Business

A cut tree, a dead elephant, is a lost tourism dollar in the future

by Michel Nugawela and Pesala Karunaratna

Four decades of inaction since introduction of open economy – Sri Lanka has never missed an opportunity to miss an opportunity

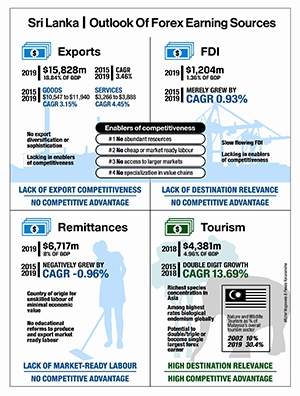

Globally and regionally, country is unplanned and unprepared to drive forex earnings; exports, FDIs, and foreign-earned wage remittances record very slow growth rates below CAGR 5%

With CAGR 13.69%, tourism sector shows resilience despite no concentrated effort or national strategy; emerges as priority sector in medium-term to be No 1 forex earner

Nature and wildlife tourism has most potential to drive Sri Lanka as a hot destination for high value travellers as global mobility returns in 2021

A single elephant, alive, contributes $0.16mn a year or $11mn over its lifetime to tourism sector; 350 elephant deaths in 2019 amount to economic value of $3.9bn had they lived their lives fully

Forest cover reduced by 130,349 hectares from 2010-2019 reflecting a sharp increase of 8.6% of net forest change

The coronavirus crisis throws into sharp relief the tenuous state of Sri Lanka’s economy. The government is committed to export expansion but remains handicapped by decades of unpreparedness in strengthening the underlying enablers of competitiveness.

The coronavirus crisis throws into sharp relief the tenuous state of Sri Lanka’s economy. The government is committed to export expansion but remains handicapped by decades of unpreparedness in strengthening the underlying enablers of competitiveness.

This opinion paper proposes a refocus on tourism as the priority sector to drive growth as Sri Lanka begins the difficult and lengthy task of reforming, restructuring, and strengthening national competitiveness. This will require shifting away from one-size-fits-all marketing under the mass tourism model to developing a product differentiation strategy that targets the best tourists – the high value traveller – with our best assets – nature and wildlife. This broad and diverse segment of travellers outspend mass tourists by 3-4 times and will be the first to travel and visit other countries once global mobility returns in 2021.

However, the high rate of deforestation dismantles the only competitive advantage Sri Lanka has to compete internationally and increase its exports of services. By stripping away nature and wildlife assets, the destination will be left with only its beaches and reputation for cheap sea-sun-sand tourism in the future.

Stagnant exports of goods and services

Exports of goods and services (% of GDP) was reported at 18.8% in 2019 of which goods accounted for 14.2% and services for 4.6%. In the years 2015-2019, total exports of goods grew from $10,547mn to $11,940mn – CAGR 3.15% – while total exports of services increased from $3,266mn to $3,888mn – just CAGR 4.45%.

Sri Lanka continues to lag other emerging economies in Asia that have successfully transitioned from an overreliance on primary goods to achieve export diversification and sophistication. In 1989, our total exports of goods and services as a percentage of GDP was 21.4% against Vietnam’s 16.5%. Thirty years later, our exports had shrunk to 18.8% as Vietnam’s increased to 119.3%. The reasons for this disparity can be found in the underlying enablers of export competitiveness where Sri Lanka’s capabilities are weak or entirely lacking.

Enabler #1 – Resource abundance

We have none. Consider the example of India’s BPO industry which is around 1% of the country’s GDP and 6% share of global BPO, directly and indirectly employing 10mn people. According to Tholons and AT Kearney Indexes of 2019, India remains the leading country to outsource because of cheap labour costs, a huge talent pool of skilled, English-speaking professionals (India’s English proficiency: #35/100 in the world and #5/25 in Asia), and tech-savvy manpower, despite competition from The Philippines, Vietnam and other Asian countries.

Enabler #2 – Price and contribution of unskilled or market-ready labour

We are stagnating at middle-income levels. The unskilled labour market demands higher wages and Sri Lanka lacks a pool of skilled market-ready workers (unlike the example of India, above).

Enabler #3 – Trade agreements that give producers access to a larger market

Domestic interest groups in Sri Lanka have opposed and successfully pressured governments to abandon free trade agreements. Meanwhile, emerging economies like Vietnam have made huge economic advances through trade liberalization and global integration. Since its Doi Moi reforms, the country has signed 12 (mostly bilateral) FTAs that have increased trade by ten-fold – from US$30bn in 2000 to almost US$300bn by 2014 – shifting it away from exports of primary goods and low-tech manufacturing products to more complex high-tech goods like electronics, machinery, vehicles and medical devices. The competitiveness of its exports will continue to increase, firstly, through more diversified input sources from larger trade networks and cheaper imports of intermediate goods from partner countries, and secondly, through partnerships with foreign firms that transfer the know-how and technology that is needed to leap into higher valued-added production.

