News

It’s China that happens to have the cash now, says Sri Lanka Minister

Each country works out its own financing arrangements, says Ajith Nivard Cabraal, referring to Sri Lanka’s borrowing from China

by Meera Srinivasan

While government critics and the Opposition in Sri Lanka raise concern over the Rajapaksa administration’s growing reliance on China, in the wake of Colombo seeking a new $700 million loan from Beijing, a State Minister has said it is China that has the “most amount of cash now”.

“In different times in world history, different countries have been the ones who have had the most amount of cash. And now it happens to be China, so China will naturally invest all over the world,” Ajith Nivard Cabraal, State Minister of Money and Capital Market and State Enterprise Reforms, told The Hindu in a recent interview, on Sri Lanka’s response to the economic impact of the global pandemic. “I think we should all respect that,” said the Minister, who was the Governor of the Central Bank of Sri Lanka during Mahinda Rajapaksa’s last term in office.

Amid the World Bank and International Monetary Fund’s (IMF) worrying forecast of a GDP contraction up to almost 7%, credit rating agency Moody’s downgrading of Sri Lanka by two notches to the “very high credit risk” category, the daunting $4.5 billion foreign debt due in the coming year, falling revenues and rising living costs, the Minister expressed optimism. Sri Lanka is exploring different options to repay its debt, including additional loans from China, currency swap facilities with India and China, and Samurai and Panda bonds, he said.

Mr. Cabraal’s remarks came a week after a high-powered delegation from Beijing flew into Colombo, and met President Gotabaya Rajapaksa and Prime Minister Mahinda Rajapaksa, who is also the Finance Minister. China, which sanctioned a $500 million loan in March to help Sri Lanka cope with the coronavirus’s blow, is likely to favourably consider the Rajapaksa government’s request for an additional $700 million now, having pledged support to the island nation’s pandemic recovery effort. Further, Sri Lanka is also negotiating a nearly $1.5-billion currency swap facility with the People’s Bank of China. Sri Lanka owes China over $5 billion so far.

Trade practices

“Nobody says China has given $1.5 trillion loans to the U.S.? We are talking about $700 million coming in… these are the trade practices, financing practices, prevalent in the world. Each country works out their own financing arrangements in line with what they feel is best for them,” Mr. Cabraal said, adding, other countries such as Japan, the U.S. and India have also been big investors in Sri Lanka. The U.S., for instance, “is a very strong investor in Sri Lanka’s sovereign bonds. I met the Indian CEO forum here, and I was quite surprised that there are more than 50 in Indian CEOs here.”

‘Different sources’

Government critics, including former Finance Minister Mangala Samaraweera, has urged the Rajapaksa administration to engage the IMF, rather than fall into a “Chinese debt trap”, but the government has ruled out an IMF bailout.

The rapid credit facility that the government had earlier sought from the multilateral lender is yet to come through. Expressing displeasure, Mr. Cabraal said: “Rapid means rapid, no. Where is rapid in October when the accident occurred in March,” adding the government would still talk to the IMF.

While President Rajapaksa has vowed to disprove the “Chinese debt trap analysis”, few other sources seem as willing to lend readily. As for India, the Reserve Bank of India signed a $400 million swap agreement with Sri Lanka in July, to help boost Sri Lanka’s foreign reserves, and is perusing a further $1 billion requested by Sri Lanka. New Delhi is also yet to respond to PM Rajapaksa’s request for a debt moratorium — Sri Lanka owes $ 960 million to India — but Mr. Cabraal observed bilateral moratoriums cannot help much. “Emerging nations have all faced external sector stresses, which is not peculiar to Sri Lanka. Recently, some of the international agencies had provided some support for around 70 odd countries, which have been ad-hoc arrangements. This is a global problem, which needs a global solution,” he said.

