Business

Harnessing social protection during pandemics

Strengthening social protection systems is of critical importance to respond to shocks such as COVID-19. They play a vital role in addressing consumption shortfalls and supporting income and job security for affected communities. Many countries have been taking various measures to strengthen their social protection. These include social assistance measures like cash and in-kind transfers, social insurance measures like pensions, unemployment benefits, social security contribution waivers/subsidisation, and active labour market related measures such as wage subsidies and training measures.

The government of Sri Lanka too introduced a relief package that included both financial and non-financial assistance to help households that were affected by the pandemic. One of the key measures was a social protection measure, i.e. a monthly cash transfer of LKR 5,000 for two consecutive months (April and May 2020) to various vulnerable groups. This social protection measure was based on a number of existing social protection schemes like the Samurdhi cash transfer programme, disability assistance, farmers’ and fishermen’s pension schemes etc. In addition, committees were set up in each Grama Niladhari (GN) division/ward to identify and approve other deserving individuals and families for this cash grant.

Horizontal expansion

Sri Lanka’s social protection response to COVID-19 showed a horizontal expansion/scaled-up coverage compared to the pre-COVID-19 level; it covered not only the current beneficiaries of the programmes considered (e.g. Samurdhi, elder’s assistance and disability assistance programmes) but also those who were in the waitlists as well as individuals and families selected by the Committees.

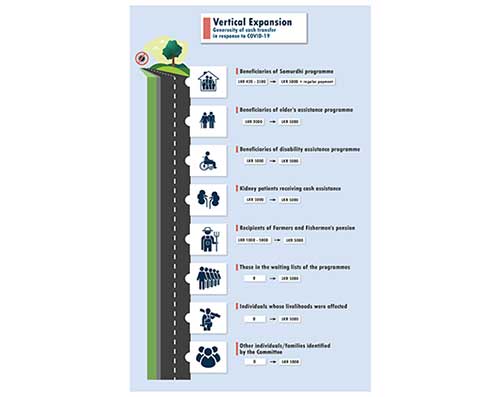

This social protection measure also indicated some level of vertical expansion, i.e. higher level of benefits compared to their pre-COVID-19 levels. Yet, the level of generosity of the benefits (compared to the pre-COVID-19 levels) varied from 0% to over 100% depending on the beneficiary category (see Figure). For example, over 100% increase in benefits was seen among the current beneficiaries of the Samurdhi and elders assistance programme while beneficiaries of the disability assistance programme and kidney patients allowance merely received their regular monthly allowance of LKR 5,000.

Recommendations

Despite the expansion, the cash transfer scheme had a number of limitations. Immediate/short-term measures like distribution of cash assistance are inadequate to sustain the recovery and to mitigate future crises. Long-term measures are required to strengthen Sri Lanka’s social protection.

• Integrated Social Protection System: The COVID-19 pandemic highlights the need for an integrated social protection system and a unified and coordinated structure at the national level as well as at the divisional level in Sri Lanka. The existing system is a fragmented system with parallel structures.

• Scaled-up /Universal Coverage: The pandemic has also shown that not only the poor and vulnerable, but all segments of the population require protection. This calls for a universal social protection system, including social protection floors.

• Digitisation of Payments: Digital payment systems are key to improve efficiency of the delivery process without delays and higher transaction costs, while complying with health guidelines to combat a pandemic. They do not require both physical mobility of people and payments in cash. Thus, it is time for Sri Lanka too to move towards a digital payment system for delivery of cash transfers.

This Policy Insight is based on the comprehensive chapter on “Harnessing Social Protection During Pandemics” in ‘Sri Lanka: State of the Economy 2020’ report – the flagship publication of the Institute of Policy Studies of Sri Lanka (IPS). The complete report can be purchased from the Publications Unit of the IPS.

Business

AHK Sri Lanka champions first-ever Sri Lankan delegation at Drupa 2024

The Delegation of German Industry and Commerce in Sri Lanka (AHK Sri Lanka) proudly facilitated the first-ever Sri Lankan delegation’s participation at Drupa 2024, the world’s largest trade fair for the printing industry and technology. Held after an eight-year hiatus, Drupa 2024 was a landmark event, marking significant advancements and opportunities in the global printing industry.