Enabler #4 – Ability to enter, establish or move up regional or global value chains and production networks

Today, global firms optimize resources by investing or outsourcing the design, procurement, production, or distribution stages of their value chain activities across different countries. Yet since 1978, Sri Lanka has only captured share in the manufacturing and design stages of the global apparel value chain. The examples of Vietnam and Thailand demonstrate how both economies have become integral to different stages of the smartphone and automobile value chains for Samsung and Toyota.

Vietnam:

Vietnam attracted Samsung at the early stages of smartphone evolution. Samsung established its first factory in Vietnam in 2008, when smartphone penetration was 10.8% globally; today it has three factories in Vietnam and world smartphone penetration is at 41%. Samsung remains the single largest foreign investor in Vietnam, with investments totaling $17bn (20% of Sri Lanka’s GDP) whilst Vietnam’s exports of smartphones and spare parts, mostly produced by Samsung Electronics, account for $51.38bn (20% of Vietnam’s GDP). On top of the current $220mn Samsung R&D center, Vietnamese Prime Minister Nguyen Xuan Phuc has requested Samsung Chairman Lee Jae-yong to next invest in a chip manufacturing plant, further strengthening the country’s competitiveness and sophistication in exports.

Thailand:

Toyota’s decision to enter the Thai automobile market in 1962 was largely due to the country’s industrial policy regime. Today – after 6 decades of concentrated effort between the Thai government and Toyota – Thailand is becoming a global passenger car production hub. Toyota’s investments have also helped to transfer knowledge and technology into Thailand, strengthening the R&D capabilities of Thai engineers. Toyota Thailand president Michinobu Sugata has expressed complete confidence in both Thailand and the company’s future direction in the country.

Since 1978, Sri Lanka has repeatedly missed opportunities to enter or establish itself in global value chains and production networks. We continue to be unplanned and unprepared in strengthening the underlying enablers of export competitiveness. Expect meagre export growth to continue.

Slow flowing foreign direct investment

These enablers of competitiveness are also the most important considerations to increase foreign direct investment. Inflows between 2015-2019 totalled $6.4bn, averaging $1.2bn every year and merely growing by CAGR 0.93% (this excludes the 99-year lease of Hambantota port to China in exchange for $1.1bn). Without improving supply-side constraints, international investors will remain reluctant to sink substantial resources in the country.

Strengthening the underlying enablers of competitiveness will take time. Expect stagnation in FDI inflows to continue.

Sluggish foreign worker remittances

Sri Lanka has become a major country of origin for unskilled workers with minimal economic value. Wage receipts, which amounted to $6,717mn in 2019 or 8% of GDP, negatively grew by CAGR -0.96% between the years 2015-2019. In 2019, the highest inflow ($3,459mn) came from the Middle East, a segment that participates in the lowest economic positions and lacks the skills, abilities and qualifications to mitigate any downturn in value in remittance flows.

However, the demographics are changing for neighbouring countries like India, where an increasing number of skilled white-collar workers (a growing cohort of professionals in the IT and engineering fields, according to MoneyGram) are quadrupling the average volume per each remittance.

To export quality human capital and increase our share of foreign-earned wages, Sri Lanka must introduce transformational policy reforms in education. Our university system – supported by proactive primary and secondary education systems – must be restructured to produce market-ready workers with the skills and adaptability to learn, grow and respond to change.

Reforms in the education sector will take time. Improving value in wage receipts remains a remote opportunity in the near future.

Amid no support or concentrated effort, tourism receipts grow double-digit

Tourism continued to expand and record double-digit growth of CAGR 13.69% between the years 2015-2018, despite the absence of a national strategy and a high percentage of low-income visitors. As a single sector, tourism receipts amounted to $4,381mn in 2018 or 4.96% of GDP and trended towards topping that in 2019. As Sri Lanka is weak or entirely lacking in the underlying enablers of competitiveness, and continues to be unplanned and unprepared in all other means of earning foreign exchange, tourism is the priority sector to drive economic growth in the short to medium-term.

The myth of mass tourism

For Sri Lanka, mass tourism has its advantages; it produces high revenues at high seasons by attracting tourists looking for the cheapest way to holiday (Sri Lanka’s largest inbound mass tourist markets are India, Britain, China, Germany, France, Australia, Russia, the US, the Maldives, and Canada). The mass tourism sector is also one of the largest employers in the country, providing direct and indirect employment to about 400,000 people.

But there are inherent constraints to the mass tourism model – such as its high seasonality, low average length of stay and low occupancy rates – which accelerate a downward pressure on prices. By repeatedly discounting for shrinking tourism dollars, mass tourism suppliers attract tourists who don’t spend (enough) and the tourism product stagnates: service quality decreases and consumer dissatisfaction increases over time. Finally, the destination gains popularity and is promoted for inexpensive travel.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”