Despite the external sector weakening significantly, Sri Lanka is “fortunate”, in Mr. Cabraal’s view. The country’s foreign reserves have “not been affected too much”, exports have “held firm” and remittances have been “pretty strong”. In September, Sri Lanka recorded over $700 million from worker remittances. Exports in July crossed $1 billion and the government’s move to restrict imports “has paid off”, according to Mr. Cabraal. “Our foreign reserves will be around $5.8 billion. I would say that is not an uncomfortable level.” A clearer picture will emerge only by end of the year, as the Department of Census and Statistics postponed the release of the second quarter GDP figures until then.

However, Sri Lanka’s challenge is far from over. It remains to be seen if the remittances will continue flowing in. Some 50,000 Sri Lankan migrant workers, who were employed in West Asian countries, want to return, while thousands lost their jobs and at least 67 succumbed to Covid-19 in their host countries. Domestically too, a new wave of COVID-19 infections is rapidly spreading within the garment manufacturing sector that is crucial to exports.

Falling revenues

Meanwhile, Sri Lanka’s revenues have fallen drastically, by an estimated LKR 440 billion (about $2.3 billion), also in the wake of tax cuts on imported items, prompting economists to emphasise a sound fiscal policy in the coming budget. Asked if the government was taking a fresh look at its tax regime to boost revenues, including considering a wealth tax that the IMF has recommended in its recent World Economic Outlook, Mr. Cabraal said: “You cannot make poor people rich, by making the rich people poor…we don’t want to put mansion taxes and these silly taxes which have actually crippled the more affluent people and remove them from the equation of providing jobs and providing support,” adding that the upcoming Budget, to be tabled next month, would reflect a “a balanced partnership”, where small and medium scale businesses will be supported, so they can extend job opportunities to the poor.

(THE HINDU)

News

US sports envoys to Lanka to champion youth development

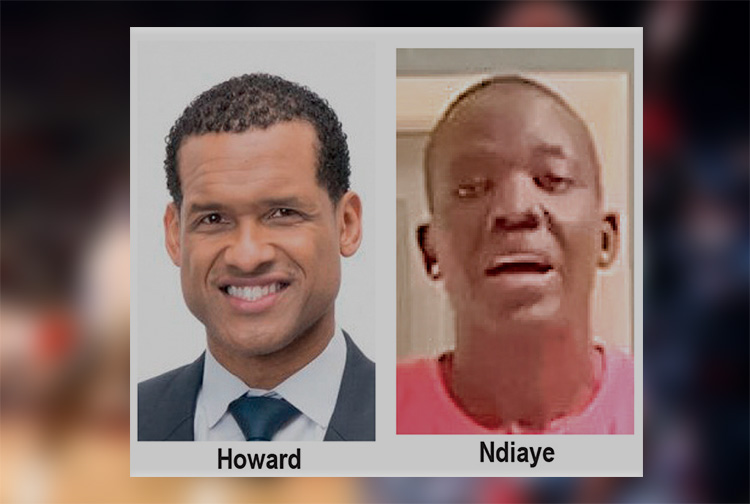

The U.S. Embassy in Colombo welcomed the U.S. Sports Envoys to Sri Lanka, former National Basketball Association (NBA) and Women’s National Basketball Association (WNBA) players Stephen Howard and Astou Ndiaye, from June 8 through 14.

The Public Diplomacy section of the U.S. Embassy said that it would launch a weeklong basketball program intended to harness the unifying power of sports, made possible through collaboration with Foundation of Goodness and IImpact Hoop Lab.

While in Sri Lanka, Howard and Ndiaye, both retired professional basketball players, will conduct a weeklong program, Hoops for Hope: Bridging Borders through Basketball. The Sports Envoys will lead basketball clinics and exhibition matches and engage in leadership sessions in Colombo and Southern Province for youth aged 14-18 from Northern, Uva, Eastern and Western Provinces, offering skills and leadership training both on and off the court. The U.S. Envoys will also share their expertise with the Sri Lanka Basketball Federation, national coaches, and players, furthering the development of basketball in the country. Beyond the clinics, they will collaborate with Sri Lankan schoolchildren to take part in a community service project in the Colombo area.

