Business

Currency Board: A solution to Sri Lanka’s economic crisis?

By Dr Asanka Wijesinghe

On 08 March, Sri Lanka devalued the rupee against the US dollar, entering into a floating exchange rate regime. The Central Bank of Sri Lanka had to abandon the pegged exchange rate as defending the rupee with dwindling reserves was impossible. The inter-bank exchange rate shot up once the banks were assured that the exchange rate was floated. The initial shoot-up was followed by further rallying of the US dollar reaching close to Rs. 300 per USD. With the gradually weakening rupee, inflation is also ascending to worrisome levels calling for radical changes, including adopting a currency board. This article discusses the effectiveness and suitability of a currency board for Sri Lanka in the current macroeconomic context.

Weakening Rupee, Rising inflation, and the

Currency Board Solution

A currency board is a system that issues domestic banknotes in exchange for specific foreign currency – anchor currency like the USD which is used for trade with partner countries – at a constant rate. A cornerstone of the currency board mechanism is the authority’s ability to meet all demand for foreign currency by the holders of the domestic currency.

In Sri Lanka, even after the rupee was floated, reports suggest that an active kerb market with a significant premium above the inter-bank rate exists. While such market behaviour indicates an acute dollar shortage in the market and the equilibrium rate is further away, no official data exists on the kerb market money exchange. However, cryptocurrency platforms provide some critical insights. The Tether coin (USDT), which is closely pegged to the US dollar on a one-to-one basis, is traded for rupees on peer-to-peer (P2P) platforms as USDT is used as a medium to purchase other cryptocurrencies, including Bitcoin.

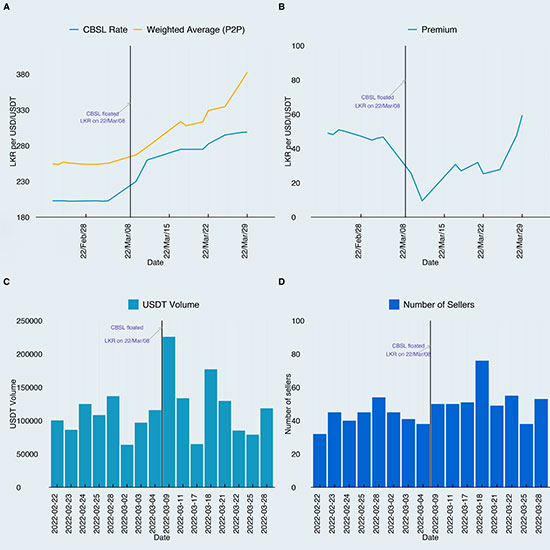

Data extracted from the P2P platform medium of Binance – a popular cryptocurrency exchange among Sri Lankans – show some supporting evidence for the continually widening gap between official and informal rates again. Significantly, the premium over the official rate plummeted once the rupee was floated, but it gradually recovered to the pre-floated period (A and B panels of Figure 1). The number of sellers and the USDT volume available for sale also went up but riveted back to the levels of the pre-floated period (C and D panels of Figure 1).

The inflationary pressure also does not show any unwinding signs, further eroding people’s purchasing power. These developments encourage the adoption of a currency board as a currency board is believed to be a solution for rising inflation. By the inner mechanics of the currency boards, the independence of discretionary monetary policy is taken away, substituting a disciplined monetary policy – a gold standard without gold – which eliminates the inflationary bias. Indeed, empirical evidence exists in favour of the anti-inflationary effect of currency boards. The inflation rate is lower under currency boards than in pegged or floating rate regimes. Moreover, economies under currency boards grew faster than the average of countries with pegged regimes. However, empirically disentangling multiple influences to pinpoint the low inflation on the currency board is an excruciating task.

Another selling point of the currency board is the fiscal discipline, as currency board regulations prohibit direct monetary financing of government expenditures. A high budget deficit in Sri Lanka and excessive government borrowings from the Central Bank make the fiscal-discipline effect of currency boards much more appealing. Empirical evidence points to low fiscal deficits or larger surpluses under currency board regimes.

Source: Author’s illustration using Binance data

Challenges in Adopting a Currency Board

A significant drawback of a currency board is the need to surrender the monetary policy independence required for managing asymmetric shocks. Such loss is costly when the anchor currency country responds to cyclical conditions, which are different from the prevailing conditions in the country operating the currency board. For example, Hong Kong’s currency board imported low-interest rates from the US in the early 1990s. Such monetary easing was appropriate for the US, but Hong Kong faced an asset price boom that called for monetary tightening. A counterargument against the negative impact of losing monetary policy is the availability of fiscal policy at the operating country’s disposal. However, the maneuverability of fiscal policy is determined by the fiscal and debt positions. In Sri Lanka’s context, the high debt to GDP ratio and fiscal deficits might restrict the use of fiscal policy for pump-priming-stimulating the economy in a recessionary period- due to the fear of losing investor confidence in debt sustainability. Thus, international evidence shows that countries with hard pegged exchange rate regimes generally tighten their fiscal policy in a recession. The Argentinian attempts to bring down the deficit in a recession in 2000 proved to be disastrous.

Sri Lanka’s high indebtedness will also challenge installing a currency board. Once a threat of a possible default looms, the interest rates soar, and refinancing debt will be increasingly difficult. In addition, the operating country needs reserves to back the monetary base in a currency board. In a currency board, the board must continually convert domestic currency for the anchor currency at a constant rate. It should be noted that the reserve level of Sri Lanka has dwindled over time in the recent past. Another drawback of currency boards is the requirement of real sector changes to compensate for the exchange rate deviations. For example, if the anchor currency appreciates against Sri Lanka’s main trading partners, wages should fall to compensate for the increase in foreign consumer prices, restoring competitiveness. Such an exercise needs greater flexibility in the labour markets. Thus, the flexibility of labour markets is a key to the sustainability of currency boards. The political feasibility of the institutional attempts to ease labour market regulations is highly doubtful.

Against this backdrop, the decision to install a currency board should be taken after a careful cost-benefit analysis. A currency board will be helpful to stabilise inflation in the short run but in the long run, Sri Lanka will be better off with a more flexible exchange rate regime. In addition, the benefits of a currency board are not exclusive. For example, fiscal discipline should be stronger in flexible exchange rate regimes as fiscal policy effects are reflected immediately and more transparently. Thus, if Sri Lanka enters into a currency board to stabilise inflation and domestic currency, it needs to contemplate an exit strategy. Generally, it is advisable to leave a currency board when the economy recovers. The requirement to surrender monetary independence and the inability to finance government expenditure under a currency board might reduce the political preference for such a system.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”