Business

The Central Bank of Sri Lanka maintains policy interest rates at their current levels

Monetary Policy Review: No. 08 – November 2021

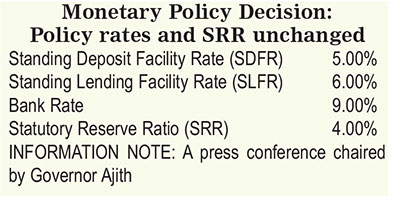

The Monetary Board of the Central Bank of Sri Lanka, at its meeting held on 24 November 2021, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 5.00 per cent and 6.00 per cent, respectively. The Board arrived at this decision after carefully considering the macroeconomic conditions and expected developments on the domestic and global fronts. The Board noted the recent acceleration of inflation, driven mainly by supply disruptions and the surge in global commodity prices, and reiterated its commitment to maintaining inflation at the targeted levels over the medium term with appropriate measures, while supporting the economy to reach its potential in the period ahead.

The Sri Lankan economy is gradually recovering The Sri Lankan economy witnessed a strong recovery during the first half of 2021, supported by fiscal and monetary stimulus measures. The re-emergence of the COVID-19 pandemic and the resultant disturbances to production activities appear to have affected the ongoing recovery somewhat during the third quarter of 2021. However, the available high frequency indicators suggest that economic activity is fast returning to normalcy. The removal of COVID-19 related lockdown measures in October 2021 and the successful nationwide COVID-19 vaccine rollout would help activity in the period ahead. While real GDP growth is projected at around 5 per cent in 2021, the ongoing rise in COVID-19 infections both globally and domestically could impact this expectation to some extent.

The external sector remains resilient against strong headwinds Earnings from merchandise exports remained robust, recording over US dollars 1 billion for the fourth consecutive month in September 2021. Preliminary data show that merchandise exports have recorded an all time high in October 2021. Expenditure on imports also increased, widening the trade deficit during the nine months ending September 2021 over the corresponding period of the previous year.

The tourism sector has displayed strong signs of revival with the easing of restrictions. Despite subdued inflows on account of workers’ remittances in recent months, a rebound is expected in the period ahead with the continuous rise in worker migration and efforts taken to facilitate remittance flows through formal channels.

The depreciation of the Sri Lanka rupee against the US dollar is recorded at 7.2 per cent thus far in 2021. The exchange rate has remained stable at around Rs.200-203 levels against the US dollar during the past three months. Meanwhile, gross official reserves were estimated at US dollars 2.3 billion by end October 2021. This, however, does not include the bilateral currency swap facility with the People’s Bank of China (PBoC) of CNY 10 billion (equivalent to approximately US dollars 1.5 billion). Moreover, measures taken by the Government and the Central Bank to attract fresh forex inflows, as well as the anticipated inflows to the private sector, including the financial sector, are expected to augment gross official reserves, thereby strengthening the external sector in the period ahead. Specifically, a greater conversion of export proceeds is observed, while negotiations with the foreign counterparts of the Government and the Central Bank are progressing, broadly in line with the path envisaged in the Six-Month Road Map.

Market interest rates have increased, reflecting the passthrough of tight monetary conditions In response to the tight monetary and liquidity conditions, most market lending rates have adjusted upwards. Yields on government securities, which increased notably, have stabilised with enhanced subscriptions at primary auctions, reflecting improved market sentiments. Meanwhile, credit extended to the private sector, which expanded notably underpinned by eased monetary conditions, has slowed somewhat in September 2021.

However, data for the nine months ending September 2021 indicate that credit flows, particularly to the industry and services sectors of the economy, have improved significantly, thereby supporting the revival of the economy. In the meantime, credit obtained by the public sector from the banking system, particularly net credit to the Government, continued to expand. Overall, the growth of broad money (M2b) decelerated in September 2021, commensurate with the moderation of credit to the private sector and the decline in the net foreign assets of the banking system.

Inflation accelerated recently mainly due to supply side disturbances and the surge in commodity prices internationally Supply side disruptions, removal of domestic price controls and upward adjustments to several administratively determined prices to reflect the rising global energy and other commodity prices along with the gradual firming of aggregate demand conditions, have pushed inflation above the targeted levels recently. A further acceleration of headline inflation is possible in the immediate future, although such movements are expected to be transitory. The monetary policy measures already taken by the Central Bank will help curbing excessive demand pressures and preventing the buildup of adverse inflation expectations.

Policy rates are maintained

at current levels

In consideration of the current and expected macroeconomic developments as highlighted above, the Monetary Board was of the view that the current policy interest rates are appropriate. Nevertheless, the Central Bank will remain vigilant and continue monitoring domestic and global macroeconomic and financial market developments and will take appropriate measures, as and when necessary, with the aim of ensuring stability in the external sector, maintaining inflation in the desired range, and supporting sustained economic recovery.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”