Features

There is no such person as ‘one- armed economist’

by Jayampathy Molligoda

The Sri Lankan government adopted a relaxed monetary policy coupled with lower taxes to stimulate economic growth since 2020 (beginning) till end of 2021. The objective was to provide relief to people and businesses in order to overcome negative effects due to COVID 19 and Easter Sunday attack in April 2019. However, whether the economy really produced goods and services to the extent that is required is questionable. It is true that during the year 2021 they have been able to convert the negative growth rate of 3.6% in 2020 into a positive growth rate of 3.7% in 2021. Commencing 2022, Central Bank (CBSL) has adopted a policy of tightening the monetary policy by increasing the interest rates and increase income tax and indirect taxes such as VAT and social security contribution levy in order to reduce inflation and inflationary expectations. One can argue that all these contrasting policy measures are in accordance with the accepted macro- economic theories put forward by eminent economists.

This year Nobel Price goes to Economist, Bernanke, Ex-Chief of Central bank, US:

Eminent economist, Ex-Fed reserve, Chief, US, Ben Bernanke, together with two other eminent economists, won the Economics Nobel price this October on the role of banks, particularly during financial crises and how to regulate financial markets. “In his role as Chief of the Central Bank, US, Bernanke was able to put knowledge from research into policy during the financial crisis of 2008-2009” the Nobel Committee said.

Bernanke has been previously credited and hailed for the Fed’s unorthodox response of slashing interest rates and flooding the financial system with liquidity and thus successfully handling the recovery after the 2008 recession, but at the same time, criticised for doing little to avert it, allowing investment bank Lehman Brothers to collapse. The award winners also showed how the financial institutions were vulnerable to so called bank runs. “If a large number of customers (savers) simultaneously run to the bank to withdraw their money, the rumour may become a self-fulfilling prophecy – a bank run occurs and the bank collapses” the Nobel Committee said. The Committee added this dangerous dynamic can be avoided by governments providing credit and giving banks a life-line by becoming a lender of last resort. “In a nutshell, the theory says that banks can be tremendously useful but they are only guaranteed to be stable if they are properly regulated,” Nobel committee chairman added.

Solutions to great depression in the 1930s:

This reminds me ‘Keynesian’ economics, which involves government expenditures while economics believe that government spending causes inflation and therefore need to control the supply of money that flows into the economy. In contrast, Keynesian economists believe that a troubled economy continues in a downward spiral unless a government intervention drives consumers to buy more goods and services. They believe in consumption, government expenditure and to change the state of the economy. In short, governments should balance out the cyclical movement of the economy by spending more in downturns and less in prosperous times (thereby preventing inflation). In fact, Keynes begins his general theory by attacking Say’s law, the view that ‘supply creates its own demand’. Keynes proceeded to turn Say’s law on his head, arguing that aggregate demand determines the supply of output and level of employment. (Post-Keynesian Economics (PKE) is a school of economic thought which builds upon John Maynard Keynes’s argument that effective demand is the key determinant of economic performance.) In the field of monetary theory, ‘post-Keynesian’ economists were among the first to emphasise that money supply responds to the demand for bank credit, so that Central Banks cannot control the quantity of money, but only manage the interest rate by managing the quantity of monetary reserves.

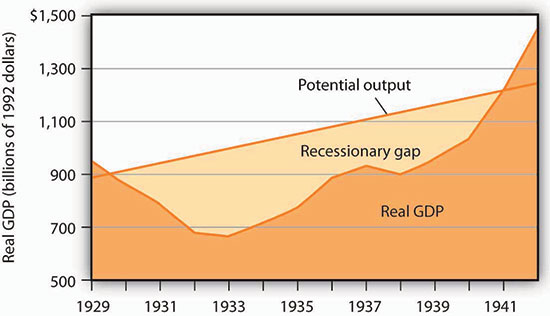

By the way, Bernanke previously received awards for his analysis, conducted in the early 1980s, of the ‘Great Depression’ in the 1930s, the worst economic crisis. For Keynesian economists, the experience of Great Depression provided impressive confirmation of Keynes’s idea which is consistent with Keynes’s argument. A sharp reduction in aggregate demand had gotten the trouble started. A reduction in aggregate demand took the economy from above its potential output to below its potential output, and, as we see in below the recessionary gap created by the change in aggregate demand had persisted for more than a decade, but expansionary fiscal policy had put an end to the worst macroeconomic nightmare.