“We are so proud to welcome Stephen and Astou as our Sports Envoys to Sri Lanka, to build on the strong people-to-people connections between the United States and Sri Lanka,” said U.S. Ambassador Julie Chung. “The lessons that will be shared by our Sports Envoys – communication, teamwork, resilience, inclusion, and conflict resolution – are essential for leadership development, community building, equality, and peace. The U.S. Sports Envoy program is a testament to our belief that sports can be a powerful tool in promoting peace and unity.”

News

Rahuman questions sudden cancellation of leave of CEB employees

SJB Colombo District MP Mujibur Rahuman in parliament demanded to know from the government the reasons for CEB suspending the leave of all its employees until further notice from Thursday.

MP Rahuman said that the CEB has got an acting General Manager anew and the latter yesterday morning issued a circular suspending leave of all CEB employees with immediate effect until further notice.

“We demand that Minister Kanchana Wijesekera should explain this to the House. This circular was issued while this debate on the new Electricity Amendment Bill was pending. There are many who oppose this Bill. The Minister must tell parliament the reason for the urge to cancel the leave of CEB employees,” the MP said.However, Speaker Mahinda Yapa Abeywardena prevented Minister Wijesekera responding to the query and said that the matter raised by MP Rahuman was not relevant.

News

CIPM successfully concludes 8th Annual Symposium

The Chartered Institute of Personnel Management (CIPM) successfully concluded the 8th Annual CIPM Symposium, which took place on 31st May 2024. Themed “Nurturing the Human Element—Redefining HRM in a Rapidly Changing World,” the symposium underscored the pivotal role of human resource management (HRM) in today’s dynamic global landscape. Since its inception in 1959, CIPM has been dedicated to advancing the HR profession through education, professional development, and advocacy, solidifying its position as Sri Lanka’s leading professional body for HRM.

Ken Vijayakumar, the President of the CIPM, graced the occasion as the chief guest. The symposium commenced with the welcome address by the Chairperson, Prof. Arosha Adikaram, followed by the Web Launch of the Symposium Proceedings and Abstract Book by the CIPM President. The event featured distinguished addresses, including a speech by Chief Guest Ken Vijayakumar, President of CIPM, and an address by Guest of Honor Shakthi Ranatunga, Chief Operating Officer of MAS Holdings Pvt. Ltd., Sri Lanka.

The symposium also featured an inspiring keynote address by Prof. Mario Fernando, Professor of Management and Director of the Centre for Cross Cultural Management (CCCM) at the University of Wollongong, Australia.

Vote of Thanks of the inauguration session was delivered by Dr. Dillanjani Weeratunga, Symposium Co-chair.

The symposium served as a comprehensive platform for researchers to present their findings across a wide range of critical topics in HRM. These included Cultural Diversity and Inclusion, Talent Development and Retention, Ethical Leadership and Corporate Social Responsibility, Adapting to Technological Advancements, Mental Health and Well-being at Work, Global Workforce Challenges, Employee Empowerment, and Reskilling and Upskilling.

The plenary session was led by Prof. Wasantha Rajapakse. Certificates were awarded to the best paper presenters during the valedictory session, followed by a vote of thanks delivered by Kamani Perera, Manager of Research and Development.

The annual symposium of CIPM was a truly inclusive event, attracting a diverse audience that spanned undergraduates, graduates, working professionals, research scholars and lecturers. This widespread interest highlights the symposium’s significance in the field of HRM, offering a unique opportunity for everyone to network and learn from scholarly brains.The CIPM International Research Symposium was sponsored by Hambantota International Port, Sri Lanka Institute of Information Technology (SLIIT), E B Creasy & Co. PLC, and Print Xcel Company.