Business

Black, White and Grey Markets: The dynamics of foreign exchange and remittances in Sri Lanka

By Bilesha Weeraratne

Written Ahead of International Migrants’ Day on December 18, 2021

Despite the pandemic and related difficulties in remitting, remittances to Sri Lanka had picked up by December 2020 to record year-over-year growth of 5.8 %, contrary to all expectations.

The reasons for such a quick rebound include catching up on postponed remittances, accumulated terminal employment benefits and savings-related remittances of migrant workers laid off due to the pandemic, receipt of counter-cyclical remittances from less frequent remitters and the shift from informal to formal channels. In the current context of the foreign exchange crisis in Sri Lanka, the latter is the most critical factor to focus on.

From Informal to Formal Channels

The fundamental reason for remitters to shift from informal to formal channels was the accessibility issue during lockdowns or limited physical operations. Similarly, the increased risk of informal channels may have encouraged the use of formal channels. With adjustments to operate under the new normal and easing of lockdown measures, it is reasonable to assume that the informal remittance channels may have also evolved to function during the pandemic. As such, the Central Bank of Sri Lanka’s (CBSL’s) Special Deposit Accounts (SDA), with its 1-2% higher interest rate and the LKR 2 higher foreign exchange rate for remittances channelled through licensed commercial banks (LCBs), were woefully inadequate to retain such recently converted formal remitters.

Black, White and Grey Foreign

Exchange Rates

One of the key attractions of informal remittances is the relatively low cost, partly due to the more attractive exchange rate offered by informal channels. The recent movements in the official LKR/USD foreign exchange rate indicated high pressure towards further depreciation and the excess demand amidst the deteriorating supply of USDs within the Sri Lankan economy resulted in a wide divergence between the exchange rate offered by the LCBs – the white market, and non-bank but authorised money exchangers. The latter can be termed ‘the grey market’ because they are permitted to buy foreign exchange, albeit did at their own rate. The divergence was even more pronounced compared with those of the black market or kerb rate.

One of the key attractions of informal remittances is the relatively low cost, partly due to the more attractive exchange rate offered by informal channels. The recent movements in the official LKR/USD foreign exchange rate indicated high pressure towards further depreciation and the excess demand amidst the deteriorating supply of USDs within the Sri Lankan economy resulted in a wide divergence between the exchange rate offered by the LCBs – the white market, and non-bank but authorised money exchangers. The latter can be termed ‘the grey market’ because they are permitted to buy foreign exchange, albeit did at their own rate. The divergence was even more pronounced compared with those of the black market or kerb rate.

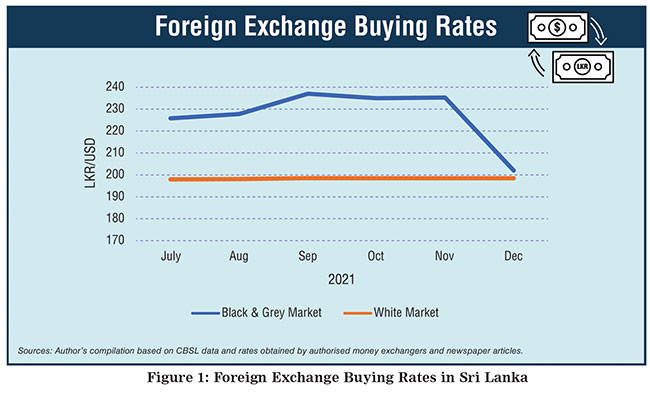

Figure 1 below indicates a wide gap exceeding LKR 25 across the different foreign exchange markets from July to November 2021. This gap created an opportunity for informal remittances exchanged in the Sri Lankan grey or black foreign exchange market to be more rewarding to remitters. The extra LKR 2 and the subsequent top-up to an extra LKR 10 offered by the LCBs paled in comparison! Finally, in early December 2021, those in the grey market were forced to adhere to the soft pegged LKR/USD 198-202 rate.

Sources: Author’s compilation based on CBSL data and rates obtained by authorised money exchangers and media articles.