The dark-shaded area shows real GDP from 1929 to 1942, the upper line shows potential output, and the light-shaded area shows the difference between the two—the recessionary gap. The gap nearly closed in 1941 The chart suggests that the recessionary gap remained very large throughout the 1930s.

Inflation, money printing and unemployment:

Under the Monetary Law Act 1949 as amended, the economic and price stability and financial system stability were made the core objectives of the CBSL. Therefore, it should focus on maintaining stable price levels, means containing inflation and inflationary expectations. In order to attain ‘price stability’, CBSL is required to keep liquidity and money supply of the country at appropriate levels so that the total demand for goods and services known as the ‘aggregate demand’ is more or less equal to the total supply of goods and services called ‘aggregate supply’.

In 1958, economist A W Phillips published an article in the British journal of economica that would make him famous covering a relationship between unemployment and inflation. Phillips curve showed negative correlation between rate of unemployment and the inflation. When inflation is high, the rate of unemployment is low and vice versa. Practically policy makers use this by altering monetary & fiscal policies in influencing ’aggregate demand’ in the short run and achieve trade -off between employment and rate of inflation. The ‘Nobel Price’ winner in 2001, Economist George Akerlof once said “probably the single most important macroeconomic relationship is the Phillips curve.

New Keynesian approach has emerged as the preferred approach:

Steeply rising prices is a bigger threat to businesses than high interest rates which will have to be maintained for a time until inflation start to ease, Central Bank Governor Dr. Nandalal Weerasinghe said recently. He was quoted by the local media as saying. “Sri Lanka was now experiencing the result of past money printing and if rates are cut now, runaway inflation could be the result. Higher interest rates are cost to business, but inflation drives up all costs,” Governor Weerasinghe explained addressing concerns of businesses on high interest rates and raising taxes. However, the Columbia University professor, author of “The Price of Inequality” and “Globalisation and Its Discontents,” Joseph Stiglitz argued that the overwhelming source of inflation is supply-side disruptions leading to higher prices in oil and food. “Will raising interest rates lead to more oil, lower prices of oil, more food, lower prices of food? Answer is clearly not”.

This is in response to recent announcements by Federal Reserve officials in the US indicating that interest rate hikes will continue in order to bring down rising prices — but this may intensify inflationary pressures, according to the Nobel Prize-winning economist. “The real worry in my mind is, will they increase interest rates too high, too fast, too far?” Joseph Stiglitz told CNBC recently at a Forum in Italy. In fact, the real risk is it will make it worse; Why? Because what we need to do is to make investments to relieve some of these supply-side bottlenecks that are causing such havoc on our economy. It’s going to make it more difficult.” Unquote. According to Joseph Stiglitz, raising interest rates in non-competitive markets may lead to even more inflation.

While there is less consensus on macroeconomic policy issues than on issues in the microeconomic and international areas, surveys of economists generally show that the new Keynesian approach has emerged as the preferred approach to macroeconomic analysis. The finding that about 80% of economists agree that governments’ expansionary fiscal measures can deal with recessionary gaps certainly suggests that most economists can be counted in the new Keynesian camp. Neither monetarist nor new classical analysis would support such measures. At the same time, there is considerable discomfort about actually using discretionary fiscal policy, as the same survey shows that about 70% of economists feel that discretionary fiscal policy should be avoided and that the business cycle should be managed by the Fed (Fuller & Geide-Stevenson, 2003). Just as the new Keynesian approach appears to have won support among most economists, it has become dominant in terms of macroeconomic policy.

Conflicting theories on macro-economic policies put in to practice:

As can be seen, Sri Lankan policy makers tend to adopt economic policies going into two extreme ends, namely; relaxed monetary policy, coupled with government expenditure through excessive money printing and lower taxes on the one hand, and tight monetary policies coupled with high Income Tax and indirect taxes on the other hand. When interest rates are raised, availability of bank credit reduces and consequently overall economic activities tend to slow down. If they continue to adopt tight monetary policy framework and fiscal (high taxation) policies, it’s likely the aggregate supply will contract and may lead to lower production, which in turn end up in ‘stagflation’ or it could even end up in a recession. The economy is expected to contract this year around 8-9 percent of gross domestic product (GDP) as investment and consumption falls. Nevertheless, at the IMF and World bank annual sessions in Washington this October, the State Finance Minister Shehan Semasinghe was quoted as saying; “Sri Lanka’s ongoing IMF-prescribed reforms to come out of an unprecedented economic crisis will not be reversed in future unlike in the past as there is somewhat consensus among the current lawmakers for such reforms”; Unquote. Already the micro and small and medium enterprises have serious issues, where they cannot afford to borrow any more or repay the debts already taken. As a result, household indebtedness may gradually increase to unprecedented levels. This may intern, increase the instability of the financial and banking system. How the present government is going to address those serious socio/ economic issues is yet to be seen.

