Features

Diversifying in new directions – hospitality plantations, broking and health care

(Excerpted from the Merrill J Fernando autobiography)

Sometime in 2003, together with Dilhan and his family, I holidayed in Bali. Indonesia, at Bali Villas, an exclusive hospitality complex. We rented two units which came with a highly-personalized service, including maids and a chef for each villa. We also had our own swimming pools and a common spa facility. Outside the complex there were cafes, restaurants, and little eating houses, offering dazzling arrays of food, which made eating out a daily adventure.

On the morning of the second day, a very tall gentleman walked in to my villa and introduced himself: “Good morning, Mr. Dilmah, I am an Aussie and the owner of this hotel.” Over a cup of tea, he told me his story. He had first visited Sri Lanka looking for both a location and a partner to launch this special hospitality concept he had in mind. Whilst he had been happy with the opportunities, he had not been able to find a suitable partner, nor had he been very comfortable with the political climate. Abandoning Sri Lanka for those reasons, eventually be had located this special project in Bali.

After an interesting conversation with me, he called his CEO, Chris Green, an Englishman, and told him to give us anything we wanted and Chris offered us a 60% discount on all the spa treatments. In the course of our friendly discussion with Chris which followed, I told him that I was interested in setting up a similar project in Sri Lanka and asked for his advice.

One week later Chris was in Sri Lanka and Malik was taking him around, visiting potential locations in the plantation regions. The tourist industry has always attracted me, in view of the tremendous potential that Sri Lanka possesses and the fact that it is an industry that Sri Lanka can own totally. The raw material is the composites of our unparalleled natural beauty, the easily accessible game parks, the cultural and historical heritage seen in our many ancient cities like Polonnaruwa, Anuradhapura, and Sigiriya, and the natural friendliness and spontaneous, welcoming hospitality of our people. These charming inborn attributes cannot be supplanted by imports!

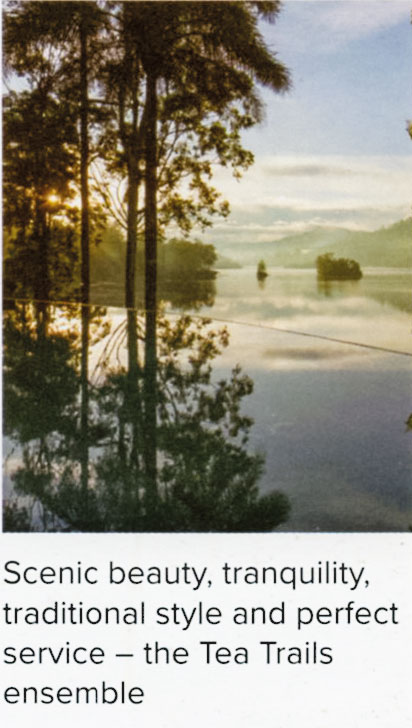

Ceylon Tea Trails

Our upcountry plantation areas are amongst the most scenic in the country, with the emerald green cover of tea carpeting an undulating landscape, broken up by spectacular rock escarpments and mountains blanketed by montane forest, heavily-wooded ravines in the valleys, and the whole crisscrossed by tumbling streams and cascading waterfalls.

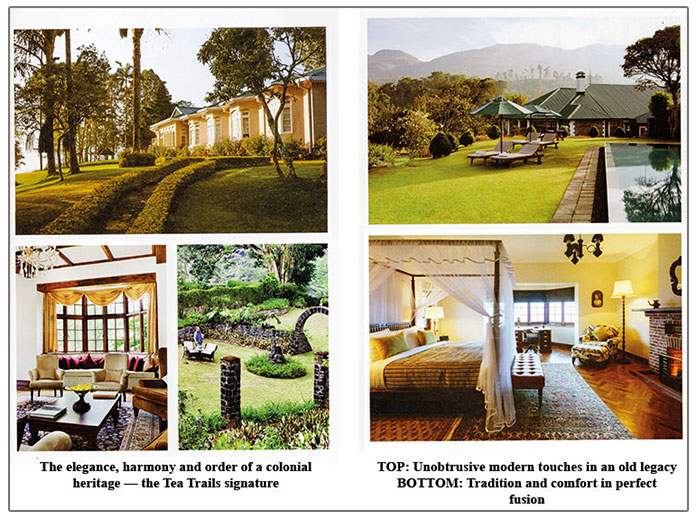

There are also the historic plantation bungalows, rambling and comfortable, often somewhat neglected but set in large gardens and, invariably, panoramically sited. The British who first built them had, collectively, an unerring instinct for commanding locations, obviously conditioned by the ‘monarch of all I survey’ worldview of the Western coloniser.

