News

Pulling back from the precipice: A Pathfinder perspective

The way out of Sri Lanka’s most challenging external financing crisis is to negotiate an arrangement with the IMF and agree on a preemptive debt restructuring, Pathfinder Foundation has said in a media statement.

An IMF programme could include strengthening the government’s revenue base (widening the tax base and improving tax administration); improving the primary balance in the budget (revenue – (expenditure-interest payments)); proactive, data-driven and non-interventionist monetary policy; a flexible and realistic exchange rate policy to assist in building up external reserves; commercialisation of SOE operations, including full cost-recovery in the pricing of electricity and fuel, restructuring of the CEB and the CPC, the implementation of the Statements of Intent and addressing the losses being incurred by SriLankan Airlines, the Foundation said.

Pathfinder Foundation said that the Gross Official Reserves have declined to USD 1.6 bn as at end-November. Repayments over the subsequent 12 months amount to about USD 7 billion.

“The authorities have responded with import and capital controls as well as a fixed exchange rate based on moral suasion by the CBSL and rationing of foreign exchange by the commercial banks. This has resulted in a scarring of the economy which will inevitably have an adverse impact on growth, employment and incomes. Inflation is rising and is on the verge of reaching double digits and shortages constantly emerge of essential goods and services,” the Foundation said.

The Pathfinder statement in full: “The Road Map, presented by the CBSL, identified a number of potential sources of debt- and non-debt-creating inflows to fill the external financing gap. The securitisation of remittance flows has been added to the menu of options recently. However, to date there has been an alarming depletion of external reserves and an inexorable increase in the external financing gap.

The Pathfinder statement in full: “The Road Map, presented by the CBSL, identified a number of potential sources of debt- and non-debt-creating inflows to fill the external financing gap. The securitisation of remittance flows has been added to the menu of options recently. However, to date there has been an alarming depletion of external reserves and an inexorable increase in the external financing gap.

“If the authorities have clear visibility of sufficient inflows to arrest the steady deterioration in the country’s external position, one can be hopeful of a turnaround to avoid the possibility of a debt default which would greatly amplify problems, such as rising inflation; pressure on exchange and interest rates; losses in the real value of incomes; decline in business confidence; and disruption to the supplies of basic goods and services. If the anticipated inflows are not forthcoming in sufficient quantities to fill the external financing gap, there will be no option but to turn to the IMF to avoid further scarring of the economy and creating greater shortages of essential goods and services.

“It is extremely unlikely that it would be possible to obtain IMF assistance without a debt rescheduling as the Fund does not support countries where the debt is considered unsustainable. Equally, it is not practical to reach agreement on debt restructuring without an IMF programme. So, the twin pillars of the way forward would need to be negotiating an arrangement with the IMF and agreement on a preemptive debt restructuring.

“Attempting to undertake stabilisation of the economy without the cushion of financing that can be mobilised through an IMF programme would be like performing on the high-trapeze without a safety-net. There needs to be a less painful blend of adjustment and financing. However, it must be highlighted that pain cannot be avoided. An IMF programme would impose significant burdens on the people. The main thrust of this article is that this pain would be less than the severe dislocation that is already being caused by squeezing the economy to make up for the dollar illiquidity. The conditionality attached to IMF programmes are intended to stabilise the economy (contain inflation and balance of payment pressure) and improve its creditworthiness.

“An IMF programme could include, inter alia, the following: strengthening the government’s revenue base (widening the tax base and improving tax administration); improving the primary balance in the budget (revenue – (expenditure-interest payments)); proactive, data-driven and non-interventionist monetary policy; a flexible and realistic exchange rate policy to assist in building up external reserves; commercialisation of SOE operations, including full cost-recovery in the pricing of electricity and fuel, restructuring of CEB and CPC, the implementation of the Statements of Intent and addressing the losses being incurred by SriLankan Airlines.

“An IMF Extended Fund Facility can provide balance of payment financing of up to USD 1 bn per year for three years. The amount made available would be calibrated according to the strength of the reforms undertaken. An IMF programme would also unlock direct budgetary support from the World Bank, Asian Development Bank and possibly a few bilateral donors (over and above their usual project loans). Both balance of payments and budgetary support are most urgently required for the twin deficit Sri Lankan economy. Based on indications in 2020, up to USD 2 bn in all can be mobilised through these sources, depending on the strength of the reforms undertaken. Engagement with the IMF will also transmit positive signals to both investors and creditors, both at home and abroad. It can also pave the way for an eventual upgrading of the sovereign rating, which would improve the prospect of attracting foreign investment and credits.