We need to reiterate the fact that the Sri Lankan economy can only be re-built in the medium term by successfully addressing the structural weaknesses, increase exports as a % of GDP and thus eliminating the twin deficits, namely government budget deficit and balance of payments with rest of the world. Simultaneously, the above stated vulnerabilities; household indebtedness, banking system stability etc. must be arrested in order to make a sustainable economic recovery possible. However, the challenge is the time it can take for the economy to adjust to these changes and how to manage the cash flows and social unrest during the interim period. USA President Harry S. Truman (33rd President serving from 1945 to 1953) hated what he termed two-armed economists, those who would advise him first “on the one hand” and then “on the other hand.” Give me a one-armed economist, he demanded, an adviser who wouldn’t waffle.

Features

The heart-friendly health minister

by Dr Gotabhya Ranasinghe

Senior Consultant Cardiologist

National Hospital Sri Lanka

When we sought a meeting with Hon Dr. Ramesh Pathirana, Minister of Health, he graciously cleared his busy schedule to accommodate us. Renowned for his attentive listening and deep understanding, Minister Pathirana is dedicated to advancing the health sector. His openness and transparency exemplify the qualities of an exemplary politician and minister.

Dr. Palitha Mahipala, the current Health Secretary, demonstrates both commendable enthusiasm and unwavering support. This combination of attributes makes him a highly compatible colleague for the esteemed Minister of Health.

Our discussion centered on a project that has been in the works for the past 30 years, one that no other minister had managed to advance.

Minister Pathirana, however, recognized the project’s significance and its potential to revolutionize care for heart patients.

The project involves the construction of a state-of-the-art facility at the premises of the National Hospital Colombo. The project’s location within the premises of the National Hospital underscores its importance and relevance to the healthcare infrastructure of the nation.

This facility will include a cardiology building and a tertiary care center, equipped with the latest technology to handle and treat all types of heart-related conditions and surgeries.

Securing funding was a major milestone for this initiative. Minister Pathirana successfully obtained approval for a $40 billion loan from the Asian Development Bank. With the funding in place, the foundation stone is scheduled to be laid in September this year, and construction will begin in January 2025.

This project guarantees a consistent and uninterrupted supply of stents and related medications for heart patients. As a result, patients will have timely access to essential medical supplies during their treatment and recovery. By securing these critical resources, the project aims to enhance patient outcomes, minimize treatment delays, and maintain the highest standards of cardiac care.

Upon its fruition, this monumental building will serve as a beacon of hope and healing, symbolizing the unwavering dedication to improving patient outcomes and fostering a healthier society.We anticipate a future marked by significant progress and positive outcomes in Sri Lanka’s cardiovascular treatment landscape within the foreseeable timeframe.

Features

A LOVING TRIBUTE TO JESUIT FR. ALOYSIUS PIERIS ON HIS 90th BIRTHDAY

by Fr. Emmanuel Fernando, OMI

Jesuit Fr. Aloysius Pieris (affectionately called Fr. Aloy) celebrated his 90th birthday on April 9, 2024 and I, as the editor of our Oblate Journal, THE MISSIONARY OBLATE had gone to press by that time. Immediately I decided to publish an article, appreciating the untiring selfless services he continues to offer for inter-Faith dialogue, the renewal of the Catholic Church, his concern for the poor and the suffering Sri Lankan masses and to me, the present writer.

It was in 1988, when I was appointed Director of the Oblate Scholastics at Ampitiya by the then Oblate Provincial Fr. Anselm Silva, that I came to know Fr. Aloy more closely. Knowing well his expertise in matters spiritual, theological, Indological and pastoral, and with the collaborative spirit of my companion-formators, our Oblate Scholastics were sent to Tulana, the Research and Encounter Centre, Kelaniya, of which he is the Founder-Director, for ‘exposure-programmes’ on matters spiritual, biblical, theological and pastoral. Some of these dimensions according to my view and that of my companion-formators, were not available at the National Seminary, Ampitiya.

