Business

ComBank sees need to play a ‘far more urgent and vital’ role against impacts of C19

• Extends moratoriums on 81,387 loans with a total capital outstanding of Rs 443 billion during first and second waves

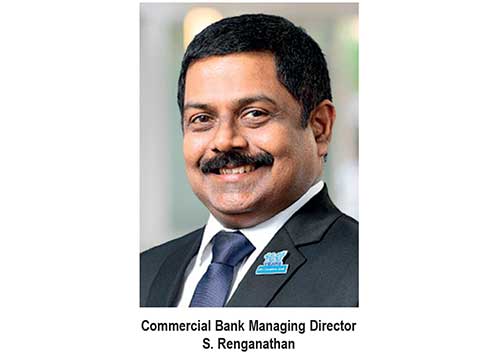

“We began the year on a celebratory note, with an ambitious portfolio of community initiatives to commemorate our 100-year history, but it soon became evident that we would have to play a far more urgent and vital role to underwrite the survival of people and businesses impacted by the effects of the pandemic,” Commercial Bank Managing Director S. Renganathan said in a press statement issued yesterday.

“We are proud to end the year as the leading provider of COVID-19 linked concessionary loans among the private banks, and the process continues,” he said.

ComBank statement said:

“The Commercial Bank of Ceylon provided new concessionary lending of nearly Rs 30 billion in 2020, its centenary year, to help Sri Lankans weather the impacts of the COVID-19 pandemic and ended the year as the most generous lender among the country’s private banks.”

“This high volume of concessionary loans was in addition to the relief the Bank granted to customers in the form of debt, capital or interest moratoriums on a staggering 81,387 existing loans with a capital outstanding of Rs 443 billion as well as repayment of outstanding credit card balances, the Bank disclosed this week.”

“The total of Rs 29.6 billion in COVID-19 support loans disbursed by the Bank as at 30th December 2020 under multiple relief schemes to provide working capital loans to pandemic affected businesses included loans provided under the Central Bank mandated programme as well as the Bank’s own support schemes.”

“Under the working capital loan scheme titled ‘Saubagya COVID-19 Renaissance facility’ launched by the Central Bank of Sri Lanka (CBSL), Commercial Bank registered 5,637 applications with a total value of Rs 28 billion over the three phases of the programme and disbursed 5,387 loans with a value of Rs 26.6 billion at the close of 2020. Notably, Commercial Bank disbursed the highest loan value within a short period during the first wave of the pandemic, and disbursed Rs 2.8 billion, Rs 17.7 billion and Rs 6.1 billion respectively under Phases I, II and III of the programme. Moreover, the Bank lent another Rs 1.4 billion under the Liquidity Facility for Contractors in the construction sector and other suppliers to the government.”

“Commercial Bank also funded two other special loan schemes of its own, one for SMEs affected by COVID-19 and the other the ‘Dirishakthi COVID-19 Support Loan’ scheme to assist micro enterprises disrupted by the pandemic. The Bank lent Rs 1.4 billion via 102 loans to help small and medium businesses and Rs 34 million via 313 loans to micro enterprises under these bank-funded loan schemes.”

“Taking on the mantle of the driving force in economic recovery in the post-pandemic period, the Bank grouped 12 different schemes implemented for affected businesses and individuals under the umbrella of the ‘Arunella’ Financial Support Scheme and extended these relief programmes beyond the mandated debt moratorium. These concessions included flexible payment options, up to 20% rebates on accrued interest during the moratorium periods, extension of moratorium periods for up to another six months, further reductions on Credit Card repayments and applicable interest rates, and Debt Consolidation Plans.”

“Commercial Bank became the first private bank in Sri Lanka to surpass Rs 1.5 trillion in assets, Rs 1 trillion in deposits, and Rs 900 billion in loans in 2020. The Bank also introduced several innovative products and services such as the upgraded online banking platform ‘ComBank Digital’ with multiple new and enhanced features, a trilingual multi-channel Integrated Contact Centre, and QR-enabled payment option for Credit Cards for the first time in the country and also introduced WhatsApp Banking for the first time in Sri Lanka”, the statement said.

The Bank also completed a landmark private equity placement with IFC in 2020. It launched CBC Finance Ltd., its fully owned Licensed Non-bank Finance Institution (NBFI) and installed its 250th Cash Recycler Machine (CRM) by the end of 2020, taking its network of automated machines to 905. The Bank increased its stake in Commercial Insurance Brokers, and its subsidiary CBC Myanmar Microfinance Ltd. expanded its operations by opening a branch in Pyinmana.

In the sphere of CSR initiatives, Commercial Bank donated Rs 10 million to the National COVID-19 Healthcare and Social Security Fund and joined forces with the Sri Lankan Army’s ‘Thuru Mithuru’ project focused on driving Sri Lanka towards self-sufficiency in essential food. Marching on with its contribution towards IT education in Sri Lanka, the Bank donated its 200th fully-equipped IT laboratory and set up Coding Clubs in 50 schools and initiated a project to established 100 STEM (Science Technology Engineering and Mathematics) classrooms in 100 schools as part of its 100-year celebrations. The Bank has also pledged to reforest 100 hectares of land in the dry zone of Sri Lanka to mark its centenary.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”