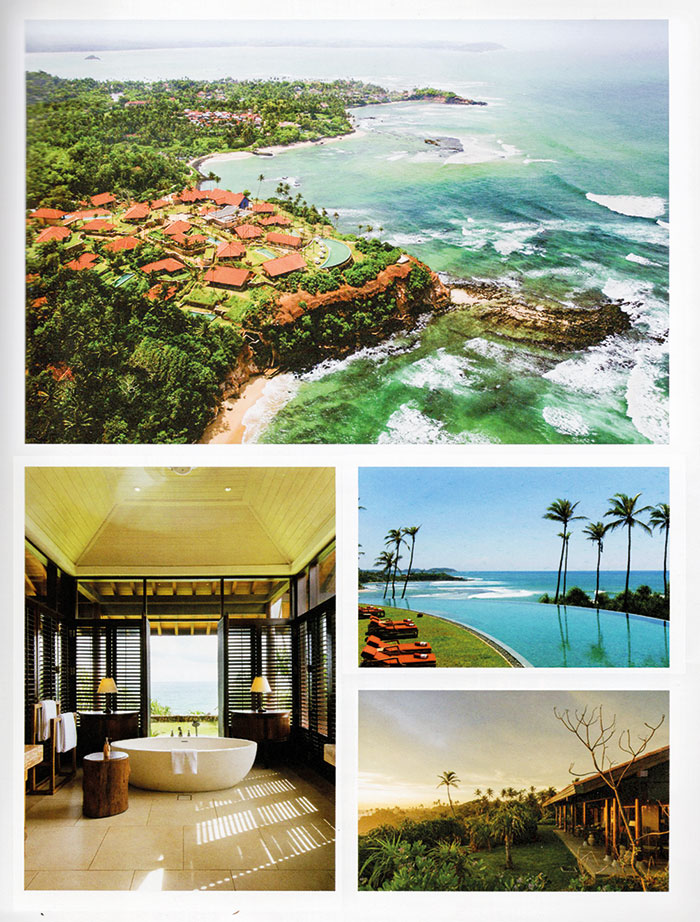

The Cape — A peerless location View from the pool — all the way to the South Pole Tranquility at dusk Old fashioned comfort in a modern setting

Following the preliminary tour with Chris, Malik engaged Miguel, a young Spaniard, who toured the plantation regions on a motorcycle and identified four bungalows with the best combination of scenery, attractive bungalow configuration, and accessibility: the Tientsin, Norwood, Summerville, and Castlereagh bungalows, all located in close proximity to each other in the Bogawanthalawa-Norwood area, were finally selected for the project.

The proximity of the picturesque Castlereagh Reservoir, nestled in the basin created by the surrounding tea-covered hills, was one of the key selling points. Later, Dunkeld bungalow, sited on the Western banks of the reservoir and located on our own estate, was restored and added to the list, when the demand for accommodation rapidly overtook capacity.

A South African interior designer was selected to reconfigure and refurbish all the bungalows. This was a delicately-managed operation, as the prime consideration was to maintain the original, old world charm of the bungalows, whilst unobtrusively introducing all the modern amenities and conveniences expected by a discerning clientele, accustomed to and prepared to pay for luxurious but unique hostelry in exclusive locations. The new had to merge seamlessly with the old, as if the offering in its entirety had been there always, handed down intact across generations by the original British owners.

The features of comfort and attraction needed to be tangible, quantifiable, and visible, while the designer’s hand remained invisible. There were no invoices submitted to the guest on departure. The customer was made to feel that he/she was holidaying in the home of a wealthy, generous, and caring friend. It was a personalized service where guests discussed dining choices for each meal with an own chef, whilst the in-house butlers’ service was at hand, at any time of the day or night, to attend to every guest need or fancy. What was on offer was a fully-inclusive concept, which anticipated and provided everything that the guest needed and desired.

Thus, with the opening of the first bungalow, Castlereagh, in June 2005, ‘Ceylon Tea Trails’ was born and, simultaneously, Malik came in to his own as an entrepreneur. Tea Trails projected the now somewhat-hackneyed boutique hotel concept into a new dimension, previously unknown to Sri Lanka. The bungalows were between two to 15 kilometres apart and guests could walk or cycle between them, and be served meals in any one of them, as if they had visited the house of a close friend. Each bungalow had four to five bedrooms and suites and a total of 27 rooms, in locations in the tea-covered hills encircling the Castlereagh Reservoir.

Many of the vegetables, herbs, and spices featured in the wide-ranging and exquisite cuisine on offer at the bungalows are grown organically in the bungalow gardens themselves. The preparation is personally handled by experienced chefs with international training.