(https://economynext.com/sri-lanka-rupee-quoted-at-225-226-50-to-us-dollar-in-kerb-market-amid-money-printing-83579/;

https://economynext.com/sri-lanka-rupee-weakens-to-227-228-50-to-dollar-in-kerb-market-bond-yields-up-85162/;

https://ceylontoday.lk/news/official-directive-strengthens-kerb-market;

https://economynext.com/sri-lanka-cb-expects-falling-remittance-to-reverse-trend-from-october-87157/)

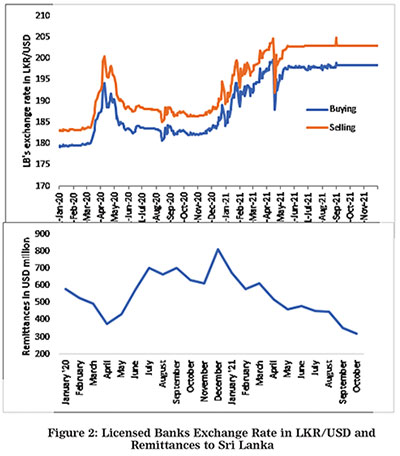

As seen in the top panel in Figure 2, when the CBSL intervention stabilised the LKR-USD exchange rate, formal remittances to Sri Lanka shown in the bottom panel continued on a steeper decline in October and November 2021.

Desperate Measures

In 2021 various mechanisms were rolled out to access foreign currency available in the economy. In May 2021, the CBSL directed that LCBs sell 10% of inward worker remittances converted to the CBSL. In October, a previous directive on the mandatory conversion of merchandise export proceeds was expanded to cover services. The change also shifted away from a 25% limit, to converting the “residual” after utilising goods and services export proceeds.

The Attractiveness of Informal Channels

This latest update has resulted in much confusion. Though the CBSL indicated that this directive would not affect worker remittances, operationally, this does not appear very likely. A single Personal Foreign Currency Account (PFCA) may receive foreign exchange as worker remittances from a family member or a well-wisher and payment for trade-in services. The method of distinguishing the two types of inward remittances is still unclear to many. At the same time, many individuals have already received correspondence from commercial banks requesting to convert the funds in their PFCAs.

This latest update has resulted in much confusion. Though the CBSL indicated that this directive would not affect worker remittances, operationally, this does not appear very likely. A single Personal Foreign Currency Account (PFCA) may receive foreign exchange as worker remittances from a family member or a well-wisher and payment for trade-in services. The method of distinguishing the two types of inward remittances is still unclear to many. At the same time, many individuals have already received correspondence from commercial banks requesting to convert the funds in their PFCAs.

Amidst the confusion and effort to protect workers’ foreign currency earnings, more migrant workers are seeking informal channels to remit, while others refrain from or delay remitting. Yet others are diverting their remittances to accounts held overseas.

Sources: Top panel https://www.cbsl.gov.lk/en/rates-and-indicators/exchange-rates; Bottom panel CBSL, Weekly Economic Indicators, various dates

Early Warning

Remittances are seasonal. As such, official remittances in December may increase. But it should not be prematurely considered an indicator of the success of the recent efforts to increase remittances or divert from informal to formal channels. The departures for labour migration during the first half of 2021 are a mere third of the pre-pandemic departures in the same period in 2019. Many migrant workers who return are unable to find foreign jobs and this depleted stock of Sri Lankan migrant workers is a weak base to prop up formal remittances.

Moreover, domestic economic hardship makes many migrants and families desirous of a possible extra return through informal remittance channels. As such, excessive regulations to clamp down on informal remittances may inadvertently create a breeding ground for even greater informal activities and black markets, thereby proving entirely counter-productive to the intended objectives.

Future efforts to increase remittances should not underestimate the resilience of informal remittance channels crafted along the centuries-old method of Undiyal or Hawala. Thus, instead of overly focusing on shifting from informal to formal channels of remittances, policies should mainly focus on ensuring a more realistic exchange rate. Similarly, it is important to encourage labour migration and trade in services and their remittances.

Link to original blog: https://www.ips.lk/talkingeconomics/2021/12/17/black-white-and-grey-markets-the-dynamics-of-foreign-exchange-and-remittances-in-sri-lanka/#

Bilesha Weeraratne is a Research Fellow at IPS focusing on internal and international migration and urbanisation. She is also interested in labour economics, economic development, and economics of sports. Prior to re-joining IPS in 2014, Bilesha was a Postdoctoral Research Associate at Princeton University, USA. Bilesha holds a MPhil and a PhD in Economics from the City University of New York, USA. (Talk to Bilesha – bilesha@ips.lk)

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”