Business

Sri Lanka’s Sovereign Foreign Debt: to restructure or not?

By Dr Dushni Weerakoon

Sovereign debt restructuring can be pre-emptive or post-default. A default is inherently costly as it can result in a sustained loss of access to capital markets. That leaves pre-emptive restructuring when a country deems itself unable to service outstanding debt.

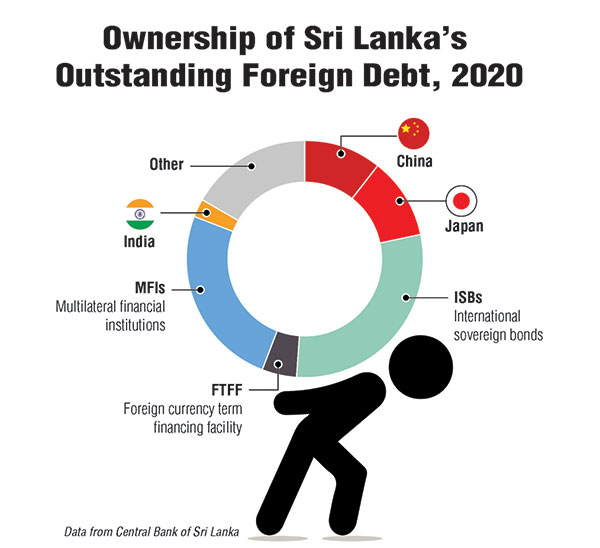

The complex creditor landscape of today though makes governments reluctant to entertain sovereign debt restructuring. The landscape of sovereign borrowing has evolved from a small group made up of multilateral organisations, a few commercial banks, and the ‘Paris Club’ of rich countries to something much more complicated. In recent decades, emerging markets and developing economies have borrowed proportionately more from international bond markets with their dispersed private investors, and tapped new non-Paris Club lenders like China. From the sovereign’s perspective, this makes a potential debt restructuring operation particularly complicated.

The first step in any restructuring is calculating how much a country owes and to whom. This involves sharing detailed information on all categories of sovereign debt denominated in foreign currency, including collateralised liabilities and the debts of state-owned enterprises. The adoption of an IMF programme may be conditioned as a part of a restructuring to underwrite the data, economic plan and the promise of macroeconomic and fiscal supervision.

The first step in any restructuring is calculating how much a country owes and to whom. This involves sharing detailed information on all categories of sovereign debt denominated in foreign currency, including collateralised liabilities and the debts of state-owned enterprises. The adoption of an IMF programme may be conditioned as a part of a restructuring to underwrite the data, economic plan and the promise of macroeconomic and fiscal supervision.

Lenders will weigh the upfront losses of a debt standstill and restructuring against the total magnitude of

losses in the event of a default. In entering restructuring talks, though, they will also demand to do so on the principle of comparable treatment of creditors in any proposed debt reprofilings and restructurings. Lenders will be mindful that any relief offered does not give preferential treatment to other creditors, especially in the face of new geopolitical power rivalries. This would typically mean that a country in distress asks for debt relief from friendly governments to whom it owes money and then seeks a comparable deal from private lenders.

The Holdout Problem

Over the past decades, there has been progress in governance frameworks to deal with sovereign debt crises, but considerable gaps persist. In the COVID-19 era, the G-20 Common Framework for Debt Treatments apply only to low-income countries (LICs), and even then, do not compel the participation of private creditors. Emerging markets that have undergone debt restructuring most recently (e.g. Argentina and Ecuador) are categorised in academic research as countries with a track record of serial default – i.e. more than two default spells or episodes. Given research evidence that countries that have defaulted on their debt obligations in the past are more likely to default again in the future, creditors have an added incentive to enter into negotiations in such cases.

All told, with the creditor landscape transformed, debt restructuring is still very much a matter of ad hoc negotiations between a sovereign and its creditors.

The creditors are aware of their special legal protection that comes down to a question of money due but not paid. At the same time, creditors too have virtually no choice but to negotiate as there will be inadequate assets to satisfy every creditor’s claims even with a successful legal remedy. In the extreme, ‘vulture funds’ have used litigation as an investment strategy to buy the debt at a hefty discount and pursue full payment through the courts. Confronted with this reality, a negotiated resolution should appeal to both creditors and debtor country.

At the centre of such a coordinated effort will be creditor (especially bondholder) committees. The composition of such committees – inclusive of large institutional investors, hedge funds, etc. – is critical to obtain a relatively quick resolution. However, there are no guarantees of fast and efficient mechanisms, and countries still risk fighting creditor lawsuits from those who may hold out.

Such potential holdout creditors may not necessarily take the view that what is good for the many is always good for the few. A disgruntled holdout creditor has the leverage to cause disturbing headlines, especially when countries resume bond market access once again at some point. Holdout creditors can be reined in through exit consents – where a majority of holders can amend terms, or as more commonly used now, employ collective action clauses (CACs) in bond agreements to bind minority holders. In the latter case, a specified supermajority of holders (usually 75%) can bind a minority to the terms of a debt restructuring. But much depends on whether a debtor country’s outstanding stock of international sovereign bonds contains these clauses. Some countries have also adopted anti-vulture fund legislation that limits holdout creditor recovery as a deterrent.

Net Benefit Calculation

High uncertainty during a restructuring, and the risk of prolonged negotiations means debt restructuring is still the last resort, to be done only if you must. A restructuring is a costly exercise with reputational downsides, loss of market access and more expensive debt issuances, weighed down further by concerns about adverse legal implications. For policymakers, a decisive step can be taken after a careful net benefit calculation of whether a country’s economic conditions are likely to deteriorate further without a restructuring, or whether a timely restructure may reduce the total magnitude of upfront losses and return debt to a sustainable level at the lowest cost to both the country and its creditors.

Link to Talking Economics blog: https://www.ips.lk/talkingeconomics/2022/01/12/sri-lankas-sovereign-foreign-debt-to-restructure-or-not/

Dr Dushni Weerakoon is the Executive Director of the Institute of Policy Studies of Sri Lanka (IPS) and Head of its Macroeconomic Policy research. She joined IPS in 1994 after obtaining her PhD, and has written and published widely on macroeconomic policy, regional trade integration and international economics. She has extensive experience working in policy development committees and official delegations of the Government of Sri Lanka. Dushni Weerakoon holds a BSc in Economics with First Class Honours from the Queen’s University of Belfast, U.K., and an MA and PhD in Economics from the University of Manchester, U.K. (Talk with Dr Dushni – dushni@ips.lk)

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”