“The second pillar, preemptive restructuring, must also be pursued concurrently with negotiations with the IMF. Not only can this facilitate the obtaining of a Fund programme but it can also create some leeway to stabilise the economy and place it on a path of sustained growth. Debt restructuring can be achieved through: extending maturities; modifying coupon (interest) rates; and hair-cuts on the principal (write-downs). One or more of these modalities can be used to reach an agreement with creditors that places Sri Lanka’s debt servicing on a sustainable path. Ideally, about a 3-year window should be created where debt servicing is suspended. This can release a very substantial amount of scarce foreign exchange to finance imports. The impact on growth, employment and incomes would be materially positive. In considering debt restructuring, it is important to realise that the most significant usual downside is a loss of access to international capital markets. In Sri Lanka’s case, this has already happened with the downgrading of the sovereign rating. So, the most important disadvantage is no longer a factor. Another concern relates to the impact on domestic holders of USD denominated sovereign debt, mainly banks. A mitigating factor is that a significant share of these holdings have been bought at a discount from the secondary markets. In other countries, Central Banks have exercised regulatory forbearance to assist financial institutions which have required such support to repair their balance sheets.

“It must, however, be recognised that it could take 4-6 months to negotiate an IMF programme and a preemptive debt restructuring agreement. The present trends in external reserves on the one hand and net drains on foreign currency on the other indicate that bridging finance is required to meet obligations over the next 6 months to avoid a debt default. The package of assistance offered by India is an encouraging start and needs to be finalised as soon as possible. It has to be supplemented by financing from other friendly countries, like Japan. There is scope for India and Japan to work together to support Sri Lanka at this critical juncture. Their willingness to step forward is likely to be greater, if it is known that Sri Lanka has taken a decision to approach the IMF. While our development partners will be wary of having to make an open-ended commitment, they are likely to find bridging finance more palatable.

Time has almost run out. Urgent, focused and pragmatic attention to these pressing issues is of paramount importance. An IMF programme can be at the heart of a medium-term strategy to overcome the current challenges and give Sri Lankans greater hope about the future prospects of the economy.”

News

US sports envoys to Lanka to champion youth development

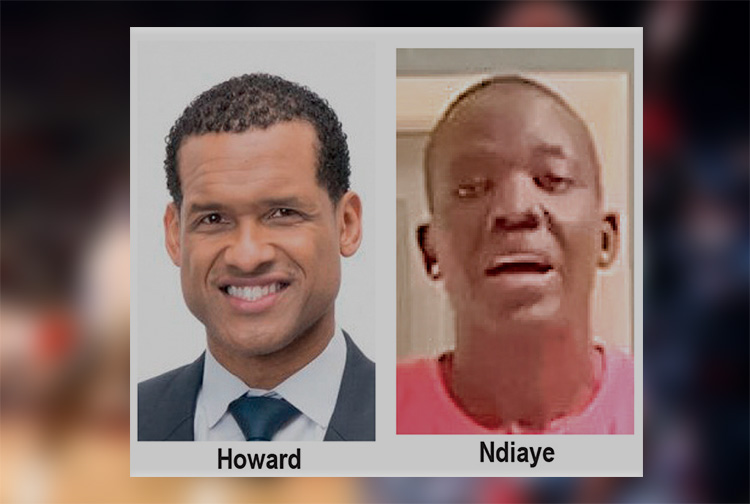

The U.S. Embassy in Colombo welcomed the U.S. Sports Envoys to Sri Lanka, former National Basketball Association (NBA) and Women’s National Basketball Association (WNBA) players Stephen Howard and Astou Ndiaye, from June 8 through 14.

The Public Diplomacy section of the U.S. Embassy said that it would launch a weeklong basketball program intended to harness the unifying power of sports, made possible through collaboration with Foundation of Goodness and IImpact Hoop Lab.