Tea Trails soon became a high-demand holiday destination, fully booked most of the time and I frequently had great difficulty in securing a room when I wanted one. Most bookings were repeats and made a year ahead! Finally, Malik developed a nice little cottage on Dunkeld, designated as the ‘Owner’s Cottage,’ for my personal use, supposedly at my will and pleasure.

Once it was done I asked him to hand the keys over to me, but I was not very surprised when Malik apologetically responded that I would have to be little patient as it had been booked till the end of August that year! Though it has been over two years since it was completed, I have been able to occupy it with friends only once.

On account of its exclusivity, exceptional quality of service and cuisine, and guests’ recommendations, Tea Trails was invited to join the prestigious Paris-based Relais & Chateaux Association, known for its uncompromisingly rigid admission standards. Since the 65 years of its founding in France, it has permitted only 580 landmark hotels and restaurants worldwide to enter its elite membership.

Since then the two other resorts in our group which followed, Tea Trails, Cape Weligama in Weligama and Wild Coast Tented Lodge, deeper south in Yala, have been admitted to Relais & Chateaux to date the only three members in Sri Lanka.

Cape Weligama

A few years ago, Malik persuaded me to buy a beautiful hilltop property near the beach in Weligama, overlooking the Indian Ocean east of Galle. My original intention was to resell it to a hotel developer, but Malik had other ideas and convinced me that the location was ideal for an exclusive, boutique-type hotel. He hired a well-known architect, Lek Bunnag from Thailand, who produced an exceptional design.

Along with Malik I visited Bangkok to review the plans and was very impressed by them. The construction then commenced and on completion, much to my serious displeasure, the final cost had far exceeded the initial budget.

Malik’s explanation was that this was the first hotel we built from ground-up and that it was also a learning experience for us! Further, in the process of construction, many new features had to be introduced to complement the degree of exclusivity and uniqueness that we were striving for. It opened in 2014 with 39 suites and villas, the latter starting at around 130 square metres in extent.

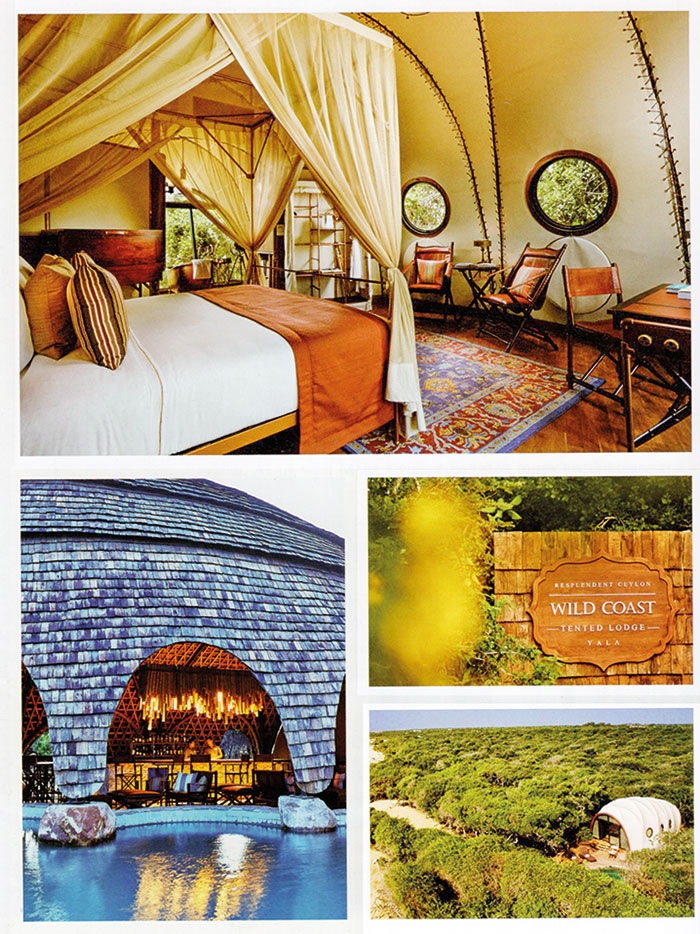

Wild Coast Lodge

With two exclusive and successful tourist destinations in our portfolio, and a little more experience in the hospitality trade under our belts, we decided to expand further in that direction and commenced work on a seven-acre, heavily-wooded site, near the Yala National Park. The land, between the beach and the jungle and comprising a contiguous segment of the real jungle, lent itself ideally to the concept we had in mind for a tented, but luxurious resort.

