. The Sports Envoys will lead basketball clinics and exhibition matches and engage in leadership sessions in Colombo and Southern Province for youth aged 14-18 from Northern, Uva, Eastern and Western Provinces, offering skills and leadership training both on and off the court. The U.S. Envoys will also share their expertise with the Sri Lanka Basketball Federation, national coaches, and players, furthering the development of basketball in the country. Beyond the clinics, they will collaborate with Sri Lankan schoolchildren to take part in a community service project in the Colombo area.

“We are so proud to welcome Stephen and Astou as our Sports Envoys to Sri Lanka, to build on the strong people-to-people connections between the United States and Sri Lanka,” said U.S. Ambassador Julie Chung. “The lessons that will be shared by our Sports Envoys – communication, teamwork, resilience, inclusion, and conflict resolution – are essential for leadership development, community building, equality, and peace. The U.S. Sports Envoy program is a testament to our belief that sports can be a powerful tool in promoting peace and unity.”

News

Rahuman questions sudden cancellation of leave of CEB employees

SJB Colombo District MP Mujibur Rahuman in parliament demanded to know from the government the reasons for CEB suspending the leave of all its employees until further notice from Thursday.

MP Rahuman said that the CEB has got an acting General Manager anew and the latter yesterday morning issued a circular suspending leave of all CEB employees with immediate effect until further notice.

“We demand that Minister Kanchana Wijesekera should explain this to the House. This circular was issued while this debate on the new Electricity Amendment Bill was pending. There are many who oppose this Bill. The Minister must tell parliament the reason for the urge to cancel the leave of CEB employees,” the MP said.However, Speaker Mahinda Yapa Abeywardena prevented Minister Wijesekera responding to the query and said that the matter raised by MP Rahuman was not relevant.

News

CIPM successfully concludes 8th Annual Symposium

The Chartered Institute of Personnel Management (CIPM) successfully concluded the 8th Annual CIPM Symposium, which took place on 31st May 2024. Themed “Nurturing the Human Element—Redefining HRM in a Rapidly Changing World,” the symposium underscored the pivotal role of human resource management (HRM) in today’s dynamic global landscape. Since its inception in 1959, CIPM has been dedicated to advancing the HR profession through education, professional development, and advocacy, solidifying its position as Sri Lanka’s leading professional body for HRM.

Ken Vijayakumar, the President of the CIPM, graced the occasion as the chief guest. The symposium commenced with the welcome address by the Chairperson, Prof. Arosha Adikaram, followed by the Web Launch of the Symposium Proceedings and Abstract Book by the CIPM President. The event featured distinguished addresses, including a speech by Chief Guest Ken Vijayakumar, President of CIPM, and an address by Guest of Honor Shakthi Ranatunga, Chief Operating Officer of MAS Holdings Pvt. Ltd., Sri Lanka.

The symposium also featured an inspiring keynote address by Prof. Mario Fernando, Professor of Management and Director of the Centre for Cross Cultural Management (CCCM) at the University of Wollongong, Australia.

Vote of Thanks of the inauguration session was delivered by Dr. Dillanjani Weeratunga, Symposium Co-chair.

The symposium served as a comprehensive platform for researchers to present their findings across a wide range of critical topics in HRM. These included Cultural Diversity and Inclusion, Talent Development and Retention, Ethical Leadership and Corporate Social Responsibility, Adapting to Technological Advancements, Mental Health and Well-being at Work, Global Workforce Challenges, Employee Empowerment, and Reskilling and Upskilling.

The plenary session was led by Prof. Wasantha Rajapakse. Certificates were awarded to the best paper presenters during the valedictory session, followed by a vote of thanks delivered by Kamani Perera, Manager of Research and Development.

The annual symposium of CIPM was a truly inclusive event, attracting a diverse audience that spanned undergraduates, graduates, working professionals, research scholars and lecturers. This widespread interest highlights the symposium’s significance in the field of HRM, offering a unique opportunity for everyone to network and learn from scholarly brains.The CIPM International Research Symposium was sponsored by Hambantota International Port, Sri Lanka Institute of Information Technology (SLIIT), E B Creasy & Co. PLC, and Print Xcel Company.