AHK Sri Lanka played a pivotal role in organising and supporting the delegation, which comprised 17 members from the Sri Lanka Association for Printers (SLAP), representing eight companies from the commercial, newspaper, stationery printing, and packaging industries. This pioneering effort by AHK Sri Lanka not only showcased the diverse capabilities of Sri Lanka’s printing sector but also facilitated vital bilateral discussions with key stakeholders from the German printing industry.

Business

Unveiling Ayugiri: Browns Hotels & Resorts sets the stage for a new era in luxury Ayurveda Wellness

In a captivating reimagining of luxury wellness tourism, Browns Hotels & Resorts proudly unveiled the exquisite Ayugiri Ayurveda Wellness Resort Sigiriya. This momentous occasion, celebrated amidst a vibrant and serene grand opening on the 6th of June, heralds a new chapter in the Ayurveda wellness tourism landscape in Sri Lanka. Nestled amidst 54 acres of unspoiled natural splendour, Ayugiri features 22 exclusive suites and stands out as the only luxury Ayurveda wellness resort in the country offering plunge pools in every room, rendering it truly one-of-a-kind.

The grand opening of Ayugiri Ayurveda Wellness Resort was an enchanting event, where guests were captivated by the melodies of flutists and violinists resonating through Sigiriya’s lush landscapes. As traditional drummers and dancers infused the air with vibrant energy, Browns Hotels & Resorts’ CEO, Eksath Wijeratne, Kotaro Katsuki, Acting Ambassador for the Embassy of Japan and General Manager, Buwaneka Bandara, unveiled the resort’s new logo, marking a significant moment witnessed by distinguished guests from the French Embassy, Ayurveda and wellness enthusiasts along with officials from the Sigiriya area, LOLC Holdings and Browns Group.

“Our strategic expansion into wellness tourism with Ayugiri Ayurveda Wellness Resort Sigiriya symbolises a significant milestone for Browns Hotels & Resorts. Wellness tourism has consistently outperformed the overall tourism industry for over a decade, reflecting a growing global interest in travel that goes beyond leisure to offer rejuvenation and holistic well-being. By integrating the timeless wisdom of Ayurveda with modern luxury, we aim to set a new standard in luxury wellness tourism in Sri Lanka. Whether your goal is prevention, healing, or a deeper connection to inner harmony, Ayugiri offers a sanctuary for holistic well-being” stated Eksath Wijeratne.

Ayugiri encapsulates the essence of life, inspired by the lotus flower held by the graceful queens of the infamous Sigiriya frescoes. Just as the lotus emerges from the murky depths, untainted and serene,

Ayugiri invites guests on a journey of purity and rejuvenation, harmonised with a balance of mind, body and spirit, the essence of nature, echoes of culture and the wisdom of ancient Ayurvedic healing.

Business

HNB General Insurance recognized as Best General Bancassurance Provider in Sri Lanka 2024

HNB General Insurance, one of Sri Lanka’s leading general insurance providers, has been honored as the Best General Bancassurance Provider in Sri Lanka 2024 by the prestigious Global Banking and Finance Review – UK.

The esteemed accolade underscores HNB General Insurance’s unwavering commitment to excellence and its outstanding performance in the field of bancassurance. Through dedication and hard work, the HNB General Insurance team has continuously endeavored to deliver innovative insurance solutions, cultivate strong relationships with banking partners, and provide unparalleled service to customers nationwide. This recognition is a testament to the team’s dedication and relentless pursuit of excellence in the bancassurance business.

“We are honored to receive this prestigious award, which reflects our team’s tireless efforts and dedication to delivering value-added insurance solutions and exceptional service through our bancassurance partnerships,” said Sithumina Jayasundara, CEO of HNB General Insurance. “This recognition reaffirms our position as a trusted insurance provider in Sri Lanka and motivates us to continue striving for excellence in serving our customers and communities.”