While in Sri Lanka, Howard and Ndiaye, both retired professional basketball players, will conduct a weeklong program, Hoops for Hope: Bridging Borders through Basketball. The Sports Envoys will lead basketball clinics and exhibition matches and engage in leadership sessions in Colombo and Southern Province for youth aged 14-18 from Northern, Uva, Eastern and Western Provinces, offering skills and leadership training both on and off the court. The U.S. Envoys will also share their expertise with the Sri Lanka Basketball Federation, national coaches, and players, furthering the development of basketball in the country. Beyond the clinics, they will collaborate with Sri Lankan schoolchildren to take part in a community service project in the Colombo area.

“We are so proud to welcome Stephen and Astou as our Sports Envoys to Sri Lanka, to build on the strong people-to-people connections between the United States and Sri Lanka,” said U.S. Ambassador Julie Chung. “The lessons that will be shared by our Sports Envoys – communication, teamwork, resilience, inclusion, and conflict resolution – are essential for leadership development, community building, equality, and peace. The U.S. Sports Envoy program is a testament to our belief that sports can be a powerful tool in promoting peace and unity.”

News

Rahuman questions sudden cancellation of leave of CEB employees

SJB Colombo District MP Mujibur Rahuman in parliament demanded to know from the government the reasons for CEB suspending the leave of all its employees until further notice from Thursday.

MP Rahuman said that the CEB has got an acting General Manager anew and the latter yesterday morning issued a circular suspending leave of all CEB employees with immediate effect until further notice.

“We demand that Minister Kanchana Wijesekera should explain this to the House. This circular was issued while this debate on the new Electricity Amendment Bill was pending. There are many who oppose this Bill. The Minister must tell parliament the reason for the urge to cancel the leave of CEB employees,” the MP said.However, Speaker Mahinda Yapa Abeywardena prevented Minister Wijesekera responding to the query and said that the matter raised by MP Rahuman was not relevant.

News

CIPM successfully concludes 8th Annual Symposium

The Chartered Institute of Personnel Management (CIPM) successfully concluded the 8th Annual CIPM Symposium, which took place on 31st May 2024. Themed “Nurturing the Human Element—Redefining HRM in a Rapidly Changing World,” the symposium underscored the pivotal role of human resource management (HRM) in today’s dynamic global landscape. Since its inception in 1959, CIPM has been dedicated to advancing the HR profession through education, professional development, and advocacy, solidifying its position as Sri Lanka’s leading professional body for HRM.

Ken Vijayakumar, the President of the CIPM, graced the occasion as the chief guest. The symposium commenced with the welcome address by the Chairperson, Prof. Arosha Adikaram, followed by the Web Launch of the Symposium Proceedings and Abstract Book by the CIPM President. The event featured distinguished addresses, including a speech by Chief Guest Ken Vijayakumar, President of CIPM, and an address by Guest of Honor Shakthi Ranatunga, Chief Operating Officer of MAS Holdings Pvt. Ltd., Sri Lanka.

The symposium also featured an inspiring keynote address by Prof. Mario Fernando, Professor of Management and Director of the Centre for Cross Cultural Management (CCCM) at the University of Wollongong, Australia.

Vote of Thanks of the inauguration session was delivered by Dr. Dillanjani Weeratunga, Symposium Co-chair.

The symposium served as a comprehensive platform for researchers to present their findings across a wide range of critical topics in HRM. These included Cultural Diversity and Inclusion, Talent Development and Retention, Ethical Leadership and Corporate Social Responsibility, Adapting to Technological Advancements, Mental Health and Well-being at Work, Global Workforce Challenges, Employee Empowerment, and Reskilling and Upskilling.

The plenary session was led by Prof. Wasantha Rajapakse. Certificates were awarded to the best paper presenters during the valedictory session, followed by a vote of thanks delivered by Kamani Perera, Manager of Research and Development.

The annual symposium of CIPM was a truly inclusive event, attracting a diverse audience that spanned undergraduates, graduates, working professionals, research scholars and lecturers. This widespread interest highlights the symposium’s significance in the field of HRM, offering a unique opportunity for everyone to network and learn from scholarly brains.The CIPM International Research Symposium was sponsored by Hambantota International Port, Sri Lanka Institute of Information Technology (SLIIT), E B Creasy & Co. PLC, and Print Xcel Company.