It is an arresting fusion of two extremes, the wildness and the potential danger of the proximal animal inhabited scrub forest, as a counterpoint to the understated indulgence of every modern comfort and convenience within. The bamboo and tented resort blended seamlessly with the surrounding forest and opened for business in 2017. It has since has won several global awards, including a UNESCO award for uniqueness of design.

Resplendent Ceylon

With these three destinations, Malik has very successfully captured the contrasting aspects of the beauty of different parts of our country, and the scenic diversity it has to offer the traveler. “Resplendent Ceylon,” as he calls this varied collection the gentle, quaint charm of our verdant plantation country, with its cool climate and orderly tea cultivation, the warm, balmy beach land of the south, and the harsh, arid beauty of the south east epitomizes the multi-faceted, natural splendour of our country. The only commonality between these destinations, with such contrasting features of attractiveness, is the matchless service they offer. Given these attributes, it is fair to say that Resplendent Ceylon is the pioneering small luxury hotel brand in Sri Lanka.

Acquisition of Forbes and Walker and Kahawatte Plantations

Elsewhere in this writing I have several times referred to my resolve to eventually become independent of external assistance for critical aspects of my business operation. In this age of enterprise complexity, admittedly, it is difficult for any operation, however efficient it may be, to be totally self-sufficient. Independent providers of ancillary services and products do play an important part in any large business operation. Generally, obtaining the services of independent contractors to complement the less-crucial aspects of your operation makes sound commercial sense.

However, in regard to my tea export business, the mainstay of my group enterprise, I was determined that I would become totally self-reliant, with direct ownership and control of the value chain, ‘from-bush-to-cup’ as it were. It was that intent which earlier led to my investing in Printcare. I did not put a label on my purpose, but business management experts identify it as the principle of ‘vertical integration’.

I decided that the first step in the above direction would be to acquire control of a tea broking company. Broking has been an important corollary activity of the plantation industry, growing from a purely marketing service in its infancy in the last quarter of the 19th century, to its present multi-faceted role as provider of warehousing, finance, technical advisory, and other related services.

Sometime in early 2000 I became aware that the owners of Forbes Ceylon Limited (FCL), VANIK Incorporated a now largely-inactive private investment bank were seriously considering the sale of Forbes & Walker (F&W), including its produce broking arm, Forbes Tea Brokers, a very reliable and well-established broking firm with a long history. As a tea buyer and exporter for over five decades up to that time, I was very familiar with the company and, over the years, had got to know all its key personnel from the early 1950s onwards.

However, one condition attached by VANIK to the sale of Forbes was that Forbes Plantations, through which it owned Kahawatte Plantations Plc, a Regional Plantation Company, should also be disposed of at the same time. The intention of VANIK was to exit from the tea industry altogether. The purchase of Kahawatte Plantations, then owned by FCL, had to be part of the transaction. One could not happen without the other.

Whilst I was discussing the possible sale of Forbes Brokers with VANIK, the latter were in negotiation with another party, Central Highfields Ceylon (Pvt) Ltd. (CHFC) incorporated in the UK, with its Sri Lankan interests represented by Nimal Silva, a former planter, for the sale of Kahawatte Plantations. An agreement had been signed between VANIK, CHFC, and FCL, with CHFC paying an advance of Rs. 100 million against an agreed price of Rs. 200 million, for the purchase of a majority shareholding of Kahawatte, through Forbes Plantations.

Since CHFC was unable to deliver the balance Rs. 100 million on the due date, it agreed to VANIK borrowing the sum from my company. I agreed to the proposal, because I wanted to assist CHFC in its purchase of Kahawatte, thus ensuring that I would be able to purchase Forbes Brokers, thereby meeting VANIK’s condition of an exit from the tea industry altogether. As security against the loan, VANIK furnished my company with a primary mortgage over the Kahawatte shares held by Forbes Plantations.

Luxury inside a tent The forest outside and the indulgence within — a matchless union. Unique design

It had not been my original intention to buy the plantation company as, at that time, my company already had sizeable holdings in both Elpitiya and Talawakelle Plantations. Therefore, a produce broking company was the only missing link in the vertical integration value chain.

I gave CHFC more than one extension on the deadline for the settlement of the advance. In fact, even after I had served VANIK with notice to transfer the Kahawatte shareholding in lieu of settlement of the loan. I gave additional time to CHFC to settle the issue. However, it was unable to secure funding and by end of 2000, both Forbes & Walker and Kahawatte Plantations had become part of the MJF Group of Companies.