Ever since that time, our Oblate formators/ accompaniers at the Oblate Scholasticate, Ampitiya , have continued to send our Oblate Scholastics to Tulana Centre for deepening their insights and convictions regarding matters needed to serve the people in today’s context. Fr. Aloy also had tried very enthusiastically with the Oblate team headed by Frs. Oswald Firth and Clement Waidyasekara to begin a Theologate, directed by the Religious Congregations in Sri Lanka, for the contextual formation/ accompaniment of their members. It should very well be a desired goal of the Leaders / Provincials of the Religious Congregations.

Besides being a formator/accompanier at the Oblate Scholasticate, I was entrusted also with the task of editing and publishing our Oblate journal, ‘The Missionary Oblate’. To maintain the quality of the journal I continue to depend on Fr. Aloy for his thought-provoking and stimulating articles on Biblical Spirituality, Biblical Theology and Ecclesiology. I am very grateful to him for his generous assistance. Of late, his writings on renewal of the Church, initiated by Pope St. John XX111 and continued by Pope Francis through the Synodal path, published in our Oblate journal, enable our readers to focus their attention also on the needed renewal in the Catholic Church in Sri Lanka. Fr. Aloy appreciated very much the Synodal path adopted by the Jesuit Pope Francis for the renewal of the Church, rooted very much on prayerful discernment. In my Religious and presbyteral life, Fr.Aloy continues to be my spiritual animator / guide and ongoing formator / acccompanier.

Fr. Aloysius Pieris, BA Hons (Lond), LPh (SHC, India), STL (PFT, Naples), PhD (SLU/VC), ThD (Tilburg), D.Ltt (KU), has been one of the eminent Asian theologians well recognized internationally and one who has lectured and held visiting chairs in many universities both in the West and in the East. Many members of Religious Congregations from Asian countries have benefited from his lectures and guidance in the East Asian Pastoral Institute (EAPI) in Manila, Philippines. He had been a Theologian consulted by the Federation of Asian Bishops’ Conferences for many years. During his professorship at the Gregorian University in Rome, he was called to be a member of a special group of advisers on other religions consulted by Pope Paul VI.

Fr. Aloy is the author of more than 30 books and well over 500 Research Papers. Some of his books and articles have been translated and published in several countries. Among those books, one can find the following: 1) The Genesis of an Asian Theology of Liberation (An Autobiographical Excursus on the Art of Theologising in Asia, 2) An Asian Theology of Liberation, 3) Providential Timeliness of Vatican 11 (a long-overdue halt to a scandalous millennium, 4) Give Vatican 11 a chance, 5) Leadership in the Church, 6) Relishing our faith in working for justice (Themes for study and discussion), 7) A Message meant mainly, not exclusively for Jesuits (Background information necessary for helping Francis renew the Church), 8) Lent in Lanka (Reflections and Resolutions, 9) Love meets wisdom (A Christian Experience of Buddhism, 10) Fire and Water 11) God’s Reign for God’s poor, 12) Our Unhiddden Agenda (How we Jesuits work, pray and form our men). He is also the Editor of two journals, Vagdevi, Journal of Religious Reflection and Dialogue, New Series.

Fr. Aloy has a BA in Pali and Sanskrit from the University of London and a Ph.D in Buddhist Philosophy from the University of Sri Lankan, Vidyodaya Campus. On Nov. 23, 2019, he was awarded the prestigious honorary Doctorate of Literature (D.Litt) by the Chancellor of the University of Kelaniya, the Most Venerable Welamitiyawe Dharmakirthi Sri Kusala Dhamma Thera.

Fr. Aloy continues to be a promoter of Gospel values and virtues. Justice as a constitutive dimension of love and social concern for the downtrodden masses are very much noted in his life and work. He had very much appreciated the commitment of the late Fr. Joseph (Joe) Fernando, the National Director of the Social and Economic Centre (SEDEC) for the poor.

In Sri Lanka, a few religious Congregations – the Good Shepherd Sisters, the Christian Brothers, the Marist Brothers and the Oblates – have invited him to animate their members especially during their Provincial Congresses, Chapters and International Conferences. The mainline Christian Churches also have sought his advice and followed his seminars. I, for one, regret very much, that the Sri Lankan authorities of the Catholic Church –today’s Hierarchy—- have not sought Fr.

