Business

How Should Sri Lanka Finance the COVID-19 Vaccination Rollout?

Notably, the government did not budget for a vaccination strategy in its National Budget for 2021. As such, any spending would have to be allocated through an emergency budgetary allocation. The government could potentially reallocate funding from other sectors or even reallocate from within the health sector. These reallocations, for example, could occur through built-in fiscal space for public investments in the budget, postponements or revisions to non-essential government spending initiatives such as non-essential small-scale infrastructure projects

By Harini Weerasekera and Kithmina Hewage

An effective vaccination strategy is a necessity for countries to move beyond COVID-19. However, it also requires careful policymaking to balance the financial cost of purchasing and delivering vaccines while stimulating economic growth. This article, based on a recent IPS analysis, provides an overview of the approximate costs associated with the COVID-19 vaccination rollout in Sri Lanka and evaluates policy options to finance the initiative.

Assessing Costs

While there is no universally agreed level, considering the emergence of new variants, many experts agree that a country should vaccinate around 80% of its population to achieve herd immunity against COVID-19. This translates to 17.5 million Sri Lankans. Thus far, Sri Lanka has received or is expected to receive vaccine donations and other financial assistance from the likes of the World Health Organization’s COVAX Facility to cover approximately 20% of the population.

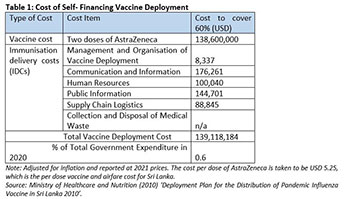

Based on publicly available proxy data, as detailed in Table 1 below, assuming that 20% of the population will be financed through the WHO COVAX scheme, the total cost of self-financing another 60% of the population is USD 139.1 million. These costs include both the cost of purchasing the cheapest vaccine (AstraZeneca- Oxford) and the immunisation delivery costs.

Oxford) and the immunisation delivery costs.

In a recent study, the World Bank estimates that for the South Asian region, the average per person vaccination cost amounts to USD 12 to receive one dose of the COVID-19 vaccine, under certain assumptions. This costing consists of the full vaccine deployment cost per person, which includes the vaccine dosage cost along with the international airfare and other delivery costs.

Using this basis of costing, financing two doses of the vaccine for 60% of Sri Lanka’s population would amount to USD 336 million. This is over double the minimum estimate made earlier using local proxy data. As such, a range of USD 140-336 million (LKR 27-66 billion) can be treated as a minimum and maximum estimate range for financing the long-term vaccination strategy in Sri Lanka. This amounts to 0.6-1.4% of total government expenditure for 2020, which is a relatively small proportion of the country’s total government expenditure. For context, the health sector was allocated 4.8% of total government expenditure in 2020. That said, the estimated costs range between 12 and 29.5% of the Ministry of Health’s total expenditure for 2021.

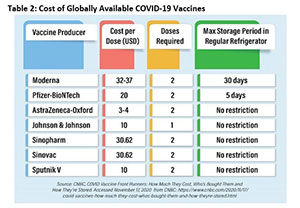

Furthermore, given difficulties in securing all necessary vaccines from a single producer (e.g. AstraZeneca) due to supply shortages, Sri Lanka has already moved towards purchasing Sputnik V and Pfizer vaccines, which are more expensive than AstraZeneca, and therefore will increase costs. The cost increase will be significant given that other vaccines are two to six times more expensive than a dose of Astra-Zeneca (Table 2).

Given these realities, Sri Lanka will need to cover these costs through one or a combination of: (a) reallocating existing budgetary commitments; (b) receiving more bilateral and multilateral vaccine donations or financial assistance; or (c) self-financing through targetted tax policies and future borrowings.

Reallocating Budgetary Commitments

Notably, the government did not budget for a vaccination strategy in its National Budget for 2021. As such, any spending would have to be allocated through an emergency budgetary allocation. The government could potentially reallocate funding from other sectors or even reallocate from within the health sector. These reallocations, for example, could occur through built-in fiscal space for public investments in the budget, postponements or revisions to non-essential government spending initiatives such as non-essential small-scale infrastructure projects.

However, the extent to which such revisions can be incorporated is greatly limited by the economic conditions under which this vaccination initiative is taking place. Some of these small-scale infrastructure projects, for instance, are geared towards stimulating the economy.

Sri Lanka’s post-COVID-19 economic recovery is dependent on adequate government spending to stimulate growth, and there has already been a significant amount of spending rationalisation that has taken place. Furthermore, the government will be required to ensure that the broader public health sector is not compromised in any form simply to fund the COVID-19 vaccination initiative as that may have further severe long-term repercussions.

Self-Financing

Given the current economic climate, the government is unlikely to increase direct taxes in the immediate future. Increasing indirect taxes such as import tariffs are also likely to be counter-productive since imports are restricted. Rather, a tax rationalisation on luxury goods and a sin-tax rationalisation on alcohol and cigarettes could generate a significant amount of revenue that can be directed towards the vaccination drive.

For instance, a recent study by IPS estimated that government revenue could be increased by LKR 17 billion by 2021, and LKR 37 billion by 2023, if taxes on cigarettes are streamlined and raised in line with inflation. This additional revenue can finance the vaccination strategy such that it reaches the midpoint of the study’s cost estimation range of LKR 20-67 billion.

For instance, a recent study by IPS estimated that government revenue could be increased by LKR 17 billion by 2021, and LKR 37 billion by 2023, if taxes on cigarettes are streamlined and raised in line with inflation. This additional revenue can finance the vaccination strategy such that it reaches the midpoint of the study’s cost estimation range of LKR 20-67 billion.

A targetted tax intervention achieves the dual aim of raising the required funds to vaccinate the public while simultaneously ensuring that the government’s broader macroeconomic stimulus initiatives can continue unimpeded. If the government is unwilling to finance the entire cost through a targetted tax intervention, even a partial self-financing measure would reduce the necessity for the government to depend on further loans to cover the cost.

Best Option

A basic economic impact analysis by IPS found that the vaccination rollout would generate an additional 30.6 billion in national output, and an extra value addition of LKR 26 billion. Besides, the country’s economy will benefit additionally due to the indirect impacts associated with the public health benefits of a vaccinated populace.

Considering these factors, the government is best off pursuing a medium-term self-financing option through targetted tax interventions and if required, through external financing. The challenge for Sri Lanka is to secure adequate funding without compromising on its investments in broader public health and social welfare initiatives as weaknesses on those fronts can undermine the success of vaccinating the public from COVID-19.

From a budgetary perspective, the cost of vaccinating the public fast will also be cheaper than the cost of continuous PCR testing, managing quarantine centres and cluster associated lockdowns over a prolonged period. In addition to securing funding, receiving an adequate supply of vaccine doses for the country to reach its vaccination coverage targets remains uncertain as we progress further into 2021.

To learn more, read IPS’ Policy Discussion Brief (PDB) ‘Fiscal Implications of Vaccinating Sri Lanka Against COVID-19’.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”