The main reason for my decision to exercise my right to the Kahawatte shareholding, was that the uncertainty surrounding the ownership transfer was soon reflected in management inadequacies,which were visibly affecting the company’s performance. Further delays in the finalization of the transaction would only have accelerated its decline.

When I acquired Kahawatte, it was in dire financial straits, with large accumulated losses and substantial liabilities, a significant proportion of the latter represented by unpaid statutory dues. Those

were settled soon after the acquisition. Subsequently, a comprehensive factory rehabilitation, in parallel with a product quality policy drive, resulted in the company achieving the highest annual net sale average for in the Regional Plantation Company sector.

It has maintained this position for several years. Apart from the capital intensive consolidation of core crops, involving extensive replanting of both tea and rubber, we also launched a major crop diversification initiative, cultivating Ceylon Cinnamon in the low-country sector. Presently, Kahawatte has over 200 Ha in mature cinnamon, making it the largest single owner of cinnamon in the country.

Since its acquisition, the investment in shares and the value of corporate guarantees extended to Kahawatte by MJF Holdings and its subsidiaries together exceed Rs. 3 billion. As for Forbes & Walker, it was my firm belief that as a broker, F&W should remain independent, despite being part of the main group. That could be achieved only if the management also had a stake in the company, with the company itself being operated as a Joint Venture. Consequently, I caused a management trust to be created, which held 30% of the F&W shareholding on behalf of the management of the broking company. It proved to be a sound principle and has continued to operate efficiently to the present day.

The health sector

My friend, the late Lawrence Tudawe, who built my Maligawatte office and packing complex, had, at some point in time, purchased Durdans Hospital. It had been founded in 1939 and in the colonial period, was the primary military hospital in then Ceylon, mostly serving the British Armed Forces then stationed in the country. In 1945 it was acquired by a group of doctors and managed as Ceylon Hospitals Limited, before being bought by the Tudawe family.

The younger Tudawes , Ajit, Rohan, and Upul have since developed it to its present position as one of the finest private healthcare centres in the country. A few years ago, I was persuaded by the Tudawe family to invest in the company and I acquired a reasonable shareholding in Ceylon Hospitals, which owns and operates Durdans Hospital. Subsequently I made a further investment in the more modern entity, Durdans Medical and Surgical Hospitals (Pvt) Ltd. I consider it a very useful investment, not only on account of the financial returns but also because of the excellent healthcare service it provides the public, which also includes the employees of my group of companies.

Features

The heart-friendly health minister

by Dr Gotabhya Ranasinghe

Senior Consultant Cardiologist

National Hospital Sri Lanka

When we sought a meeting with Hon Dr. Ramesh Pathirana, Minister of Health, he graciously cleared his busy schedule to accommodate us. Renowned for his attentive listening and deep understanding, Minister Pathirana is dedicated to advancing the health sector. His openness and transparency exemplify the qualities of an exemplary politician and minister.

Dr. Palitha Mahipala, the current Health Secretary, demonstrates both commendable enthusiasm and unwavering support. This combination of attributes makes him a highly compatible colleague for the esteemed Minister of Health.

Our discussion centered on a project that has been in the works for the past 30 years, one that no other minister had managed to advance.

Minister Pathirana, however, recognized the project’s significance and its potential to revolutionize care for heart patients.

The project involves the construction of a state-of-the-art facility at the premises of the National Hospital Colombo. The project’s location within the premises of the National Hospital underscores its importance and relevance to the healthcare infrastructure of the nation.

This facility will include a cardiology building and a tertiary care center, equipped with the latest technology to handle and treat all types of heart-related conditions and surgeries.

Securing funding was a major milestone for this initiative. Minister Pathirana successfully obtained approval for a $40 billion loan from the Asian Development Bank. With the funding in place, the foundation stone is scheduled to be laid in September this year, and construction will begin in January 2025.

This project guarantees a consistent and uninterrupted supply of stents and related medications for heart patients. As a result, patients will have timely access to essential medical supplies during their treatment and recovery. By securing these critical resources, the project aims to enhance patient outcomes, minimize treatment delays, and maintain the highest standards of cardiac care.

Upon its fruition, this monumental building will serve as a beacon of hope and healing, symbolizing the unwavering dedication to improving patient outcomes and fostering a healthier society.We anticipate a future marked by significant progress and positive outcomes in Sri Lanka’s cardiovascular treatment landscape within the foreseeable timeframe.