Aloy’s expertise for the renewal of the Catholic Church in Sri Lanka and thus have not benefited from the immense store of wisdom and insight that he can offer to our local Church while the Sri Lankan bishops who governed the Catholic church in the immediate aftermath of the Second Vatican Council (Edmund Fernando OMI, Anthony de Saram, Leo Nanayakkara OSB, Frank Marcus Fernando, Paul Perera,) visited him and consulted him on many matters. Among the Tamil Bishops, Bishop Rayappu Joseph was keeping close contact with him and Bishop J. Deogupillai hosted him and his team visiting him after the horrible Black July massacre of Tamils.

Features

A fairy tale, success or debacle

Sri Lanka-Singapore Free Trade Agreement

By Gomi Senadhira

senadhiragomi@gmail.com

“You might tell fairy tales, but the progress of a country cannot be achieved through such narratives. A country cannot be developed by making false promises. The country moved backward because of the electoral promises made by political parties throughout time. We have witnessed that the ultimate result of this is the country becoming bankrupt. Unfortunately, many segments of the population have not come to realize this yet.” – President Ranil Wickremesinghe, 2024 Budget speech

Any Sri Lankan would agree with the above words of President Wickremesinghe on the false promises our politicians and officials make and the fairy tales they narrate which bankrupted this country. So, to understand this, let’s look at one such fairy tale with lots of false promises; Ranil Wickremesinghe’s greatest achievement in the area of international trade and investment promotion during the Yahapalana period, Sri Lanka-Singapore Free Trade Agreement (SLSFTA).

It is appropriate and timely to do it now as Finance Minister Wickremesinghe has just presented to parliament a bill on the National Policy on Economic Transformation which includes the establishment of an Office for International Trade and the Sri Lanka Institute of Economics and International Trade.

Was SLSFTA a “Cleverly negotiated Free Trade Agreement” as stated by the (former) Minister of Development Strategies and International Trade Malik Samarawickrama during the Parliamentary Debate on the SLSFTA in July 2018, or a colossal blunder covered up with lies, false promises, and fairy tales? After SLSFTA was signed there were a number of fairy tales published on this agreement by the Ministry of Development Strategies and International, Institute of Policy Studies, and others.

However, for this article, I would like to limit my comments to the speech by Minister Samarawickrama during the Parliamentary Debate, and the two most important areas in the agreement which were covered up with lies, fairy tales, and false promises, namely: revenue loss for Sri Lanka and Investment from Singapore. On the other important area, “Waste products dumping” I do not want to comment here as I have written extensively on the issue.

1. The revenue loss

During the Parliamentary Debate in July 2018, Minister Samarawickrama stated “…. let me reiterate that this FTA with Singapore has been very cleverly negotiated by us…. The liberalisation programme under this FTA has been carefully designed to have the least impact on domestic industry and revenue collection. We have included all revenue sensitive items in the negative list of items which will not be subject to removal of tariff. Therefore, 97.8% revenue from Customs duty is protected. Our tariff liberalisation will take place over a period of 12-15 years! In fact, the revenue earned through tariffs on goods imported from Singapore last year was Rs. 35 billion.

The revenue loss for over the next 15 years due to the FTA is only Rs. 733 million– which when annualised, on average, is just Rs. 51 million. That is just 0.14% per year! So anyone who claims the Singapore FTA causes revenue loss to the Government cannot do basic arithmetic! Mr. Speaker, in conclusion, I call on my fellow members of this House – don’t mislead the public with baseless criticism that is not grounded in facts. Don’t look at petty politics and use these issues for your own political survival.”

I was surprised to read the minister’s speech because an article published in January 2018 in “The Straits Times“, based on information released by the Singaporean Negotiators stated, “…. With the FTA, tariff savings for Singapore exports are estimated to hit $10 million annually“.

As the annual tariff savings (that is the revenue loss for Sri Lanka) calculated by the Singaporean Negotiators, Singaporean $ 10 million (Sri Lankan rupees 1,200 million in 2018) was way above the rupees’ 733 million revenue loss for 15 years estimated by the Sri Lankan negotiators, it was clear to any observer that one of the parties to the agreement had not done the basic arithmetic!

