Business

COVID-19 and the Sri Lankan economy: Policy choices and trade-offs

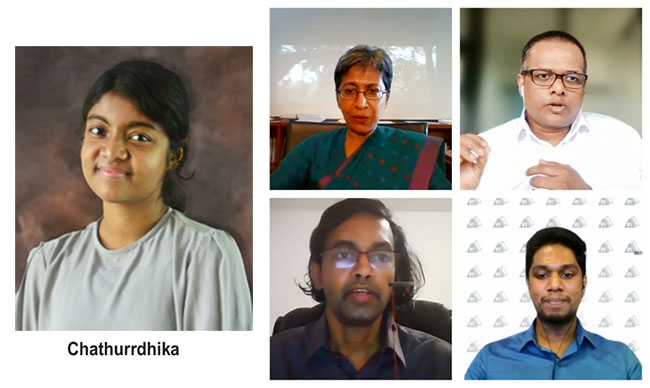

By Chathurrdhika Yogarajah

Sri Lanka’s macro-economic outlook amidst the COVID-19 pandemic came under the spotlight at a webinar panel discussion held on October 11, to mark the release of IPS’ flagship report, ‘Sri Lanka: State of the Economy 2021’. The event featured presentations by Dr Dushni Weerakoon and Dr Asanka Wijesinghe from IPS with expert insights from Dr Missaka Warusawitharana, Financial Economist, Johns Hopkins University, USA. Tharindu Udayanga from IPS moderated the discussion.

Prospects and Possibilities Dr Dushni Weerakoon, Executive Director, IPS

A V-shaped recovery is likely to take shape, but Sri Lanka faces a relatively weak output growth. A critical challenge is to lift the growth rate to, at least, 5-6% and maintain that momentum in the medium term. How investments perform will be a crucial determinant, as the dip in investment was a major driver of output contraction in 2020. With little fiscal space, Sri Lanka relied mostly on monetary policy. There was a surge in direct financing of fiscal spending, and there were efforts to ensure that borrowing costs were kept low via yield-control measures.

Sri Lanka is not so fortunately placed when considering the risks related to large-scale debt monetisation programmes due to high debt levels, elevated exposure to foreign debt with repayments of sizeable amounts in the medium term, and the low reserve stockpiles. With such weak fundamentals, the backbone of debt monetisation programmes is policy credibility. But for the last 18 months, there has been no notable effort to curtail discretionary spending and anchor fiscal plans. Thus, Sri Lanka is reluctant to deal with IMF conditionalities.

Policy measures must address fiscal imbalances through cuts in national spending or raising national income. As the latter takes time, the governments tend to focus on a policy mix to cut national spending that includes tighter budgets allowing interest rates to move with market fundamentals and implementing more flexible exchange rates. The downside is that the growth suffers in the short term with worsening debt ratios. These are politically difficult choices when economic conditions are tight as they are now.

Sri Lanka must firm up its access to foreign capital markets to balance the risks. If Sri Lanka comes to an adjustment on the fiscal front and improves access to capital markets, this will free up the space for a more orderly macroeconomic adjustment. Though the exchange rate may initially overshoot, it can be stabilised over time. This will allow the Central Bank to reverse its debt monetisation and focus on price stability, as that will be an area of concern in the coming months. A policy framework along these lines will provide a more robust environment to support investment and sustain Sri Lanka’s recovery.

Opportunities and Costs Dr Asanka Wijesinghe, Research Economist, IPS

During the pre-pandemic period, there was stabilisation in the rate of globalisation, but Sri Lanka’s openness has continuously declined especially after 2005 due to GDP growth in nontradeable sectors. However, Bangladesh, India, and South Asia, in general, show an increasing trend of openness. COVID-19 led to a deep plunge in the world’s industrial production and trade in 2019. But even after this collapse, it recovered by the beginning of 2021. There is no evidence to show deglobalisation effects due to the pandemic.

When the world trade outlook is taken into consideration, the WTO predicts a pickup in global trade volumes for the year 2022. An IMF database that uses signals emitted by sea vessels also showed an uptick in world trade from the beginning of 2021. Sri Lanka should ready itself to take advantage of trade diversion and investments opportunities the tariffs imposed on China’s textiles by the US, for instance. At present, its global value chain (GVC) participation is low and in fact declined from 2009 to 2019. In contrast countries like Bangladesh, Viet Nam, India and Pakistan showed an increasing trend. He pointed out that the US-China trade war presents opportunities for Sri Lanka to increase both forward and backward GVC participation.

A key challenge is the costly policy of import substitution, resulting in resource misallocation, reduced competitiveness, and possible retaliation from trade partners. Another challenge for Sri Lanka is the potential withdrawal of GSP+ which will be a hard hit on the seafood and textile industries. Sri Lanka should work to secure GSP+, disengage from the ‘anti-trade’ bias, integrate with GVCs, and restructure existing regional trade agreements.

Roads to Recovery

Dr Missaka Warusawitharana, Financial Economist, Johns Hopkins University, USA

Sri Lanka’s growth trajectory has not been in line with its true potential, adversely impacting the well-being of the people. This can be attributed to the low level of productivity growth. Although the manufacturing sector has contributed to growth, it has not demonstrated sufficient productivity that would enable the country to achieve a better output.

Further, the current fiscal difficulties can be pinned to structural imbalances in the country’s budgets that have spanned decades along with different administrations that have been unwilling to make hard choices. In the longer term, budgets must be structured to bring the debt down to a manageable level.

The world economy is moving away from physical goods to a digital-based economy, requiring greater provision of services. Sri Lanka scores well on the Human Development Index with its knowledgeable workforce. The need is to increase productivity by investing more in education and service-producing industries and improve the business environment by reducing institutional barriers.

Link to blog: https://www.ips.lk/talkingeconomics/2021/10/15/covid-19-and-the-sri-lankan-economy-policy-choices-and-trade-offs/

Chathurrdhika Yogarajah is a Research Assistant at IPS with research interests in macroeconomics and trade policy. She holds a BSc (Hons) in Agricultural Technology and Management, specialised in Applied Economics and Business Management from the University of Peradeniya with First Class Honours. She is currently reading for her Master’s in Agricultural Economics at the Postgraduate Institute of Agriculture, Peradeniya. (Talk with Chathurrdhika: chathurrdhika@ips.lk)

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”