Features

A LOVING TRIBUTE TO JESUIT FR. ALOYSIUS PIERIS ON HIS 90th BIRTHDAY

by Fr. Emmanuel Fernando, OMI

Jesuit Fr. Aloysius Pieris (affectionately called Fr. Aloy) celebrated his 90th birthday on April 9, 2024 and I, as the editor of our Oblate Journal, THE MISSIONARY OBLATE had gone to press by that time. Immediately I decided to publish an article, appreciating the untiring selfless services he continues to offer for inter-Faith dialogue, the renewal of the Catholic Church, his concern for the poor and the suffering Sri Lankan masses and to me, the present writer.

It was in 1988, when I was appointed Director of the Oblate Scholastics at Ampitiya by the then Oblate Provincial Fr. Anselm Silva, that I came to know Fr. Aloy more closely. Knowing well his expertise in matters spiritual, theological, Indological and pastoral, and with the collaborative spirit of my companion-formators, our Oblate Scholastics were sent to Tulana, the Research and Encounter Centre, Kelaniya, of which he is the Founder-Director, for ‘exposure-programmes’ on matters spiritual, biblical, theological and pastoral. Some of these dimensions according to my view and that of my companion-formators, were not available at the National Seminary, Ampitiya.

Ever since that time, our Oblate formators/ accompaniers at the Oblate Scholasticate, Ampitiya , have continued to send our Oblate Scholastics to Tulana Centre for deepening their insights and convictions regarding matters needed to serve the people in today’s context. Fr. Aloy also had tried very enthusiastically with the Oblate team headed by Frs. Oswald Firth and Clement Waidyasekara to begin a Theologate, directed by the Religious Congregations in Sri Lanka, for the contextual formation/ accompaniment of their members. It should very well be a desired goal of the Leaders / Provincials of the Religious Congregations.

Besides being a formator/accompanier at the Oblate Scholasticate, I was entrusted also with the task of editing and publishing our Oblate journal, ‘The Missionary Oblate’. To maintain the quality of the journal I continue to depend on Fr. Aloy for his thought-provoking and stimulating articles on Biblical Spirituality, Biblical Theology and Ecclesiology. I am very grateful to him for his generous assistance. Of late, his writings on renewal of the Church, initiated by Pope St. John XX111 and continued by Pope Francis through the Synodal path, published in our Oblate journal, enable our readers to focus their attention also on the needed renewal in the Catholic Church in Sri Lanka. Fr. Aloy appreciated very much the Synodal path adopted by the Jesuit Pope Francis for the renewal of the Church, rooted very much on prayerful discernment. In my Religious and presbyteral life, Fr.Aloy continues to be my spiritual animator / guide and ongoing formator / acccompanier.

Fr. Aloysius Pieris, BA Hons (Lond), LPh (SHC, India), STL (PFT, Naples), PhD (SLU/VC), ThD (Tilburg), D.Ltt (KU), has been one of the eminent Asian theologians well recognized internationally and one who has lectured and held visiting chairs in many universities both in the West and in the East. Many members of Religious Congregations from Asian countries have benefited from his lectures and guidance in the East Asian Pastoral Institute (EAPI) in Manila, Philippines. He had been a Theologian consulted by the Federation of Asian Bishops’ Conferences for many years. During his professorship at the Gregorian University in Rome, he was called to be a member of a special group of advisers on other religions consulted by Pope Paul VI.

Fr. Aloy is the author of more than 30 books and well over 500 Research Papers. Some of his books and articles have been translated and published in several countries. Among those books, one can find the following: 1) The Genesis of an Asian Theology of Liberation (An Autobiographical Excursus on the Art of Theologising in Asia, 2) An Asian Theology of Liberation, 3) Providential Timeliness of Vatican 11 (a long-overdue halt to a scandalous millennium, 4) Give Vatican 11 a chance, 5) Leadership in the Church, 6) Relishing our faith in working for justice (Themes for study and discussion), 7) A Message meant mainly, not exclusively for Jesuits (Background information necessary for helping Francis renew the Church), 8) Lent in Lanka (Reflections and Resolutions, 9) Love meets wisdom (A Christian Experience of Buddhism, 10) Fire and Water 11) God’s Reign for God’s poor, 12) Our Unhiddden Agenda (How we Jesuits work, pray and form our men). He is also the Editor of two journals, Vagdevi, Journal of Religious Reflection and Dialogue, New Series.

Fr. Aloy has a BA in Pali and Sanskrit from the University of London and a Ph.D in Buddhist Philosophy from the University of Sri Lankan, Vidyodaya Campus. On Nov. 23, 2019, he was awarded the prestigious honorary Doctorate of Literature (D.Litt) by the Chancellor of the University of Kelaniya, the Most Venerable Welamitiyawe Dharmakirthi Sri Kusala Dhamma Thera.