Six years later, according to a report published by “The Morning” newspaper, speaking at the Committee on Public Finance (COPF) on 7th May 2024, Mr Samarawickrama’s chief trade negotiator K.J. Weerasinghehad had admitted “…. that forecasted revenue loss for the Government of Sri Lanka through the Singapore FTA is Rs. 450 million in 2023 and Rs. 1.3 billion in 2024.”

If these numbers are correct, as tariff liberalisation under the SLSFTA has just started, we will pass Rs 2 billion very soon. Then, the question is how Sri Lanka’s trade negotiators made such a colossal blunder. Didn’t they do their basic arithmetic? If they didn’t know how to do basic arithmetic they should have at least done their basic readings. For example, the headline of the article published in The Straits Times in January 2018 was “Singapore, Sri Lanka sign FTA, annual savings of $10m expected”.

Anyway, as Sri Lanka’s chief negotiator reiterated at the COPF meeting that “…. since 99% of the tariffs in Singapore have zero rates of duty, Sri Lanka has agreed on 80% tariff liberalisation over a period of 15 years while expecting Singapore investments to address the imbalance in trade,” let’s turn towards investment.

Investment from Singapore

In July 2018, speaking during the Parliamentary Debate on the FTA this is what Minister Malik Samarawickrama stated on investment from Singapore, “Already, thanks to this FTA, in just the past two-and-a-half months since the agreement came into effect we have received a proposal from Singapore for investment amounting to $ 14.8 billion in an oil refinery for export of petroleum products. In addition, we have proposals for a steel manufacturing plant for exports ($ 1 billion investment), flour milling plant ($ 50 million), sugar refinery ($ 200 million). This adds up to more than $ 16.05 billion in the pipeline on these projects alone.

And all of these projects will create thousands of more jobs for our people. In principle approval has already been granted by the BOI and the investors are awaiting the release of land the environmental approvals to commence the project.

I request the Opposition and those with vested interests to change their narrow-minded thinking and join us to develop our country. We must always look at what is best for the whole community, not just the few who may oppose. We owe it to our people to courageously take decisions that will change their lives for the better.”

According to the media report I quoted earlier, speaking at the Committee on Public Finance (COPF) Chief Negotiator Weerasinghe has admitted that Sri Lanka was not happy with overall Singapore investments that have come in the past few years in return for the trade liberalisation under the Singapore-Sri Lanka Free Trade Agreement. He has added that between 2021 and 2023 the total investment from Singapore had been around $162 million!

What happened to those projects worth $16 billion negotiated, thanks to the SLSFTA, in just the two-and-a-half months after the agreement came into effect and approved by the BOI? I do not know about the steel manufacturing plant for exports ($ 1 billion investment), flour milling plant ($ 50 million) and sugar refinery ($ 200 million).

However, story of the multibillion-dollar investment in the Petroleum Refinery unfolded in a manner that would qualify it as the best fairy tale with false promises presented by our politicians and the officials, prior to 2019 elections.

Though many Sri Lankans got to know, through the media which repeatedly highlighted a plethora of issues surrounding the project and the questionable credentials of the Singaporean investor, the construction work on the Mirrijiwela Oil Refinery along with the cement factory began on the24th of March 2019 with a bang and Minister Ranil Wickremesinghe and his ministers along with the foreign and local dignitaries laid the foundation stones.

That was few months before the 2019 Presidential elections. Inaugurating the construction work Prime Minister Ranil Wickremesinghe said the projects will create thousands of job opportunities in the area and surrounding districts.

The oil refinery, which was to be built over 200 acres of land, with the capacity to refine 200,000 barrels of crude oil per day, was to generate US$7 billion of exports and create 1,500 direct and 3,000 indirect jobs. The construction of the refinery was to be completed in 44 months. Four years later, in August 2023 the Cabinet of Ministers approved the proposal presented by President Ranil Wickremesinghe to cancel the agreement with the investors of the refinery as the project has not been implemented! Can they explain to the country how much money was wasted to produce that fairy tale?

It is obvious that the President, ministers, and officials had made huge blunders and had deliberately misled the public and the parliament on the revenue loss and potential investment from SLSFTA with fairy tales and false promises.

As the president himself said, a country cannot be developed by making false promises or with fairy tales and these false promises and fairy tales had bankrupted the country. “Unfortunately, many segments of the population have not come to realize this yet”.

(The writer, a specialist and an activist on trade and development issues . )