Fr. Aloy continues to be a promoter of Gospel values and virtues. Justice as a constitutive dimension of love and social concern for the downtrodden masses are very much noted in his life and work. He had very much appreciated the commitment of the late Fr. Joseph (Joe) Fernando, the National Director of the Social and Economic Centre (SEDEC) for the poor.

In Sri Lanka, a few religious Congregations – the Good Shepherd Sisters, the Christian Brothers, the Marist Brothers and the Oblates – have invited him to animate their members especially during their Provincial Congresses, Chapters and International Conferences. The mainline Christian Churches also have sought his advice and followed his seminars. I, for one, regret very much, that the Sri Lankan authorities of the Catholic Church –today’s Hierarchy—- have not sought Fr.

Aloy’s expertise for the renewal of the Catholic Church in Sri Lanka and thus have not benefited from the immense store of wisdom and insight that he can offer to our local Church while the Sri Lankan bishops who governed the Catholic church in the immediate aftermath of the Second Vatican Council (Edmund Fernando OMI, Anthony de Saram, Leo Nanayakkara OSB, Frank Marcus Fernando, Paul Perera,) visited him and consulted him on many matters. Among the Tamil Bishops, Bishop Rayappu Joseph was keeping close contact with him and Bishop J. Deogupillai hosted him and his team visiting him after the horrible Black July massacre of Tamils.

Features

A fairy tale, success or debacle

Sri Lanka-Singapore Free Trade Agreement

By Gomi Senadhira

senadhiragomi@gmail.com

“You might tell fairy tales, but the progress of a country cannot be achieved through such narratives. A country cannot be developed by making false promises. The country moved backward because of the electoral promises made by political parties throughout time. We have witnessed that the ultimate result of this is the country becoming bankrupt. Unfortunately, many segments of the population have not come to realize this yet.” – President Ranil Wickremesinghe, 2024 Budget speech

Any Sri Lankan would agree with the above words of President Wickremesinghe on the false promises our politicians and officials make and the fairy tales they narrate which bankrupted this country. So, to understand this, let’s look at one such fairy tale with lots of false promises; Ranil Wickremesinghe’s greatest achievement in the area of international trade and investment promotion during the Yahapalana period, Sri Lanka-Singapore Free Trade Agreement (SLSFTA).

It is appropriate and timely to do it now as Finance Minister Wickremesinghe has just presented to parliament a bill on the National Policy on Economic Transformation which includes the establishment of an Office for International Trade and the Sri Lanka Institute of Economics and International Trade.

Was SLSFTA a “Cleverly negotiated Free Trade Agreement” as stated by the (former) Minister of Development Strategies and International Trade Malik Samarawickrama during the Parliamentary Debate on the SLSFTA in July 2018, or a colossal blunder covered up with lies, false promises, and fairy tales? After SLSFTA was signed there were a number of fairy tales published on this agreement by the Ministry of Development Strategies and International, Institute of Policy Studies, and others.

However, for this article, I would like to limit my comments to the speech by Minister Samarawickrama during the Parliamentary Debate, and the two most important areas in the agreement which were covered up with lies, fairy tales, and false promises, namely: revenue loss for Sri Lanka and Investment from Singapore. On the other important area, “Waste products dumping” I do not want to comment here as I have written extensively on the issue.

1. The revenue loss

During the Parliamentary Debate in July 2018, Minister Samarawickrama stated “…. let me reiterate that this FTA with Singapore has been very cleverly negotiated by us…. The liberalisation programme under this FTA has been carefully designed to have the least impact on domestic industry and revenue collection. We have included all revenue sensitive items in the negative list of items which will not be subject to removal of tariff. Therefore, 97.8% revenue from Customs duty is protected. Our tariff liberalisation will take place over a period of 12-15 years! In fact, the revenue earned through tariffs on goods imported from Singapore last year was Rs. 35 billion.

The revenue loss for over the next 15 years due to the FTA is only Rs. 733 million– which when annualised, on average, is just Rs. 51 million. That is just 0.14% per year! So anyone who claims the Singapore FTA causes revenue loss to the Government cannot do basic arithmetic! Mr. Speaker, in conclusion, I call on my fellow members of this House – don’t mislead the public with baseless criticism that is not grounded in facts. Don’t look at petty politics and use these issues for your own political survival.”

I was surprised to read the minister’s speech because an article published in January 2018 in “The Straits Times“, based on information released by the Singaporean Negotiators stated, “…. With the FTA, tariff savings for Singapore exports are estimated to hit $10 million annually“.

As the annual tariff savings (that is the revenue loss for Sri Lanka) calculated by the Singaporean Negotiators, Singaporean $ 10 million (Sri Lankan rupees 1,200 million in 2018) was way above the rupees’ 733 million revenue loss for 15 years estimated by the Sri Lankan negotiators, it was clear to any observer that one of the parties to the agreement had not done the basic arithmetic!

Six years later, according to a report published by “The Morning” newspaper, speaking at the Committee on Public Finance (COPF) on 7th May 2024, Mr Samarawickrama’s chief trade negotiator K.J. Weerasinghehad had admitted “…. that forecasted revenue loss for the Government of Sri Lanka through the Singapore FTA is Rs. 450 million in 2023 and Rs. 1.3 billion in 2024.”

If these numbers are correct, as tariff liberalisation under the SLSFTA has just started, we will pass Rs 2 billion very soon. Then, the question is how Sri Lanka’s trade negotiators made such a colossal blunder. Didn’t they do their basic arithmetic? If they didn’t know how to do basic arithmetic they should have at least done their basic readings. For example, the headline of the article published in The Straits Times in January 2018 was “Singapore, Sri Lanka sign FTA, annual savings of $10m expected”.

Anyway, as Sri Lanka’s chief negotiator reiterated at the COPF meeting that “…. since 99% of the tariffs in Singapore have zero rates of duty, Sri Lanka has agreed on 80% tariff liberalisation over a period of 15 years while expecting Singapore investments to address the imbalance in trade,” let’s turn towards investment.

Investment from Singapore

In July 2018, speaking during the Parliamentary Debate on the FTA this is what Minister Malik Samarawickrama stated on investment from Singapore, “Already, thanks to this FTA, in just the past two-and-a-half months since the agreement came into effect we have received a proposal from Singapore for investment amounting to $ 14.8 billion in an oil refinery for export of petroleum products. In addition, we have proposals for a steel manufacturing plant for exports ($ 1 billion investment), flour milling plant ($ 50 million), sugar refinery ($ 200 million). This adds up to more than $ 16.05 billion in the pipeline on these projects alone.

And all of these projects will create thousands of more jobs for our people. In principle approval has already been granted by the BOI and the investors are awaiting the release of land the environmental approvals to commence the project.

I request the Opposition and those with vested interests to change their narrow-minded thinking and join us to develop our country. We must always look at what is best for the whole community, not just the few who may oppose. We owe it to our people to courageously take decisions that will change their lives for the better.”

According to the media report I quoted earlier, speaking at the Committee on Public Finance (COPF) Chief Negotiator Weerasinghe has admitted that Sri Lanka was not happy with overall Singapore investments that have come in the past few years in return for the trade liberalisation under the Singapore-Sri Lanka Free Trade Agreement. He has added that between 2021 and 2023 the total investment from Singapore had been around $162 million!

What happened to those projects worth $16 billion negotiated, thanks to the SLSFTA, in just the two-and-a-half months after the agreement came into effect and approved by the BOI? I do not know about the steel manufacturing plant for exports ($ 1 billion investment), flour milling plant ($ 50 million) and sugar refinery ($ 200 million).

However, story of the multibillion-dollar investment in the Petroleum Refinery unfolded in a manner that would qualify it as the best fairy tale with false promises presented by our politicians and the officials, prior to 2019 elections.

Though many Sri Lankans got to know, through the media which repeatedly highlighted a plethora of issues surrounding the project and the questionable credentials of the Singaporean investor, the construction work on the Mirrijiwela Oil Refinery along with the cement factory began on the24th of March 2019 with a bang and Minister Ranil Wickremesinghe and his ministers along with the foreign and local dignitaries laid the foundation stones.

That was few months before the 2019 Presidential elections. Inaugurating the construction work Prime Minister Ranil Wickremesinghe said the projects will create thousands of job opportunities in the area and surrounding districts.

The oil refinery, which was to be built over 200 acres of land, with the capacity to refine 200,000 barrels of crude oil per day, was to generate US$7 billion of exports and create 1,500 direct and 3,000 indirect jobs. The construction of the refinery was to be completed in 44 months. Four years later, in August 2023 the Cabinet of Ministers approved the proposal presented by President Ranil Wickremesinghe to cancel the agreement with the investors of the refinery as the project has not been implemented! Can they explain to the country how much money was wasted to produce that fairy tale?

It is obvious that the President, ministers, and officials had made huge blunders and had deliberately misled the public and the parliament on the revenue loss and potential investment from SLSFTA with fairy tales and false promises.

As the president himself said, a country cannot be developed by making false promises or with fairy tales and these false promises and fairy tales had bankrupted the country. “Unfortunately, many segments of the population have not come to realize this yet”.

(The writer, a specialist and an activist on trade and development issues . )